Press release

Digital Payment Market 2020 SHARE, SIZE, GROWTH, DEMAND AND TOP GLOBAL PLAYERS –Google, Amazon.com, Inc., Apple Inc., Mastercard, Visa, First Data Corporation, PayPal, Worldpay

This DIGITAL PAYMENT research report includes the profiles of the key companies along with their SWOT analysis and market strategies. In addition, this DIGITAL PAYMENT report discusses the key drivers influencing market growth, opportunities, the challenges and the risks faced by key manufacturers and the market as whole. It also analyzes the key emerging trends and their impact on present and future development. It analyzes the market with respect to individual growth trends, future prospects, drivers, industry specific challenges and obstacles. Key manufactures of the market are studied on many aspects such as company overview, product portfolio and other details during forecast year.Data Bridge Market Research recently released Global Digital Payment Market research with more than 250 market data tables and figures and an easy to understand TOC in “Global Digital Payment Market research”, so you can get a variety of ways to maximize your profits. Digital Payment predicted until 2026. The Digital Payment market research report classifies the competitive spectrum of this industry in elaborate detail. The study claims that the competitive reach spans the companies of Google, Amazon.com, Inc., Apple Inc., Mastercard, Visa, First Data Corporation, PayPal, Worldpay, LLC, Wirecard AG, Fiserv, Inc., Chetu Inc., Total System Services, Inc., Novatti Group Limited, ACI Worldwide, Inc, Global Payments Inc., BlueSnap Inc, Paysafe Holdings UK Limited and Worldline.

Access Insightful Study about Digital Payment market! Click Here to Get FREE PDF Sample Market Analysis@https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-digital-payment-market&sc

Be the first to knock the door showing potential that Global Digital Payment market is holding in it. Uncover the Gaps and Opportunities to derive most relevant insights from our research document to gain market size.

Unlock new opportunities with DBMR reports to gain insightful analyses about the Digital Payment market and have a comprehensive understanding. Learn about the market strategies that are being adopted by your competitors and leading organizations also potential and niche segments/regions exhibiting promising growth.

New vendors in the market are facing tough competition from established international vendors as they struggle with technological innovations, reliability and quality issues. The report will answer questions about the current market developments and the scope of competition, opportunity, cost and more.

Global Digital Payment Market :

Global Digital Payment Market is driven by rapid increase in number of smart phones, which is projecting a rise in estimated value from USD 38.14 billion in 2018 to an estimated value of USD 146.70 billion by 2026, registering a CAGR of 18.34% in the forecast period of 2019-2026.

On the off chance that you are associated with the Digital Payment Analytics industry or mean to be, at that point this investigation will give you far reaching standpoint. It’s crucial you stay up with the latest Digital Payment Market segmented by:If you are involved in the Digital Payment industry or intend to be, then this study will provide you comprehensive outlook. It’s vital you keep your market knowledge up to date segmented

According to the Regional Segmentation the Main Bearing Market provides the Information covers following regions:

North America (USA, Canada and Mexico)

Europe (Germany, France, the United Kingdom, Netherlands, Russia, Italy and Rest of Europe)

Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia, rest of countries etc.)

Middle East and Africa (Saudi Arabia, United Arab Emirates, Israel, Egypt, Nigeria and South Africa)

The key countries in each region are taken into consideration as well, such as United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Market Dynamics:

Set of qualitative information that includes PESTEL Analysis, PORTER Five Forces Model, Value Chain Analysis and Macro Economic factors, Regulatory Framework along with Industry Background and Overview.

Some of the Major Highlights of TOC covers:

Chapter 1: Methodology & Scope

Definition and forecast parameters

Methodology and forecast parameters

Data Sources

Chapter 2: Executive Summary

Business trends

Regional trends

Product trends

End-use trends

Chapter 3: Digital Payment Industry Insights

Industry segmentation

Industry landscape

Vendor matrix

Technological and innovation landscape

Chapter 4: Digital Payment Market, By Region

North America

South America

Europe

Asia-Pacific

Middle East and Africa

Chapter 5: Company Profile

Business Overview

Financial Data

Product Landscape

Strategic Outlook

SWOT Analysis

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

BROWSE FREE | TOC with selected illustrations and example pages of Global Digital Payment Market @https://www.databridgemarketresearch.com/toc/?dbmr=global-digital-payment-market&sc

Research Methodology: Global Digital Payment Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The market data is analysed and forecasted using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more please Request an Analyst Call or can drop down your inquiry.

The key research methodology used by DBMR Research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, other data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Top to Bottom Analysis and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

In addition, the years considered for the study are as follows:

Historical year – 2014-2019 | Base year – 2019 | Forecast period – 2020 to 2027

Key Insights that Study is going to provide:

The 360-Digital Payment overview based on a global and regional level

Market Share & Sales Revenue by Key Players & Emerging Regional Players

Competitors – In this section, various Digital Payment industry leading players are studied with respect to their company profile, product portfolio, capacity, price, cost, and revenue.

A separate chapter on Market Entropy to gain insights on Leaders aggressiveness towards market [Merger & Acquisition / Recent Investment and Key Developments]

Patent Analysis** No of patents / Trademark filed in recent years.

A complete and useful guide for new market aspirants

Forecast information will drive strategic, innovative and profitable business plans and SWOT analysis of players will pave the way for growth opportunities, risk analysis, investment feasibility and recommendations

Supply and Consumption – In continuation of sales, this section studies supply and consumption for the Digital Payment Market. This part also sheds light on the gap between supply and consumption. Import and export figures are also given in this part

Production Analysis – Production of the Digital Payment is analyzed with respect to different regions, types and applications. Here, price analysis of various Digital Payment Market key players is also covered.

Sales and Revenue Analysis – Both, sales and revenue are studied for the different regions of the Digital Payment Market. Another major aspect, price, which plays an important part in the revenue generation, is also assessed in this section for the various regions.

Other analyses – Apart from the information, trade and distribution analysis for the Digital Payment Market

Competitive Landscape: Company profile for listed players with SWOT Analysis, Business Overview, Product/Services Specification, Business Headquarter, Downstream Buyers and Upstream Suppliers.

May vary depending upon availability and feasibility of data with respect to Industry targeted

Inquire for further detailed information of Global Digital Payment Market Report @ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-digital-payment-market&sc

Key questions answered in this report-:

What is the key market patterns affecting the development of the Digital Payment market?

What are the difficulties hampering the market development?

Who are the key sellers in the market?

What are the market openings and dangers looked by the merchants in this market?

What are the key variables driving the worldwide Digital Payment market?

What will the market size and the development rate be in 2026?

Data Bridge Market Research

Office Number 402,

Amanora Chambers,

Magarpatta Road, Hadapsar

Pune – 411028

Maharashtra, India.

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. We are content with our glorious 99.9 % client satisfying rate.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market 2020 SHARE, SIZE, GROWTH, DEMAND AND TOP GLOBAL PLAYERS –Google, Amazon.com, Inc., Apple Inc., Mastercard, Visa, First Data Corporation, PayPal, Worldpay here

News-ID: 2112163 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

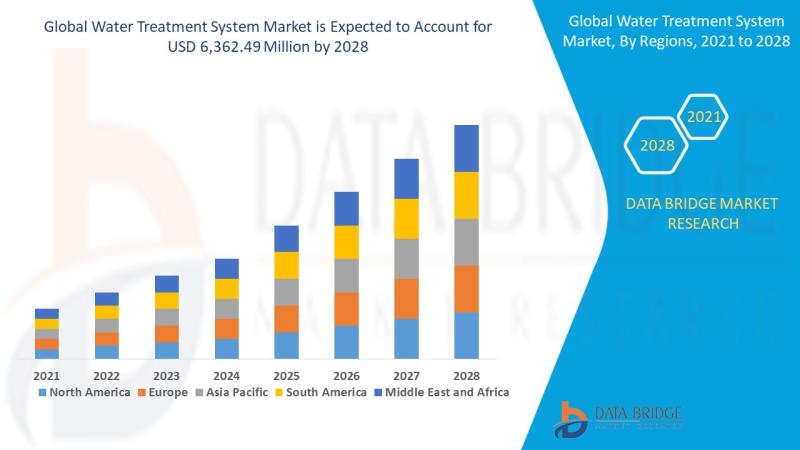

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…