Press release

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? - Ken Research

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional eligibility conditions) & prefer to provide loans to Nationals working in government jobs. Therefore, ex-pats (8.5 Mn population) are often seen resorting to loan aggregator channels.Retail loans including personal loans, credit cards, mortgages/home loans, car loans are the second most demanded loan category in UAE. With minimal documentation & eligibility criteria, personal loans in the UAE are majorly acquired for the purposes of house renovations, travel, paying off other loans, etc. In past years, personal loans outstanding in UAE have been gaining momentum owing to increased working population demand from Dubai & Northern Emirates regions. However, given similar documentation & eligibility criteria, one must expect a similar trend to be followed in credit cards demand as well. On the contrary, credit card transactions have been falling owing to limited Merchant's Banking Infrastructure availability and making credit cards usage limited & challenging.

From past 2-3 years, property prices in the UAE have been following a downward trend reaching an average price of AED 2.58 Mn by 2019 and shifting from investor led market to the owner-occupied market. Attaining home loan in UAE is a costly & a time-consuming process, therefore consumers often take online aggregator services to either compare loan prices or get assisted in overall loan acquisition process.

In recent years, instead of purchasing new car consumers have been shifting to alternative options such as car leasing, car subscriptions or purchasing used cars. This, in turn, has decreased the country's year on year car sales subsequently negatively impacting car loan demand in the country. However, car dealerships often have tie-ups with multiple banks thereby helping purchasers in loan facilitation & charges negotiations which is one of the major reasons for consumers to not preferring online aggregator services.

SME loans can be a high potential area for online aggregators. According to Dubai SME Report of 2018, 400 thousand MSMEs contribute ~40% to the GDP and employ 42% of the city's workforce. However, owing to credibility issues & failing to meet collateral requirements, SMEs in The UAE suffer from a 60-65% rejection rate, therefore, they are often seen to rely mainly on self-funding options or on aggregators for loan facilitation.

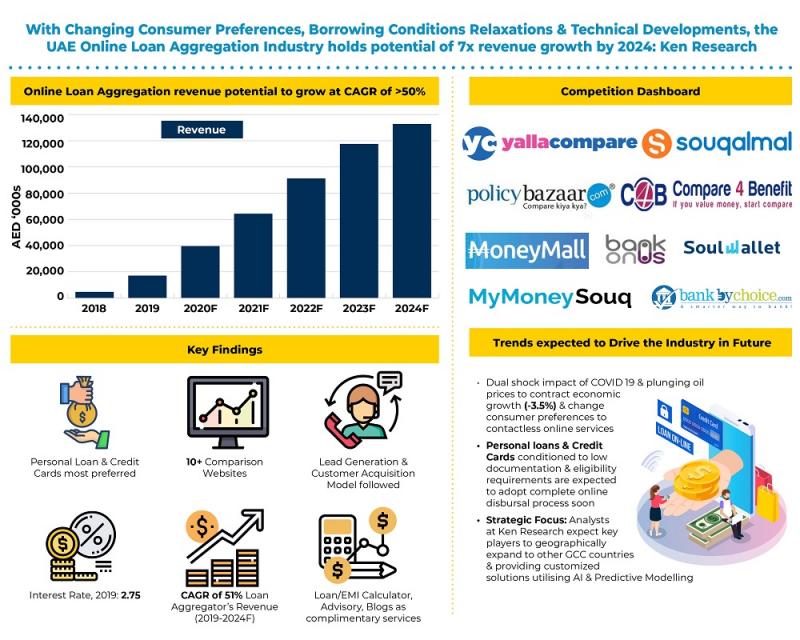

COVID 19 pandemic has made industries realize the importance of online operations and has brought in major shift in consumer behavior with consumers preferring contactless online services. Such a situation is expected to act as an opportunity for online loan aggregators thereby expecting tremendous growth through increased traffic & leads.

For More Information on the assess product portfolio, Click on the Below Link: -

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/uae-online-loan-aggregator-industry-outlook/337074-93.html

Companies Covered: -

YallaCompare

Souqalmal

BankOnUs

Policy Bazaar UAE

SoulWallet

UAE Cash Loans

Time Period Captured in the Report: -

Historical Period: 2015-2019

Forecast Period: 2020-2024

Key Topics Covered in the Report: -

Socio-Demographic, Economic & Banking Scenario in UAE

Snapshot of Lending scenario in The UAE with segmentation by Business & industrial Loans, Retail Loans, Loans to Government, Public Loans & Loans to Financial Institutions

Retail Lending Scenario with Segmentation by Personal Loans, Credit Cards, Mortgage/Home Loan, Car Loan and Others

Gaps in Traditional Loan Industry fulfilled by Online Loan Aggregators

Online Loan Aggregator Industry in The UAE with Business Model followed

End-to-End Customer Journey followed

Technological & Operational Structure followed

Regulatory Landscape in UAE Loan Industry

Competitive Landscape including Overview, Ecosystem & Cross Comparison among major players on basis of Operational, Loan Providers, Product Portfolio, Strengths & Weakness Analysis, website Features

Company Profiles-YallaComapre, Souqalmal, BankOnUs, PolicyBazaar UAE, SoulWallet, UAE Cash Loans

International Case Studies-PaisaBazaar (India), Money Super Market (UK)

Future Outlook of Retail Lending & Online Loan Aggregators

Impact of COVID 19

Related Reports by Ken Research: -

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/india-online-loan-market-research-report/622-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-peer-to-peer-lending-market-outlook/243554-93.html

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? - Ken Research here

News-ID: 2064912 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…