Press release

Buy Now Pay Later Booming Segments; Investors Seeking Growth | Afterpay, American Express, Citibank

HTF Market Intelligence released a new research report of 50 pages on title 'Buy Now Pay Later - Thematic Research' with detailed analysis, forecast and strategies. The study covers key regions that includes Asia Pacific, North America, Europe, Latin America and Rest of the World and important players such as Afterpay,Affirm,American Express,Ant Financial, Bread,Blispay, Citibank,Divido, Klarna,Mastercard,PayPal,Visa,ZipRequest a sample report @ https://www.htfmarketreport.com/sample-report/2361199-buy-now-pay-later-thematic-research

Summary

Retail finance has existed as long as there have been merchants selling goods. The latest innovation, commonly referred to as buy now pay later (BNPL), has actually been offered for a couple of decades. However, the combination of the service with mobile and credit at the point of sale POS - both in-store and, more importantly, online - has spurred its rapid growth among the shopping public.

BNPL services offer to facilitate payments between merchants and their customers or suppliers via a short-term, typically interest- and fee-free installment plan. Any normal fees are typically charged to the merchant only, with the consumer charged very little or nothing for spreading the purchase payments out over a standard term. Early repayment is not penalized as the aim is to facilitate the purchase and spread payment by the consumer over multiple pay cycles.

This report analyzes the fast-growing BNPL market. It examines key players and their offerings; analyzes which trends and drivers underpin the growth of the sector; and examines the user base of BNPL firms to draw out insights regarding the market's potential.

Scope

- While BNPL usage is concentrated among online shoppers, a key growth area has been in-store purchases. But as in-store purchases need to be made via a POS or mobile POS terminal, the spread of these terminals is crucial.

- The business model for BNPL does not allow for widespread defaults or lengthy credit terms in most instances. The main driver of defaults is unemployment. So long as this remains low, the prospects for BNPL services are bright.

- Age has been a major determinant of BNPL use, and the increased prominence of millennials in the economy means BNPL use should accelerate.

Reasons to buy

- Benchmark yourself against the rest of the market.

- Ensure you remain competitive as new innovations and business models begin to emerge.

- Learn about the key trends these digital players are targeting.

- Understand the BNPL value chain, and the value it brings merchants and consumers.

Companies Mentioned in the Report

Afterpay

Affirm

American Express

Ant Financial

Bread

Blispay

Citibank

Divido

Klarna

hoolah

Mastercard

PayPal

Visa

Zip

Get Customization in the Report, Enquire Now @ https://www.htfmarketreport.com/enquiry-before-buy/2361199-buy-now-pay-later-thematic-research

Table of Contents

Players

Trends

Technology trends

Macroeconomic trends

Demographic trends

Regulatory trends

Industry analysis

Market size and growth forecasts

The Nordics and Australasia are the most mature BNPL markets

Growth over the next three years will be robust in all markets barring the Middle East and Africa

Funding of BNPL by consumers will see little disruption to banks and card schemes

Consumer use cases

Convenience

....Continued

View Detailed Table of Content @ https://www.htfmarketreport.com/reports/2361199-buy-now-pay-later-thematic-research

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Buy this report @ https://www.htfmarketreport.com/buy-now?format=1&report=2361199

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later Booming Segments; Investors Seeking Growth | Afterpay, American Express, Citibank here

News-ID: 2150852 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Education Finance Software Market: Regaining Its Glory | PowerSchool Finance, Ty …

The latest analysis of the worldwide education finance software market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The education finance software market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors.

Key Players in This Report Include:

Blackbaud, Ellucian,…

Digital Parcel Mapping Systems Market Is Booming Worldwide | Major Giants Hexago …

The latest analysis of the worldwide digital parcel mapping systems market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The Digital Parcel Mapping Systems market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors' positions.

Key Players in This…

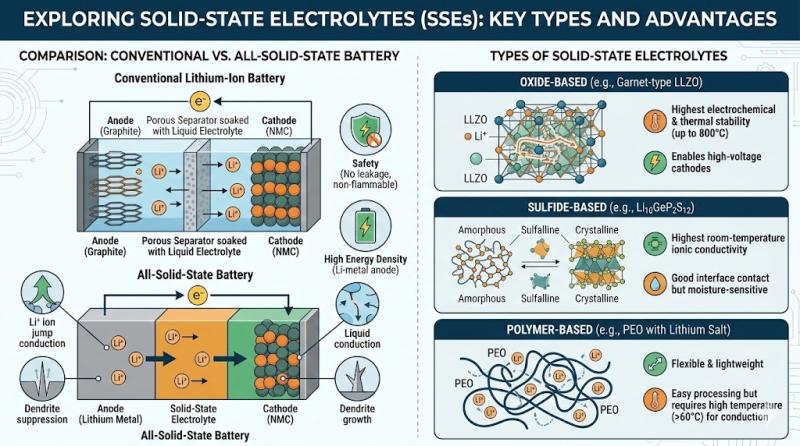

Solid-State Electrolytes Market Likely to Boost Future Growth by 2033 | QuantumS …

HTF Market Intelligence published a new research document of 150+pages on Solid-State Electrolytes Market Insights, to 2033" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Solid-State Electrolytes market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have…

Marine Mining Technology Market Current Status and Future Prospects | Odyssey Ma …

The latest study released on the Global Marine Mining Technology Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marine Mining Technology study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for BNPL

Abzer Expands UAE Digital Payment Capabilities Through BNPL Collaboration with T …

Abzer, an enterprise technology company delivering digital payment, invoicing, and revenue automation platforms, has announced a strategic collaboration with Tamara to introduce Buy Now, Pay Later (BNPL) capabilities across its payment ecosystem in the United Arab Emirates.

The collaboration is designed to support enterprises and small-to-medium businesses seeking greater flexibility within their customer payment journeys. By integrating Tamara's BNPL functionality into Abzer's Payment Orchestration and Invoicing Suite, businesses can offer installment-based…

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…