Press release

Tax Software Market Business Opportunities 2027 – Top Companies are Avalara, The Sage Group, Thomson Reuters, Vertex, Wolters Kluwer (cch incorporated), Xero Limited, Chetu, Drake Software, H&R Block, Intuit

Global Tax Software Industry detailed study that helps to provide answers and relevant questions with respect to the Emerging Trends and Growth Opportunities. It helps identify each of the prominent hurdle to Growth, apart from identifying the trends of Tax Software market.Get Sample Copy of this Report @ https://www.theinsightpartners.com/sample/TIPRE00009740/?utm_source=OpenPR-10128

Due to the advent of digitalization across regions, companies are adopting advanced technologies for reducing manual business process and implementing automated process for increasing productivity and achieving efficient business outcomes. Owing to the internet and various platforms, such as desktop and smartphone, there is no need for individuals to visit a Tax Office; they can file a tax return and make a tax payment remotely.

The reports cover key developments in the Tax Software market as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as product launches, product approvals and others such as patents and events. Inorganic growth strategies activities witnessed in the market were acquisitions, and partnership & collaborations. These activities have paved way for expansion of business and customer base of market players. The market payers from Tax Software market are anticipated to lucrative growth opportunities in the future with the rising demand for Tax Software market in the global market.

Key Players Influencing the Market

• Avalara, Inc.

• The Sage Group plc

• Thomson Reuters Corporation

• Vertex, Inc.

• Wolters Kluwer (cch incorporated)

• Xero Limited

• Chetu Inc.

• Drake Software

• H&R Block

• Intuit

Impact of COVID-19 on Tax Software Market

COVID-19 pandemic is affecting various industries in the North America region, including the software industry and directly impacting IT and tech spending. According to the Center for Strategic and International Studies, owing to COVID-19 impact, the US would experience contraction in GDP in the second quarter. Further, as per the United Nations Conference on Trade and Development (UNCTAS), foreign direct investment (FDI) flows could fall between 5% and 15% to their lowest levels since the 2008–2009 financial crisis.

In March 2020, President Donald Trump of the US signed a law in order to offer relief for the taxpayers in the US, which is hugely impacted by COVID-19. The COVID-19 law, namely, the Families First Coronavirus Response Act or H.R. 6201, comprises relief for self-employed, businesses, and individuals. As coronavirus is negatively impacting various industries, it is also affecting the tax industry in the North America region. The coronavirus outbreak will have a limited short-term impact on the market. The short-term effect of coronavirus would not affect the recovery of overall sales in the tax industry in 2020; this is mainly because of the continued promotion of tax information by various companies in the region.

Place a Purchase Order to Buy a Complete Copy of this Report @ https://www.theinsightpartners.com/buy/TIPRE00009740/?utm_source=OpenPR-10128

Answers that the report acknowledges:

• Market size and growth rate during forecast period.

• Key factors driving the Tax Software Market.

• Key market trends cracking up the growth of the -Tax Software Market.

• Challenges to market growth.

• Key vendors of Tax Software Market.

• Detailed SWOT analysis.

• Opportunities and threats faces by the existing vendors in Global Tax Software Market.

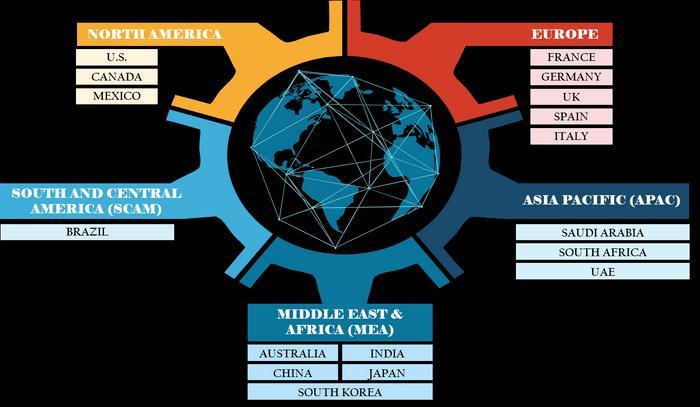

• Trending factors influencing the market in the geographical regions.

• Strategic initiatives focusing the leading vendors.

• PEST analysis of the market in the five major regions.

Contact Us:

Call: +1-646-491-9876

Email: sales@theinsightpartners.com

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Software Market Business Opportunities 2027 – Top Companies are Avalara, The Sage Group, Thomson Reuters, Vertex, Wolters Kluwer (cch incorporated), Xero Limited, Chetu, Drake Software, H&R Block, Intuit here

News-ID: 2096356 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…