Press release

Payment Security Market 2020: Analysis by Size, Share, Growth, Covid-19 Impact, Top Key Players (TokenEx, Elavon, Index, Intelligent Payments etc.) Study and Regional Forecast till 2023

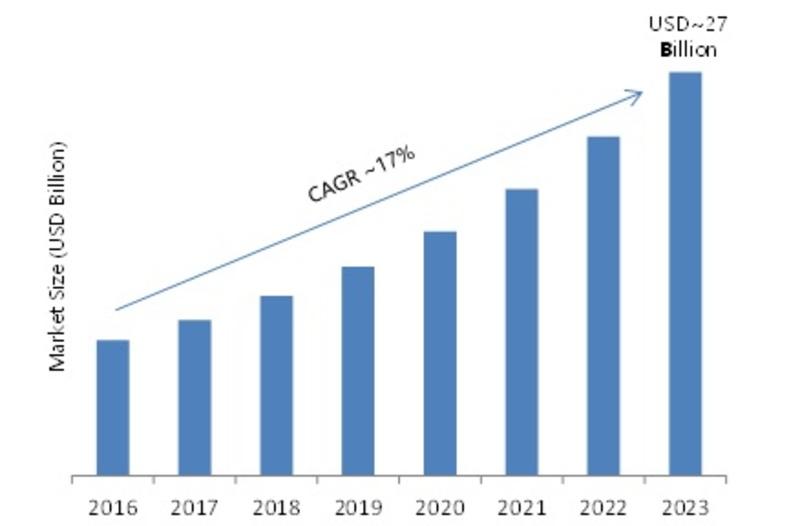

Market Synopsis:The global payment security market is estimated to value USD 27 billion by 2023 with a CAGR of 17% from 2017-2023. The global payment security market 2020 is estimated to experience a rise in expansion in the forthcoming years. The payment security system is expanding due to the rising numbers of e-Commerce and m-commerce transactions. Additionally, tokenization technology is a unique concept to this market that facilitates and secures payment security and provides a simpler payment process. It provides customer authentication without bringing any impact on the transaction’s security.

Key Players:

The distinguished players in the global payment security market are CyberSource Corporation (US), Ingenico ePayments (Netherlands), TokenEx, LLC (US), Intelligent Payments (Gibraltar), Index (US), Transaction Network Services (TNS) Inc. (US), Shift4 Corporation (US), GEOBRIDGE Corporation (US), Braintree (US), Elavon (US), and others.

Get Free Sample at:

https://www.marketresearchfuture.com/sample_request/3987

The online payment transactions utilize digital signatures which guarantee verification of transactions. Secure Sockets Layer is the most popular protocol across the industry as it completes the security requirement such as integrity, non-reputability, encryption, authentication. The developed payment security results in the modernization in the services and software modules and this will expand the demand of the payment security market.

The analysis shows that payment security is affected due to the reasons such as its operations without handling payments data, lessens the security risk posed by payment data. Additionally, it allows the payment transactions in a safe and secure method from the web and mobile browsers and provide the immediate checkout. The new players appearing across the globe, and the increase in demand for mobile commerce has imposed on the payment security standardized the payment infrastructure system in the future.

Segmentation:

The Payment Security Market has been classified on the basis of region, end-user, component, and organization size. On the basis of region, the market is classified into Asia Pacific, Europe, North America and the Rest of the World (RoW).

On the basis of end-user, the global payment security market is classified into BFSI, Travel and hospitality, Healthcare, IT and telecom, and others.

On the basis of components, the global payment security market is classified into solutions and services. Further, the solution is sub-divided into Fraud detection and prevention, Encryption, Encryption. Service can be further sub-divided into Consulting services, Support services, and Consulting services.

On the basis of organization size, the global payment security market is classified into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises and others.

Regional Analysis:

On the basis of region, the global payment security market’s analysis has been performed for Asia Pacific, America and the Rest of the World (RoW). It has been witnessed that the North American region is dominating by acquiring the largest market share in the payment security market. In the North American region, the global payment security market is expanding due to the payment security system records the log file until it is practical to maintain.

Browse More Details on Report at:

https://www.marketresearchfuture.com/reports/payment-security-market-3987

Europe is believed to be the second-largest market for payment security during the assessment period, owing to the rising requirement of on-line payment security which detects the fault and drawbacks of the system. The payment security market in the European region is earning popularity since the enterprises are continuously watching continuously and supervising the new developments and organizing their PCI DSS technology.

In the APAC region, it is believed to expand at the highest CAGR during the review period. The enterprises are investing to procure a safe and efficient payment method and give a seamless experience to the customers.

Table of Content:

1 MARKET INTRODUCTION

1.1 INTRODUCTION

1.2 SCOPE OF STUDY

1.2.1 RESEARCH OBJECTIVE

1.2.2 ASSUMPTIONS

1.2.3 LIMITATIONS

1.3 MARKET STRUCTURE:

1.3.1 PAYMENT SECURITY MARKET: BY COMPONENT

1.3.2 PAYMENT SECURITY MARKET: BY ORGANIZATION SIZE

1.3.3 PAYMENT SECURITY MARKET: BY END USERS

1.3.4 PAYMENT SECURITY MARKET: BY REGION

2 RESEARCH METHODOLOGY

2.1 RESEARCH MODEL

2.2 PRIMARY RESEARCH

2.3 SECONDARY RESEARCH

2.4 FORECAST MODEL

3 MARKET DYNAMICS

3.1 INTRODUCTION

3.2 MARKET DRIVERS

3.3 MARKET CHALLENGES

3.4 MARKET OPPORTUNITIES

4 EXECUTIVE SUMMARY

5. MARKET FACTOR ANALYSIS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

Continued..........

Also Read:

https://www.marketresearchfuture.com/reports/mobile-security-market-1192

https://www.marketresearchfuture.com/reports/cloud-application-security-market-4926

https://www.marketresearchfuture.com/reports/messaging-security-market-4219

Contact:

+1 646 845 9312

Email: sales@marketresearchfuture.com

Blog: http://mrfrblog.com/

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Market 2020: Analysis by Size, Share, Growth, Covid-19 Impact, Top Key Players (TokenEx, Elavon, Index, Intelligent Payments etc.) Study and Regional Forecast till 2023 here

News-ID: 2088366 • Views: …

More Releases from Market Research Future (MRFR)

Freeze-Dried Fruit Market to Reach USD 10.47 Billion by 2035, Driven by Health-C …

Freeze-Dried Fruit Market, valued at USD 5.108 Billion in 2024, is set to exhibit significant growth over the next decade. Market projections indicate an increase to USD 5.452 Billion in 2025 and a further rise to USD 10.47 Billion by 2035, representing a compound annual growth rate of 6.74% during the forecast period. The expansion of the market is fueled by growing consumer awareness of health and wellness, as freeze-dried…

Frozen Cooked Ready Meal Market Set to Hit USD 332.89B by 2035 on Convenience an …

Frozen Cooked Ready Meal Market has experienced robust growth in recent years, reflecting a global shift toward convenience and ready-to-eat food solutions. The market was valued at USD 188.38 billion in 2024 and is expected to reach USD 198.39 billion in 2025, with a projected expansion to USD 332.89 billion by 2035. This growth represents a compound annual growth rate (CAGR) of 5.31% over the forecast period. Busy lifestyles, increased…

Nuts and Seeds Market Poised to Hit USD 97.75B by 2035 on Health, Plant-Based, a …

Nuts and Seeds Market has demonstrated consistent growth as consumer preference shifts toward nutrient-rich and plant-based foods. Valued at approximately USD 61.7 billion in 2024, the market is expected to reach USD 64.33 billion in 2025 and further expand to USD 97.75 billion by 2035, representing a compound annual growth rate of 4.27% over the forecast period. The increasing adoption of health-conscious diets, coupled with innovative product formulations and the…

Decorations and Inclusion Market to Hit USD 18.13B by 2035 with Growth Driven by …

Decorations and Inclusion Market was valued at USD 10.77 billion in 2024 and is poised to achieve USD 18.13 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.85% during the forecast period from 2025 to 2035. The growth trajectory is underpinned by increasing consumer interest in personalized and culturally inclusive décor solutions across residential, commercial, and public spaces. Rising disposable incomes, evolving lifestyle preferences, and the adoption…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…