Press release

Credit curriculum provides a better way to teach classes on credit reports, credit scores and credit cards

LifeWise Strategies announces the release of The Good Credit Game, an innovative curriculum kit for teaching credit classes. The credit curriculum stands out for its emphasis on being fun – both for financial educators and for students learning about credit reports, credit scores and credit cards.The Good Credit Game addresses the large gap in knowledge about understanding, establishing, using and repairing credit. The FTC found that one in four consumers identified errors on their credit reports that might affect their credit scores – yet a survey from the National Foundation for Credit Counseling found most adults have reviewed neither their credit score (60%) nor their credit report (65%) in the past year. In the NFCC study, more than 40 percent of adults gave themselves a grade of C, D or F on personal finance knowledge.

The Good Credit Game was designed to overcome common complaints voiced by financial educators and credit counselors who teach credit classes. First, the teaching package uses a number of money games that make personal finance classes engaging. The activities are collaborative and encourage conversation and laughter. As a result, these hands-on activities move credit classes away from static lectures, PowerPoint presentations and worksheets.

"For years, financial educators have told us they've gotten great results using our Money Habitudes materials to teach financial habits and attitudes and they wished they had something similar to use in other financial literacy classes. We took a decade of learning from Money Habitudes and applied the same big ideas of fun, simplicity and interactivity to the important but complicated task of teaching about credit," said Lee Gimpel, Director of Development for LifeWise Strategies.

In addition, the credit teaching package can be used with students of different ages (young adult, college, adult, etc.), and educational and financial backgrounds. All of the student materials are written at a fifth-grade reading level to make them more accessible. Modules can also be customized to focus on more basic credit information or include more advanced credit lessons (e.g., bankruptcy, credit history, payday loans, etc.) and they're applicable to people with poor credit or excellent credit. Finally, the user-friendly financial lesson plans take a teach-out-of-the-box approach. Therefore, a financial educator need not be a credit expert to teach great credit classes. The Good Credit Game aligns to a variety of national standards of financial literacy.

Among the credit-teaching modules, credit curriculum covers:

• What is credit? Why good credit matters?

• What's in a credit or loan application? What's in a credit report?

• What does a credit report look like? How are credit reports used?

• How to request your annual credit report and fix mistakes?

• How does a credit report become a FICO credit score? What are the components of a credit score?

• What does a credit score mean?

• How do bad credit scores make things more expensive?

The Good Credit Game comes in three sizes for financial literacy classes of 10, 20 or 30 students. More information is available at www.GoodCreditGame.com.

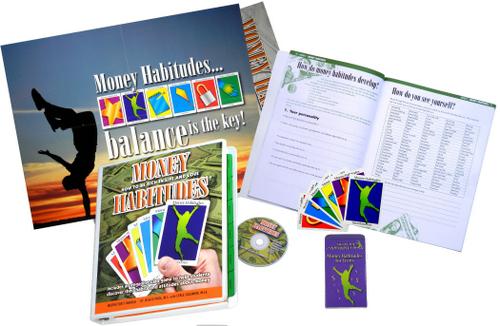

LifeWise promotes healthy relationships with money through trainings and its popular Money Habitudes cards and The Good Credit Game. Money Habitudes is a unique money conversation starter and financial personality assessment. The fun activity feels like a game and gets people thinking and talking constructively about their money habits and attitudes. The Good Credit Game is a credit curriculum designed to help financial educators teach classes about credit reports, credit scores and credit cards.

LifeWise Strategies

421 West Blackbeard Road

Wilmington, NC 28409

USA

910.399.2200

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit curriculum provides a better way to teach classes on credit reports, credit scores and credit cards here

News-ID: 288169 • Views: …

More Releases from LifeWise

Money Habitudes: How To Be Rich in Life & Love wins Excellence in Financial Lite …

The Dibble Institute and LifeWise Strategies announce that their collaboration, Money Habitudes: How To Be Rich in Life & Love, has won this year's Excellence in Financial Literacy Education (EIFLE) Award for Children’s Education Program of the Year in the Financial Responsibility and Decision Making category. Awards were presented at this week's Annual Conference on Financial Education, held in Orlando.

The EIFLE financial education award is bestowed by the Institute for…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…