Press release

Cloud Tax Management Market Increasing Demand with Leading Player, Comprehensive Analysis, Forecast 2024 | Avalara, Wolters Kluwer NV,Thomson Reuters, Intuit

The research study covers the current scenario and growth prospects of the Cloud Tax Management market (2020-2024) according to the analysis . This study includes a extensive analysis of the key segments of the industry and also the regional analysis that are taken place throughout the country.Global Cloud Tax Management Market Overview:

The report also reveals in-depth details of shifting market dynamics, pricing structures, trends, restraints, limitations, demand-supply variations, growth-boosting factors, and market variations that have been considered the most important factors in the Cloud Tax Management market.

The Cloud Tax Management market is anticipated to rise at a significant CAGR during the upcoming year. The Cloud Tax Management market increase is qualified to the rising acceptance of the cloud computing in changed verticals containing BFSI sector, IT and telecom, drive & utilities, healthcare & life science, and others. The positioning of the predictable on-evidence service-based systems for the development of the business enterprise's proficiencies and increase of new abilities takes time. Furthermore, the use of the cloud platform assists the organization to lessen its general operational cost. Cloud services removed the wait to run the application after its positioning, which results in time-saving and more effective work.

To improve their reach and access in the distributed environment, the BFSI sector has to accomplish a huge variety of consumers in several regions under different rules and protocols. As a result, a document management system for the BFSI industry is much more composite and critical. Moreover, this subdivision makes use of huge clouds to save their statistics, consequently these administrations are actively adopting cloud tax management solutions to perform KYC and threat managing, record management & OCR, professional process management, and safety & privacy. In vitality & values Cloud Tax Management solutions are used to analyse the property tax. In the healthcare &life science sector the cloud tax management solution is used to manage the service tax, goods & service tax, and property tax among others.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/247115 .

The study forecasts the rise of the Cloud Tax Management Market founded on market size, market share, demand, trends and gross sales. It also focuses on the points of large companies in relation to the economic landscape and their specific share in the world market. The report segments the industry by product type, application and end use. It displays the newest movements and technical growths in the manufacturing that can impact the industry. The study offers a meticulous viewpoint on the trends detected in the market, the subsidizing factors, the main players, the key companies and the key areas with progress potential.

Market Key Players

The global Cloud Tax Management market is marked by some strong competition from the major players operating in this industry. Many merger and acquisition, joint venture and partnership agreement, product innovation, research and development and geographical extension are some of the key strategies adopted by this player to ensure long term sustenance in these market key participants in the global Cloud Tax Management industry include

Avalara

Automatic Data Processing

Wolters Kluwer NV

Thomson Reuters…more

Segmentations

The Cloud Tax Management market has been sub-grouped into type and application. The report studies these subsets with respect to the geographical segmentation. The strategists can gain a detailed insight and devise appropriate strategies to target specific market. This detail will lead to a focused approach leading to identification of better opportunities.

Product Type Segmentation

Indirect Tax

Direct Tax

Industry Segmentation

Banking Financial Services and Insurance (BFSI)

Information Technology (IT) and Telecom

Energy and Utilities

Healthcare and Life Sciences

Regional Segmentation

The report offers a complexity assessment of rise and other features of the market in key countries such as the United States, Canada, Mexico, Germany, France, the United Kingdom, Russia and the United States Italy, China, Japan, South Korea, India, Australia, Brazil and Saudi Arabia. The study on the economic landscape of the global market report comprises significant information on market participants such as business overview, total sales (financial data), market probable, global occurrence, Cloud Tax Management sales and earnings, market share, prices, production locations and facilities, products available and applied approaches. This study provides Cloud Tax Management sales, revenue, and market share for each player covered in this report for a forecasts year 2020 and 2024.

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Cloud Tax Management Report 2020” @ https://www.businessindustryreports.com/buy-now/247115/single .

Global Industry News:

Avalara :

4/2/2020 Tennessee Marketplace Facilitator Tax Bill Signed Amid Pandemic

Tennessee has joined the majority of sales tax states with a law requiring marketplace facilitators such as Amazon.com Inc., eBay Inc., and Etsy Inc. to collect and remit taxes on remote sales.

Gov. Bill Lee (R) signed the measure (S.B. 2182) Wednesday, imposing the obligation on online marketplaces with more than $500,000 of annual sales into the Volunteer State, the same threshold the state previously set for remote sellers. The law takes effect Oct. 1.

Lawmakers in the state House and Senate passed it almost unanimously two weeks earlier, as they rushed to finish budget-related business before suspending the legislative session amid the coronavirus pandemic.

The new law is expected to generate $113 million annually in state revenue plus $38 million in local tax revenue in fiscal year 2021-22 and beyond, according to a legislative staff analysis.

The state will need the additional tax revenue, bill sponsor Rep. Patsy Hazlewood (R) said during House floor debate March 19.

Marketplace facilitator laws have blossomed in more than 30 of the 45 sales tax states in the wake of the Supreme Court’s seminal South Dakota v. Wayfair ruling. The June 2018 decision tossed out the court’s 1992 physical presence standard affirmed in Quill Corp. v. North Dakota, which limited the ability of states to tax remote sales.

The majority in the 5-4 ruling suggested strongly that South Dakota’s law, which requires remote sellers to collect sales tax if they have more than $100,000 in sales or 200 transactions to buyers in the state, would pass constitutional muster. Since the June 2018 decision, all but two states—Missouri and Florida—have asserted their authority to impose remote sales tax based on a measure of economic activity, as opposed to physical presence.

Key Points Covered :

This research study inspects the current market trends related to the demand, supply, and sales, in addition to the recent developments. Major drivers, restraints, and opportunities have been covered to provide an exhaustive picture of the market. The analysis presents in-complexity information regarding the development, trends, and industry policies and guidelines implemented in each of the geographical regions. Further, the overall directing framework of the market has been thoroughly covered to offer stakeholders a better understanding of the key factors affecting the overall market environment.

The study is a source of reliable data on:

Market segments and sub-segments

Market trends and dynamics

Supply and demand

Market size

Current trends/opportunities/challenges

Competitive landscape

Technological breakthroughs

Value chain and stakeholder analysis

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/247115 .

Major Points in Table of Contents:

Section 1 Cloud Tax Management Product Definition

Section 2 Global Cloud Tax Management Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Cloud Tax Management Shipments

2.2 Global Manufacturer Cloud Tax Management Business Revenue

2.3 Global Cloud Tax Management Market Overview

Section 3 Manufacturer Cloud Tax Management Business Introduction

3.1 Avalara Cloud Tax Management Business Introduction

3.1.1 Avalara Cloud Tax Management Shipments, Price, Revenue and Gross profit 2014-2019

3.1.2 Avalara Cloud Tax Management Business Distribution by Region

3.1.3 Avalara Interview Record

3.1.4 Avalara Cloud Tax Management Business Profile

3.1.5 Avalara Cloud Tax Management Product Specification

3.2 Automatic Data Processing Cloud Tax Management Business Introduction

3.2.1 Automatic Data Processing Cloud Tax Management Shipments, Price, Revenue and Gross profit 2014-2019

3.2.2 Automatic Data Processing Cloud Tax Management Business Distribution by Region

3.2.3 Interview Record

3.2.4 Automatic Data Processing Cloud Tax Management Business Overview

3.2.5 Automatic Data Processing Cloud Tax Management Product Specification

3.3 Wolters Kluwer NV Cloud Tax Management Business Introduction

3.3.1 Wolters Kluwer NV Cloud Tax Management Shipments, Price, Revenue and Gross profit 2014-2019

3.3.2 Wolters Kluwer NV Cloud Tax Management Business Distribution by Region

3.3.3 Interview Record

3.3.4 Wolters Kluwer NV Cloud Tax Management Business Overview

3.3.5 Wolters Kluwer NV Cloud Tax Management Product Specification

3.4 Thomson Reuters Cloud Tax Management Business Introduction

3.5 Intuit Cloud Tax Management Business Introduction

3.6 H R Block Cloud Tax Management Business Introduction ………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cloud Tax Management Market Increasing Demand with Leading Player, Comprehensive Analysis, Forecast 2024 | Avalara, Wolters Kluwer NV,Thomson Reuters, Intuit here

News-ID: 2067787 • Views: …

More Releases from Business Industry Reports

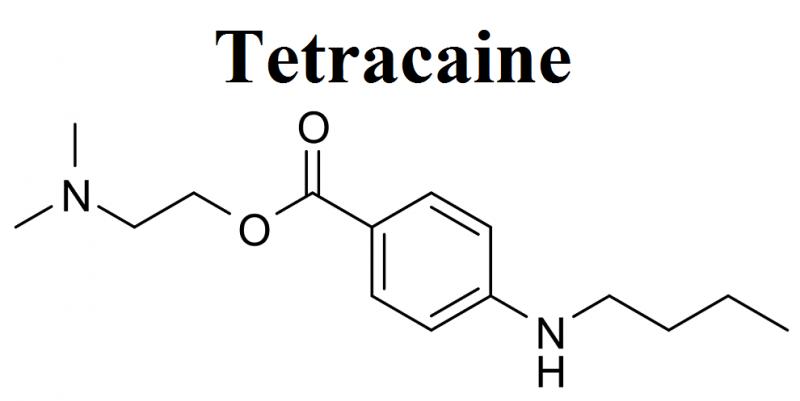

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

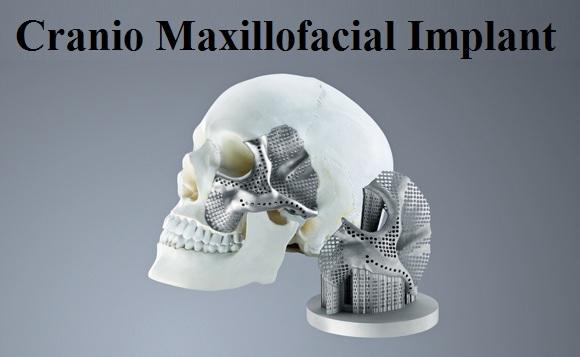

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…