Press release

Money Habitudes: How To Be Rich in Life & Love wins Excellence in Financial Literacy Education Award

The Dibble Institute and LifeWise Strategies announce that their collaboration, Money Habitudes: How To Be Rich in Life & Love, has won this year's Excellence in Financial Literacy Education (EIFLE) Award for Children’s Education Program of the Year in the Financial Responsibility and Decision Making category. Awards were presented at this week's Annual Conference on Financial Education, held in Orlando.The EIFLE financial education award is bestowed by the Institute for Financial Literacy. It acknowledges innovation, dedication, and the commitment of those that support financial literacy education. Money Habitudes: How To Be Rich in Life & Love: A curriculum about money and relationships, introduces teens to the human, emotional side of money. With a behavioral economics approach, the teen financial literacy curriculum is an important precursor to financial literacy courses. The engaging personal finance curriculum helps teens identify their personal finance patterns, how these affect their goals and relationships, and ways to use this financial self-assessment to be more successful.

"Money is such an important issue for teens – both in terms of how they relate to others and how they establish their lifelong saving and spending habits. It's a great honor for our financial education curriculum to be recognized by the Institute for Financial Literacy," noted, Kay Reed, Executive Director of The Dibble Institute.

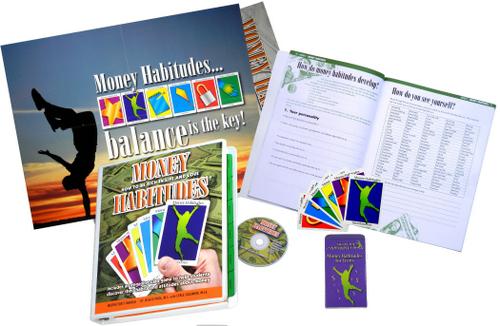

How To Be Rich in Life & Love includes a teacher guide, student workbook journal, CD, posters, and Money Habitudes cards, the foundation of the program. A hands-on teaching tool, Money Habitudes cards are a fun, instructional game that functions as both a financial ice breaker and a money conversation starter. First released in 2003, separate versions of the durable Money Habitudes cards are designed for adults, young adults and teens (high school); an adult version is also available in Spanish. The cards are widely used in programs focused on financial education, asset building, life skills, marriage and relationship education, financial planning, and career counseling.

"It is often very difficult for people to talk about money. The idea behind Money Habitudes was to make talking about money fun and to help people understand their money type in an engaging, nonjudgmental, non-threatening way – whether they are adults or high school students," said Syble Solomon, the creator of Money Habitudes. "It's been very rewarding to partner with The Dibble Institute to help teens learn about money and especially how money messages can affect relationships."

Last year, the financial literacy cards were chosen as The Washington Post's personal finance selection of the month. Previously, Solomon was named Educator of the Year by the Association for Financial Counseling and Planning Education for developing the tool. She also received the Smart Marriages Impact Award from the Coalition for Marriage, Family and Couples Education for effectively bridging the gap between finances and couples communication; money is the number one reason why couples fight.

The financial literacy curriculum can be used on its own or as a supplement to other personal finance and economics curricula such as FDIC's Money Smart and financial capability curricula developed by NEFE, FEFE, etc. How To Be Rich in Life & Love integrates with state and national standards for personal finance education. It is included in the national Jump$tart clearinghouse for financial education resources.

Other winners of the 2012 Excellence in Financial Literacy Education Awards include: Fastweb, Real Money Talk for Women, Cha-Ching: Money Smart Kids, MoneyIsland, and Consolidated Credit Counseling Services. Previous EIFLE Award winners include: Thrivent Financial, Feed The Pig, Pioneer Services, InCharge Education Foundation, Moonjar, Financial Finesse, Susan Beacham and Lynnette Khalfani-Cox, NEFE High School Financial Planning Program, D2D Fund, and Awesome Island.

About The Dibble Institute:

The Dibble Institute for Marriage Education, a nonprofit organization, helps young people learn how to create healthy romantic relationships now and in the future. The institute offers tools for teaching the practical skills essential for enhancing friendships, dating and love. Just as important, it assists teens in creating the personal vision that keeps them on a positive path. Dibble’s research-based, best practices programs are widely used across the country in classrooms, social agencies, after-school programs and other youth settings. Dibble also actively advocates for including relationship education in school curricula. The Institute is nonpartisan and nonsectarian. Funding for its activities comes from sales of educational materials, training and consulting services. It enjoys support from government grants and gifts from foundations, corporations and individuals.

Kay Reed

President and Executive Director

The Dibble Institute

800-695-7975

kayreed@dibbleinstitute.org

P. O. Box 7881

Berkeley, CA 94707-0881

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Money Habitudes: How To Be Rich in Life & Love wins Excellence in Financial Literacy Education Award here

News-ID: 218482 • Views: …

More Releases from LifeWise

Credit curriculum provides a better way to teach classes on credit reports, cred …

LifeWise Strategies announces the release of The Good Credit Game, an innovative curriculum kit for teaching credit classes. The credit curriculum stands out for its emphasis on being fun – both for financial educators and for students learning about credit reports, credit scores and credit cards.

The Good Credit Game addresses the large gap in knowledge about understanding, establishing, using and repairing credit. The FTC found that one in four consumers…

More Releases for Money

Miracle Money Magnets Review: Reprogram Your Money Vibration for Lasting Wealth

Miracle Money Magnets is a mindset transformation program created by Croix Sather that focuses on raising your personal money vibration to attract financial abundance effortlessly. The course teaches how subconscious beliefs, emotional resistance, and daily language patterns create blocks that repel wealth, and provides simple steps to reset them for consistent money flow. Priced accessibly at an introductory $7, it promises to shift users from financial struggle to prosperity by…

Just Between Friends Can Help Save Money & Make Money

Image: https://www.getnews.info/uploads/314b3c2c783a4157e147efd33935356f.jpg

Kids are expensive. Just Between Friends can help you save money and make money.

At Just Between Friends, we understand that children grow fast, which can quickly become expensive for parents.

That's why we host a community event twice a year, where families can sell the things their children no longer use and buy what they need at 50-90% below retail.

Discover a sense of Pride and Purpose when participating at Just…

The Money Wave Reviews (Controversial Or Fake 2023) The Money Wave Price Legitim …

Self-improvement and wealth promotion the The Money Wave has come to light as an innovative concept drawing the attention of thousands around the world. This revolutionary approach, grounded in the latest neuroscience research and antiquated wisdom, will unlock the potential hidden within our brains and allow our brains to generate prosperity and wealth effortlessly. It was developed in the lab of the Dr. Thomas Summers, a top neuroscientist who is…

Mobile Money Market to Witness Huge Growth by 2029 | Orange Money, Epress Union, …

The Latest research study released by HTF MI "Global Mobile Money Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are MTN…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…