Press release

Online Lending Market Growth Opportunities -2020-2025 with Global Industry Trends of Manufactures( Zopa, Faircent, Mintos, etc)

Online Lending Market Report 2020 provides an in-depth analysis of Online Lending Industry top manufacturers, growth, share, trends, industry chain structure, regional outlook, development trends and 2025 forecasts. It also includes the financial plan, supplier data, global sales, historical data, country demand, industry challenges and research expert’s opinions.Get Sample Copy at https://www.orianresearch.com/request-sample/1488003

The Online Lending market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product launches, area marketplace expanding, and technological innovations.

Development policies and plans are discussed as well as manufacturing processes and cost structures. This report also states import/export, supply and consumption figures as well as cost, price, revenue and gross margin by regions North America, Europe, Japan, China, and other regions (India, Southeast Asia, Central & South America, and Middle East & Africa) and other regions can be added.

Competitive Landscape and Online Lending Market Share Analysis

Online Lending competitive landscape provides details by vendors, including company overview, company total revenue (financials), market potential, global presence, Online Lending sales and revenue generated, market share, price, production sites and facilities, SWOT analysis, product launch. For the period 2015-2020, this study provides the Online Lending sales, revenue and market share for each player covered in this report.

The major players covered in Online Lending are:

• Zopa

• Faircent

• Mintos

• Daric

• Canstar

• Pave

• Funding Circle

• RateSetter

• Lendix

• Upstart

• Prosper

• Lending Club

• CircleBack Lending

• Peerform

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/1488003

Global Online Lending report has been compiled through extensive primary research (through analytical research, market survey and observations) and secondary research. The report also features a complete qualitative and quantitative assessment by analyzing data gathered from industry analysts and market participants across key points in the industry’s value chain.

Market segmentation

Online Lending market is split by Type and by Application. For the period 2015-2025, the growth among segments provide accurate calculations and forecasts for sales by Type and by Application in terms of volume and value. This analysis can help you expand your business by targeting qualified niche markets.

By Type, Online Lending market has been segmented into:

• On-Premise

• Cloud-Based

By Application, Online Lending has been segmented into:

• Individuals

• Businesses

The report offers in-depth assessment of the growth and other aspects of the Online Lending market in important countries (regions), including:

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Australia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Purchase this Report @ https://www.orianresearch.com/checkout/1488003

Research Methodology:

The market is derived through extensive use of secondary, primary, in-house research followed by expert validation and third party perspective, such as, analyst reports of investment banks. The secondary research is the primary base of our study wherein we conducted extensive data mining, referring to verified data sources, such as, white papers, research and regulatory published articles, technical journals, trade magazines, and paid data sources.

Major Points Covered in Table of Contents:

1 Online Lending Market Overview

2 Company Profiles

3 Market Competition, by Players

4 Market Size by Regions

5 North America Online Lending Revenue by Countries

6 Europe Online Lending Revenue by Countries

7 Asia-Pacific Online Lending Revenue by Countries

8 South America Online Lending Revenue by Countries

9 Middle East & Africa Revenue Online Lending by Countries

10 Market Size Segment by Type

11 Global Online Lending Market Segment by Application

12 Global Online Lending Market Size Forecast (2021-2025)

13 Research Findings and Conclusion

14 Appendix

Customization Service of the Report:-

Orian Research provides customization of Reports as per your requirements. This Report can be personalized to meet your need. If you have any question or query get in touch with our sales team, who will guarantee you to get a Report that suits your necessities.

Contact Us

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (832) 380-8827 | UK: +44 0161-818-8027

Email: info@orianresearch.com

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on The World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Lending Market Growth Opportunities -2020-2025 with Global Industry Trends of Manufactures( Zopa, Faircent, Mintos, etc) here

News-ID: 2121907 • Views: …

More Releases from Orian Research

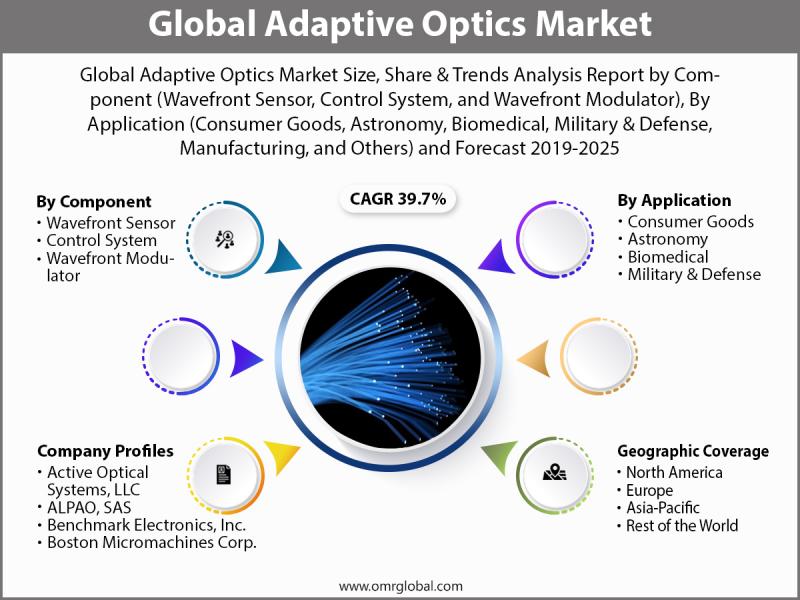

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

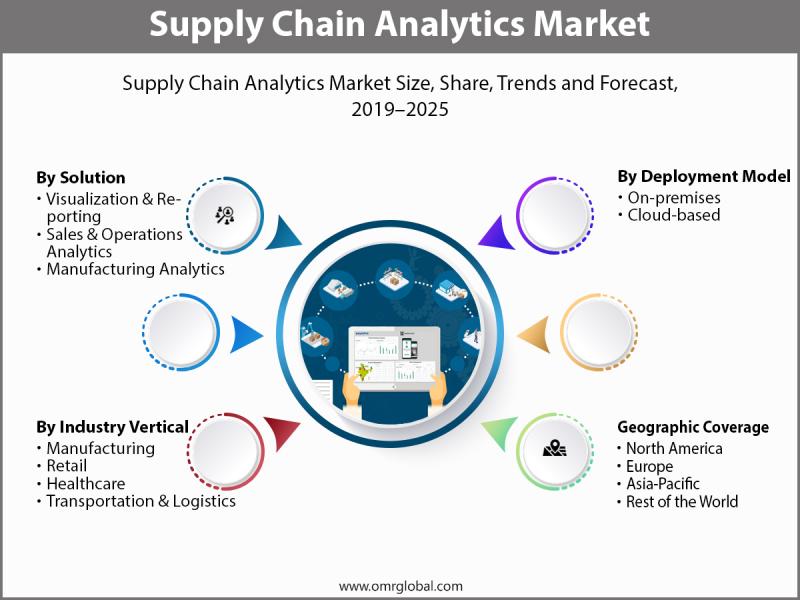

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

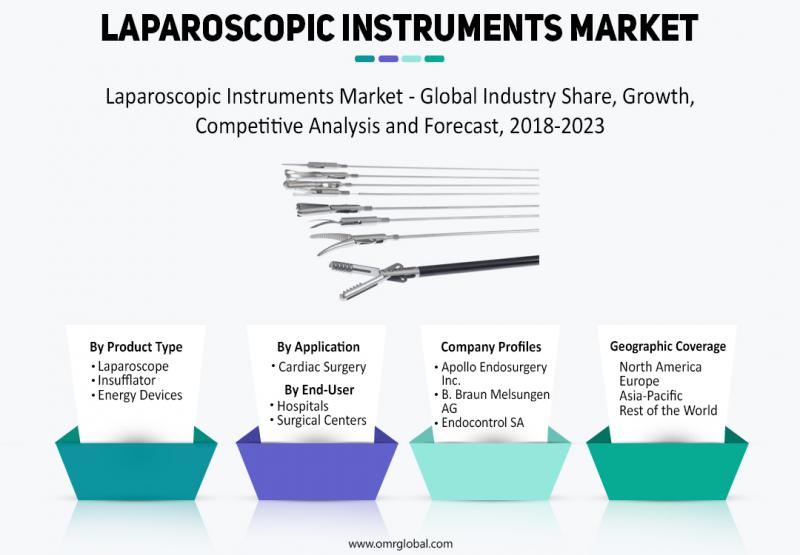

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…