Press release

Latest Canada Payments Landscape Market Report- Growth Opportunities and Risks to 2022 | Mastercard, Visa, American Express

The study includes analysis of the Canada Payments Landscape Market, with their company profiles, recent developments, and the key market strategies. Canada Payments Landscape Market report shows the latest market insights with upcoming trends and breakdowns of products and services. This report provides statistics on the market situation, size, regions and growth factors. Canada Payments Landscape Market report contains emerging players analyze data including competitive situations, sales, revenue and market share of top manufacturers.Get FREE PDF Sample of the report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=1874905

Top Company Profile Analysis in this Report

Desjardins

Royal Bank of Canada

TD Canada Trust

Scotiabank

CIBC

Bank of Montreal

Canadian Tire Bank

National Bank of Canada Interac

Mastercard

Visa

American Express

and more...

Canada Payments Landscape Market Report provides detailed analysis of market trends in the Canadian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, cards, credit transfers, direct debits, and cheques during the review-period (2014-18e).

Canada Payments Landscape Market Report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values and volumes during the review-period and over the forecast-period (2018e-22f). It also offers information on the country's competitive landscape, including market shares of issuers and schemes.

Canada Payments Landscape Market Report brings together research, modeling, and analysis expertise to allow banks and card issuers to identify segment dynamics and competitive advantages. The report also covers detailed regulatory policies and recent changes in regulatory structure.

Canada Payments Landscape Market Report provides top-level market analysis, information and insights into the Canadian cards and payments industry, including -

- Current and forecast values for each market in the Canadian cards and payments industry, including debit, credit, and charge cards.

- Detailed insights into payment instruments including cash, cards, credit transfers, direct debits, and cheques. It also, includes an overview of the country's key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Canadian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

Scope of this Report-

- As Interac charges no interchange fee for debit card transactions, interchange fees on pay-later cards naturally seem high in comparison. In August 2018 the Canadian government announced it had secured voluntary commitments from Visa, Mastercard, and American Express to reduce merchant fees in Canada for SMEs accepting credit cards. Starting from 2020, Visa and Mastercard have agreed to lower domestic consumer interchange fees to an annual average effective rate of 1.40% for five years, down from the current figure of 1.5%. American Express entered into a similar commitment. The change is expected to save SMEs a total of C$250m ($198.84m) annually.

- Non-banking companies have started entering the lucrative credit card space. In June 2018, non-bank company Brim Financial launched three credit cards: Brim Mastercard, Brim World Mastercard, and Brim World Elite Mastercard. Benefits offered include no fees on foreign transactions, loyalty points that can be redeemed at any merchant, and free access to a worldwide network of Wi-Fi hotspots. Purchases above C$500 ($397.67) can be converted into a maximum of 24 installments without affecting the credit limit available on the card.

- QR-based payments are popular in Asian markets, and they are gradually making inroads into North America. In June 2018 UnionPay International collaborated with Bank of Chinas Canadian subsidiary to launch its QR code payment service in Canada. All of the countrys Foodymart stores now accept UnionPay QR code payments. The company estimated that nearly 5,000 merchants across North America would accept its QR code payments by the end of 2018.

Reasons to buy this Report-

- Make strategic business decisions, using top-level historic and forecast market data, related to the Canadian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Canadian cards and payments industry.

- Assess the competitive dynamics in the Canadian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Canada.

- Gain insights into key regulations governing the Canadian cards and payments industry.

Single User License: US $ 2750

Get FLAT 25% Discount on this Report @ https://www.reportsnreports.com/purchase.aspx?name=1874905

Table of Contents in this Report-

Market Overview

Executive Summary

Card-based Payments

Merchant Acquiring

E-commerce Payments

Mobile Proximity Payments

P2P Payments

Bill Payments

Alternative Payments

Payment Innovations

Payments Infrastructure & Regulation

Appendix

Corporate Headquarters

Tower B5, office 101,

Magarpatta SEZ,

Hadapsar, Pune-411013, India

+ 1 888 391 5441

sales@reportsandreports.com

ReportsnReports.com is your single source for all market research needs. Our database includes 500,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latest Canada Payments Landscape Market Report- Growth Opportunities and Risks to 2022 | Mastercard, Visa, American Express here

News-ID: 2129453 • Views: …

More Releases from ReportsnReports

DeviceCon Series 2024 - UK Edition | MarketsandMarkets

Future Forward: Redefining Healthcare with Cutting-Edge Devices

Welcome to DeviceCon Series 2024 - Where Innovation Meets Impact!

Join us on March 21-22 at Millennium Gloucester Hotel, 4-18 Harrington Gardens, London SW7 4LH for a groundbreaking convergence of knowledge, ideas, and technology. MarketsandMarkets proudly presents the DeviceCon Series, an extraordinary blend of four conferences that promise to redefine the landscape of innovation in medical and diagnostic devices.

Register Now @ https://events.marketsandmarkets.com/devicecon-series-uk-edition-2024/register

MarketsandMarkets presents…

5th Annual MarketsandMarkets Infectious Disease and Molecular Diagnostics Confer …

London, March 7, 2024 - MarketsandMarkets is thrilled to announce the eagerly awaited 5th Annual Infectious Disease and Molecular Diagnostics Conference, scheduled to take place on March 21st - 22nd, 2024, at the prestigious Millennium Gloucester Hotel, located at 4-18 Harrington Gardens, London SW7 4LH.

This conference promises to be a groundbreaking event, showcasing the latest trends and insights in diagnosis, as well as unveiling cutting-edge technologies that are revolutionizing the…

Infection Control, Sterilization & Decontamination Conference |21st - 22nd March …

MarketsandMarkets is pleased to announce its 8th Annual Infection Control, Sterilisation, and Decontamination in Healthcare Conference, which will take place March 21-22, 2024, in London, UK. With the increased risk of infection due to improper sterilisation and decontamination practices, the safety of patients and healthcare workers is of paramount importance nowadays.

Enquire Now @ https://events.marketsandmarkets.com/infection-control-sterilization-and-decontamination-conference/

This conference aims to bring together all the stakeholders to discuss the obstacles in achieving…

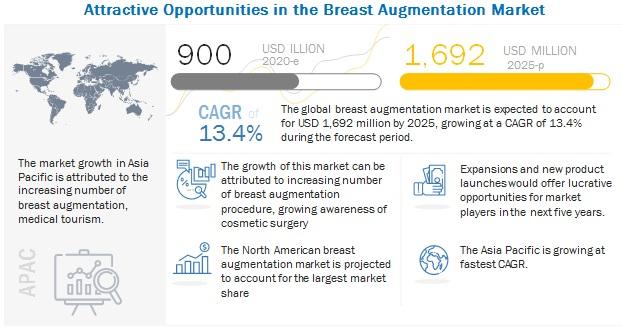

Breast Augmentation Market Key Players, Demands, Cost, Size, Procedure, Shape, S …

The global Breast Augmentation Market in terms of revenue was estimated to be worth $900 million in 2020 and is poised to reach $1,692 million by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…