Press release

Online Lending Market 2020-2025: Increasing demand with Industry Professionals: Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar, Faircent, Upstart, Funding Circle, Prosper, Peerform

The Global Online Lending Market is comprehensively and Insightful information in the report, taking into consideration various factors such as competition, regional growth, segmentation, and Online Lending Market size by value and volume. This is an excellent research study specially compiled to provide the latest insights into critical aspects of the Global Online Lending Market 2020-2025.Overview of Global Online Lending Market:

This report studies the Global Online Lending Market over the forecast period of 2020 to 2025. The Global Online Lending Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2020 to 2025.

The significant key factors driving the growth of the Global Online Lending Market are shift from traditional lending to digital lending, growth in the government initiatives to digital lending, and an increase in borrowers and lenders in need of lowered lending management time. In addition, security related issues are expected during the forecast period to affect the growth of the Global Online Lending Market.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/270841 .

The Global Online Lending Market is segmented on the basis of Type, Application and Region. Based on the Type, the Global Online Lending Market is sub-segmented into and others. On the basis of Application, the Global Online Lending Market is classified into and others.

The Global Online Lending Market report covers the Major Player’s data, including: shipment, revenue, gross profit, interview record, business distribution etc., these data help the consumer know about the competitors better. This report also covers all the regions and countries of the world, which shows a regional development status, including market size.

In terms of the geographic analysis, The Online Lending Market in North America is expected to grow at the highest CAGR during the forecast period. Moreover, the presence of major players in the Online Lending Market ecosystem results in the increasing adoption of these systems in North America.

Global Online Lending Market Objectives:

1 To provide detailed information regarding key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the Online Lending Market

2 To analyze and forecast the size of the Online Lending Market, in terms of value and volume

3 To analyze opportunities in the Online Lending Market for stakeholders and provide a competitive landscape of the market

4 To define, segment, and estimate the Online Lending Market based on deposit type and end-use industry

5 To strategically profile key players and comprehensively analyze their market shares and core competencies

6 To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

7 To forecast the size of market segments, in terms of value, with respect to main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America

8 To track and analyze competitive developments, such as new product developments, acquisitions, expansions, partnerships, and collaborations in the Online Lending Market

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Online Lending Market Report 2020” @ https://www.businessindustryreports.com/buy-now/270841/single .

Top Leading Key Manufacturers are: Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar, Faircent, Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club and others. New product launches and continuous technological innovations are the key strategies adopted by the major players.

Top Business News:

RateSetter (March 30, 2020) - Average Cash ISA from the UK’s biggest banks will earn just £12 in annual interest - The average Cash ISA from the UK’s top ten banks will earn just £12 in interest over the next year - around one quarter of the average UK monthly mobile phone bill. The analysis, by peer-to-peer lender RateSetter, highlights the stark challenge facing savers looking to grow their money in a Cash ISA.

HMRC figures show that the average amount saved in a Cash ISA is £5,114. If this amount was held in the average Cash ISA with one of the UK’s ten biggest high street banks, which on average pay 0.24% for their instant access products, it would earn £12.27 interest in a year. To put this figure in perspective, it is only half of one person’s weekly grocery shop, at £23.305.

While the interest rate offered by the ten biggest banks is slightly better for savers willing to lock in their money for two years, at 0.61%, it will still provide just £31 per year for the average Cash ISA, with penalties for early withdrawals.

Rhydian Lewis, CEO at RateSetter, said: “Cash ISAs provide certainty on the returns they deliver – but with interest rates closing in on zero, this essentially guarantees your money will fall in value once inflation is factored in.

“However, people should not give up on the prospect of growing their money in the coming year. There are still inflation-beating ISA investment options out there which offer shelter from the turbulence of the stock market, such as the Innovative Finance ISA.”

An IFISA allows peer-to-peer (P2P) investments within a tax-free wrapper - any interest earned is not taxed and does not count towards the Personal Savings Allowance. In the last year, take-up of the Innovative Finance ISA has doubled, with the number of accounts opened doubling from 45,000 to 85,000 and cumulative investment exceeding £1billion.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Online Lending in these regions, from 2013 to 2025 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/270841 .

Major Points in Table of Contents:

Global Online Lending Market Report 2020

1 Online Lending Product Definition

2 Global Online Lending Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Online Lending Shipments

2.2 Global Manufacturer Online Lending Business Revenue

2.3 Global Online Lending Market Overview

2.4 COVID-19 Impact on Online Lending Industry

3 Manufacturer Online Lending Business Introduction

3.1 Zopa Online Lending Business Introduction

3.2 Daric Online Lending Business Introduction

3.3 Pave Online Lending Business Introduction

3.4 Mintos Online Lending Business Introduction

3.5 Lendix Online Lending Business Introduction

3.6 RateSetter Online Lending Business Introduction

………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is a digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic, and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Lending Market 2020-2025: Increasing demand with Industry Professionals: Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar, Faircent, Upstart, Funding Circle, Prosper, Peerform here

News-ID: 2082592 • Views: …

More Releases from Business Industry Reports

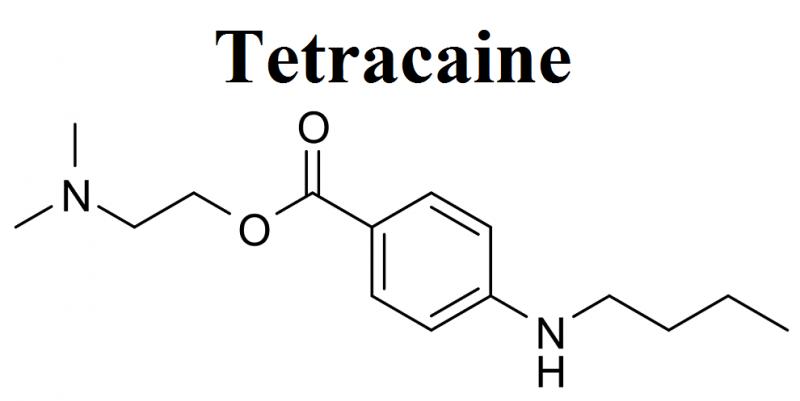

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

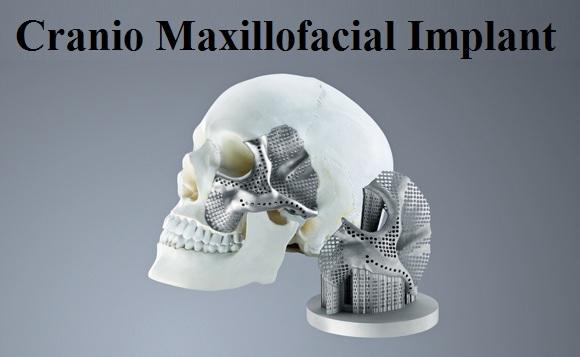

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…