Press release

Loan Service Market Next Big Thing | Major Giants Fiserv, AutoPal Software, IBM, FIS, Cloud Lending

Latest launched research document on COVID-19 Outbreak-Global Loan Service Market study of 119 Pages provides detailed analysis with presentable graphs, charts and tables. The Research Study presents a complete assessment of the Market and highlights future trend, growth factors & drivers, leaders opinions, facts, and primary validated market data. The research study provides estimates for COVID-19 Outbreak-Global Loan Service Forecast till 2025*.How to reach that market place and its associated audience with current marketing efforts? Benchmark now the competitive efforts with high growth emerging players and leaders of COVID-19 Outbreak- Loan Service Market.

Request Sample of COVID-19 Outbreak-Global Loan Service Report @: https://www.htfmarketreport.com/sample-report/2822699-covid-19-outbreak-global-loan-service-industry-market

The in-depth information by segments of the COVID-19 Outbreak-Global Loan Service market helps monitor future profitability & to make critical decisions for growth. The information on drivers, trends and market developments focuses technologies, CAPEX cycle and the changing structure industry players of the COVID-19 Outbreak-Global Loan Service Market.

COVID-19 Outbreak-Global Loan Service Product Types In-Depth: , Software & Intergrated Service

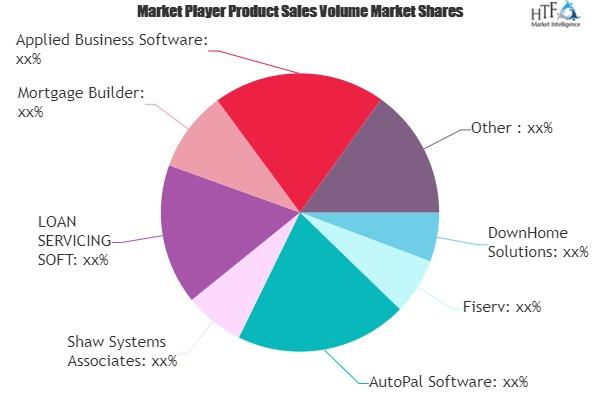

Professional players: DownHome Solutions, Fiserv, AutoPal Software, Shaw Systems Associates, LOAN SERVICING SOFT, Mortgage Builder, Applied Business Software, Cloud Lending, Graveco Software, Altisource Portfolio Solutions, C-Loans, Emphasys Software, FICS, IBM, INTEGRATED ACCOUNTING SOLUTIONS, Nortridge Software, Grants Management Systems (GMS), FIS, ISGN & Cassiopae

COVID-19 Outbreak-Global Loan Service Major Applications/End users: Homeowner, Local Bank & Enterprise

**The market is valued based on weighted average selling price (WASP) and includes all applicable taxes on manufacturers. All currency conversions used in the creation of this report have been calculated using constant annual average 2019 currency rates.

The COVID-19 Outbreak-Global Loan Service is estimated at US$ XX million in 2019 and will reach US$ YY million by the end of 2025, growing at compound annual growth rate of ZZ% during 2019-2025.

Geographical Analysis: Regional and country level analysis integrating the demand and supply forces that are influencing the growth of the market, currently covering North America (Covered in Chapter 7 and 14), United States, Canada, Mexico, Europe (Covered in Chapter 8 and 14), Germany, UK, France, Italy, Spain, Russia, Others, Asia-Pacific (Covered in Chapter 9 and 14), China, Japan, South Korea, Australia, India, Southeast Asia, Others, Middle East and Africa (Covered in Chapter 10 and 14), Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Others, South America (Covered in Chapter 11 and 14), Brazil, Argentina, Columbia, Chile & Others

** For global or regional version of report, list of countries by region are listed below can be provided as part of customization at minimum cost.

North America (United States, Canada & Mexico)

Asia-Pacific (Japan, China, India, Southeast Asian Countries & Australia etc)

Europe (Germany, UK, France, Italy, Spain, Russia, Netherlands & Belgium etc)

Central & South America (Brazil, Argentina, LATAM etc)

Middle East & Africa (United Arab Emirates, Qatar, Saudi Arabia, Israel & South Africa etc)

For detailed insights on COVID-19 Outbreak-Global Loan Service Market Size, competitive landscape is provided i.e. Revenue Share Analysis (Million USD) by Players (2017-2019), Revenue Market Share (%) by Players (2017-2019) and further a qualitative analysis is made towards market concentration rate, product differentiation, new entrants are also considered in heat map concentration.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/2822699-covid-19-outbreak-global-loan-service-industry-market

In this study, the years taken into consideration to estimate the market size of COVID-19 Outbreak-Global Loan Service are : History Year: 2014-2019; Base Year: 2019; Forecast Year 2019 to 2025

Key Target Stakeholders Covered in Study:

==> COVID-19 Outbreak- Loan Service Manufacturers

==> COVID-19 Outbreak-Global Loan Service Distributors/Traders/Wholesalers

==> COVID-19 Outbreak- Loan Service Component / Raw Material Producers

==> Downstream Vendors

Browse Full Report at @: https://www.htfmarketreport.com/reports/2822699-covid-19-outbreak-global-loan-service-industry-market

What this Research Study Offers:

COVID-19 Outbreak-Global Loan Service Market share assessments for the regional or country & business segments (Type) and End Users

Market share analysis of the industry players highlighting rank, gain in position, % share and segment revenue

Feasibility study for the new market entrants

Market forecasts for a minimum of 5 years of all the mentioned segments, sub-segments, and the regional markets / country level break-up

Company profiling with key strategies, P&L financials, and latest development activities

Market Trends (Growth Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and strategic recommendations)

Strategic recommendations in major business segments based on the market buzz or voice

Competitive landscaping & heat map analysis of emerging players with common trends

Supply / value chain trends mapping the latest technological advancements..... and some more..

Actual Numbers & In-Depth Analysis, opportunities of COVID-19 Outbreak- Loan Service Market Size Estimation Available in Full Report.

Buy Full Copy COVID-19 Outbreak-Global Loan Service Study @ https://www.htfmarketreport.com/buy-now?format=1&report=2822699

Thanks for reading full article, contact us at sales@htfmarketreport.com to better understand detailed research methodology and approach behind this study.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Service Market Next Big Thing | Major Giants Fiserv, AutoPal Software, IBM, FIS, Cloud Lending here

News-ID: 2131169 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Music Playback Platform Market All Sets for Continued Outperformance: Spotify, D …

The Music Playback Platform Market refers to the ecosystem of digital platforms, applications, and services that enable users to stream, download, organize, and play music content across connected devices. This market includes subscription-based and ad-supported platforms that provide on-demand access to licensed music libraries, playlists, podcasts, and personalized audio experiences through smartphones, computers, smart speakers, in-car systems, and wearable devices. Music playback platforms leverage technologies such as cloud computing, recommendation…

Luxury Ampoule Market Getting Back To Stellar Growth Ahead | Shiseido, Amorepaci …

The Luxury Ampoule Market refers to the premium segment of the skincare and beauty industry focused on highly concentrated, fast-acting ampoule formulations designed to deliver intensive skin benefits. Luxury ampoules are typically enriched with high-potency active ingredients such as peptides, stem cell extracts, hyaluronic acid, vitamins, botanical complexes, and advanced bio-technology compounds. Positioned above serums in both efficacy and pricing, these products are marketed for targeted concerns including anti-aging, skin…

Litecoin Transaction Market Rewriting Long Term Growth Story | Coinbase, Binance …

The Litecoin Transaction Market refers to the ecosystem surrounding the creation, validation, processing, and settlement of transactions conducted using Litecoin (LTC), a decentralized peer-to-peer cryptocurrency. This market encompasses on-chain transaction activity, supporting infrastructure such as wallets, exchanges, payment gateways, mining and validation services, and analytics platforms that facilitate the transfer of value over the Litecoin blockchain.

Reflect on the broader context of these developments within the industry @ https://www.htfmarketintelligence.com/sample-report/global-litecoin-transaction-market

Market Drivers

• Low…

Upcoming Opportunities in Healthcare BI Platform Market: Future Trend and Analys …

The latest study released on the Global Healthcare BI Platform Market by HTF MI evaluates market size, trend, and forecast to 2033. The Healthcare BI Platform market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…