Press release

Loan Origination Systems Market 2025 Future Trends and Technology by Key Companies- Ellie Mae, Mortgage Cadence (Accenture), Fiserv, Calyx Software, Mortgage Builder Software, FICS, Tavant Tech, PCLender, LLC

Loan Origination Systems Market 2020 Industry Research Report focuses Market Size, Share, Growth, Manufacturers and Forecast to 2025. The report is beneficial for strategists and industry players to plan their future business strategies. The research report on the Loan Origination Systems market includes an evaluation of all critical aspects underlying it, and this factor which is valuable & supportive to the business.Get Sample Copy @ https://www.orianresearch.com/request-sample/1480436

Market Overview

The global Loan Origination Systems market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of xx% in the forecast period of 2020 to 2025 and will expected to reach USD xx million by 2025, from USD xx million in 2019.

The Global Loan Origination Systems Market 2020 report includes Loan Origination Systems Market Revenue, market Share, industry volume, and Trends, Growth aspects. Growing prevalence of Loan Origination Systems fuelled by the changing lifestyle, inclination towards the sedentary lifestyle & growing obesity disorder among people, is some of the predominant driving force contributing to the market growth.

This report focuses on the global Loan Origination Systems status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Loan Origination Systems development in North America, Europe, China, Japan, Southeast Asia, India and Central & South America.

Inquire more or share questions if any before the purchase on this report@ https://www.orianresearch.com/enquiry-before-buying/1480436

The Global Loan Origination Systems Market 2020 report incorporates Loan Origination Systems industry volume, piece of the overall industry, Market Trends, Loan Origination Systems Growth perspectives, an extensive variety of uses, Utilization proportion, Supply and request examination, producing limit, Loan Origination Systems Price amid the Forecast Period from 2020 to 2025. Further, the Loan Origination Systems report gives data on the organization profile, piece of the pie and contact subtle elements alongside esteem chain examination of Loan Origination Systems industry, Loan Origination Systems industry standards and approaches, conditions driving the development of the market and impulse hindering the development. Loan Origination Systems Market improvement scope and different business techniques are additionally specified in this report.

TOP KEY PLAYERS

• Ellie Mae

• Mortgage Cadence (Accenture)

• Fiserv

• Calyx Software

• Mortgage Builder Software

• FICS

• Tavant Tech

• PCLender, LLC

• Byte Software

• Wipro

• Pegasystems

• Axcess Consulting Group

• DH Corp

• …

Order a copy of the Loan Origination Systems Market Report: https://www.orianresearch.com/checkout/1480436

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analysed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins. The report focuses on global major leading Loan Origination Systems Industry players providing information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information.

Features of the Report:

• The analysis of Loan Origination Systems Market, their growth, demand, position, size and share from different regions are mentioned in detailed.

• The key players in the market and their share in the global market are discussed.

• The new strategic plan and suggestions that will help old as well as new market players to maintain the competitiveness are also discussed.

• The Loan Origination Systems Market report provides some important points related to growth factors, challenges, opportunities, end-user analysis and achievement and so on.

By Type, Loan Origination Systems market has been segmented into:

• On-demand (Cloud)

• On-premise

By Application, Loan Origination Systems has been segmented into:

• Banks

• Credit Unions

• Mortgage Lenders & Brokers

• Others

Major Points from Table of Contents:

Global Loan Origination Systems Market Size, Status and Forecast 2025

1 Industry Overview of Loan Origination Systems

2 Global Loan Origination Systems Competition Analysis by Players

3 Company (Top Players) Profiles

4 Global Loan Origination Systems Market Size by Type and Application (2015-2020)

5 United States Loan Origination Systems Development Status and Outlook

6 EU Loan Origination Systems Development Status and Outlook

7 Japan Loan Origination Systems Development Status and Outlook

8 China Loan Origination Systems Development Status and Outlook

9 India Loan Origination Systems Development Status and Outlook

10 Southeast Asia Loan Origination Systems Development Status and Outlook

11 Market Forecast by Regions, Type and Application (2020-2025)

12 Loan Origination Systems Market Dynamics

13 Market Effect Factors Analysis

14 Research Finding/Conclusion

15 Appendix

Methodology

Analyst Introduction

Data Source

Customization Service of the Report:

Orian Research provides customisation of reports as per your need. This report can be personalised to meet your requirements. Get in touch with our sales team, who will guarantee you to get a report that suits your necessities.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727| UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Origination Systems Market 2025 Future Trends and Technology by Key Companies- Ellie Mae, Mortgage Cadence (Accenture), Fiserv, Calyx Software, Mortgage Builder Software, FICS, Tavant Tech, PCLender, LLC here

News-ID: 2130689 • Views: …

More Releases from Orian Research

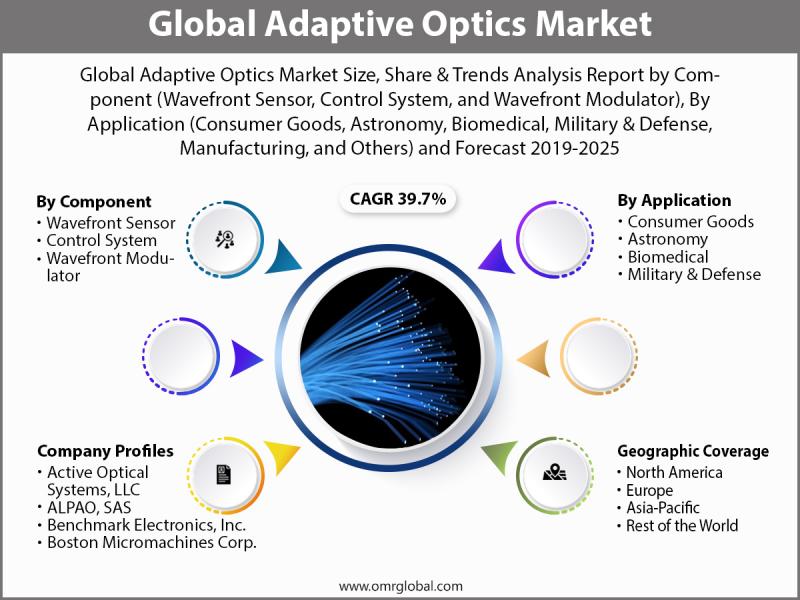

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

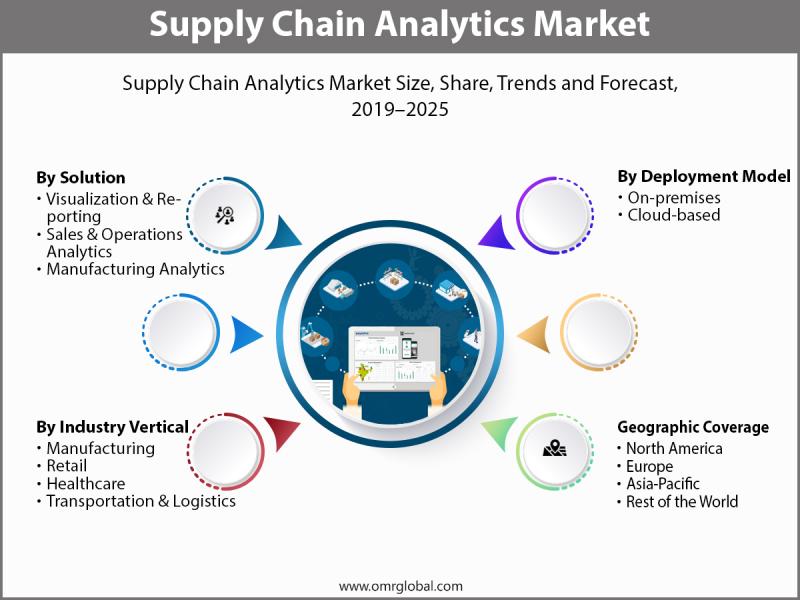

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

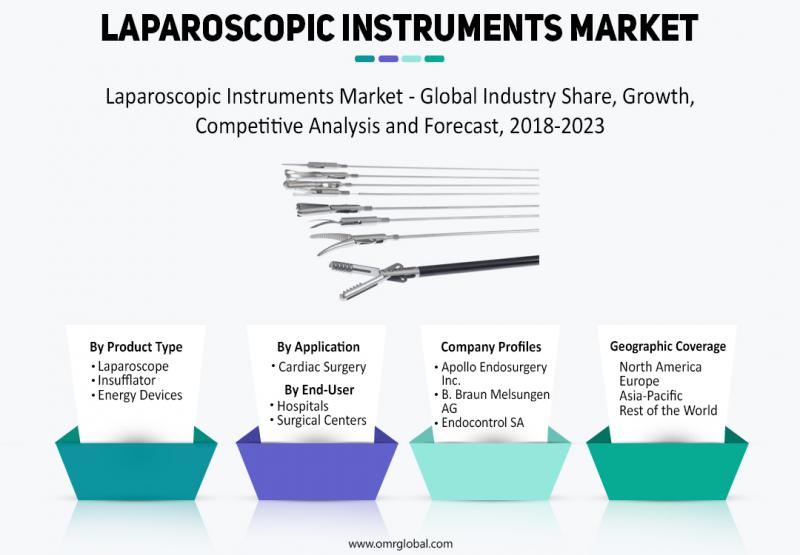

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…