Press release

Mobile Payment Market Ongoing Trends and Recent Development | Google, Microsoft, Apple, Vodafone, Visa, American Express, Mastercard, Tencent

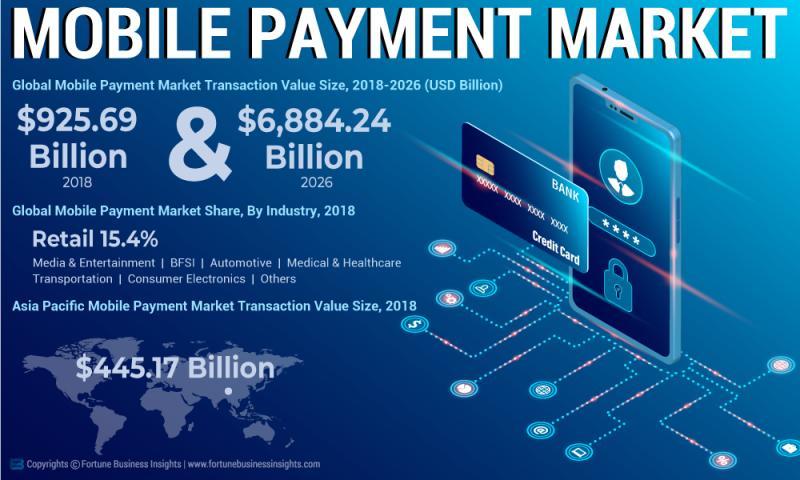

Increasing shift towards an online platform to fuel demand in the global Mobile Payment Technology market. The market has been witnessing the development of new technology. Fortune Business Insights has announced publishing of a report, titled "Mobile Payment Technology Market Size, Share and Global Trend By Payment Mode, By Industry Vertical and Geography Forecast till 2026".To Gain More Insights into the Mobile Payment Technology Market, Browse Summary of the Research Report - https://www.fortunebusinessinsights.com/industry-reports/mobile-payment-technology-market-100336

"Key players are expected to emphasize integrating Artificial Intelligence in the system. This is anticipated to propel the growth in the global Mobile Payment Technology market," said a lead analyst at Fortune Business Insights.

Top Players List:

o Google

o Microsoft Corporation

o Apple

o Vodafone

o American Express

o Visa

o Tencent

o MasterCard

o PayPal

o Ant Financial

o Bharti Airtel

o Boku

o Fortumo

o AT&T Inc.

Integration of internet of things with the system is a major factor anticipated to fuel the demand in the market during the forecast period 2018-2025. Additionally, the rising adoption of e-financial services is expected to boost the global market.

Request a Sample Copy for more detailed Mobile Payment Technology Market Overview - https://www.fortunebusinessinsights.com/enquiry/sample/mobile-payment-technology-market-100336

Major Segments Mentioned:

o By Payment Mode

o By Industry Vertical

o By Geography

On the contrary, high cost associated with upgraded technology is a factor that may restrain the global Mobile Payment Technology market.

Regional Analysis:

o North America (the USA and Canada)

o Europe (UK, Germany, France, Italy, Spain, Scandinavia and Rest of Europe)

o Asia Pacific (Japan, China, India, Australia, Southeast Asia and Rest of Asia Pacific)

o Latin America (Brazil, Mexico and Rest of Latin America)

o Middle East & Africa (South Africa, GCC and Rest of the Middle East & Africa)

As stated in the report, North America held a significant share in the market in 2017. The region is expected to witness impressive growth during the forecast period. Owing to intense research and development taking place in the region for IoT integration in the system is likely to enable the growth in the region. Besides this, Asia Pacific is expected to witness promising growth owing to the rising adoption of a sedentary lifestyle in nations such as India and China.

The report also offers insights on the key players operating in the global Mobile Payment Technology market.

Major Table of Content for Mobile Payment Technology Market:

1. Introduction

2. Executive Summary

3. Market Dynamics

4. Key Insights

5. Global Mobile Payment Technology Market Analysis, Insights and Forecast, 2014-2025

6. North America Mobile Payment Technology Market Analysis, Insights and Forecast, 2014-2025

7. Europe Mobile Payment Technology Market Analysis, Insights and Forecast, 2014-2025

8. Asia Pacific Mobile Payment Technology Market Analysis, Insights and Forecast, 2014-2025

9. Middle East and Africa Mobile Payment Technology Market Analysis, Insights and Forecast, 2014-2025

10. Latin America Mobile Payment Technology Market Analysis, Insights and Forecast, 2014-2025

11. Competitive Landscape

12. Company Profile

13. Conclusion

Complete TOC Available Here...

Purchase Full Report for Exclusive Mobile Payment Technology Market Growth Forecast - https://www.fortunebusinessinsights.com/checkout-page/100336

An Overview of the Impact of COVID-19 on this Market:

The emergence of COVID-19 has brought the world to a standstill. We understand that this health crisis has brought an unprecedented impact on businesses across industries. However, this too shall pass. Rising support from governments and several companies can help in the fight against this highly contagious disease. There are some industries that are struggling and some are thriving. Overall, almost every sector is anticipated to be impacted by the pandemic.

We are taking continuous efforts to help your business sustain and grow during COVID-19 pandemics. Based on our experience and expertise, we will offer you an impact analysis of coronavirus outbreak across industries to help you prepare for the future.

Click here to get the short-term and long-term impact of COVID-19 on this Market.

Please visit: https://www.fortunebusinessinsights.com/enquiry/covid19-impact/mobile-payment-technology-market-100336

Contact Us:

Fortune Business Insights(TM) Pvt. Ltd.

308, Supreme Headquarters,

Survey No. 36, Baner,

Pune-Bangalore Highway,

Pune - 411045, Maharashtra, India.

Phone:

US :+1 424 253 0390

UK : +44 2071 939123ac

APAC : +91 744 740 1245

Email: sales@fortunebusinessinsights.com

Fortune Business Insights(TM) offers expert corporate analysis and accurate data, helping organizations of all sizes make timely decisions. Our reports contain a unique mix of tangible insights and qualitative analysis to help companies achieve sustainable growth. Our team of experienced analysts and consultants use industry-leading research tools and techniques to compile comprehensive market studies, interspersed with relevant data.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Market Ongoing Trends and Recent Development | Google, Microsoft, Apple, Vodafone, Visa, American Express, Mastercard, Tencent here

News-ID: 2049387 • Views: …

More Releases from Fortune Business Insights Pvt. Ltd.

Global Bread Maker Market to Reach USD 11.13 Billion by 2032, Driven by a 4.71% …

The global bread maker market size was valued at USD 7.48 billion in 2023 and is expected to be worth USD 7.70 billion in 2024. The market is projected to reach USD 11.13 billion by 2032, recording a CAGR of 4.71% during the forecast period.

Bread maker machines enable users to create a diverse range of bread at home cost-effectively. The increasing demand for innovative home appliances and the rising replacement…

Streetwear Industry to Reach $637.12 Billion by 2032 at 7.89% CAGR During Foreca …

The global streetwear market size was valued at USD 325.28 billion in 2023. The market is projected to be worth USD 347.14 billion in 2024 and reach USD 637.13 billion by 2032, exhibiting a CAGR of 7.89% during the forecast period. Asia Pacific dominated the streetwear market with a market share of 36.17% in 2023.

Fortune Business InsightsTM displays this information in a report titled, "Streetwear Market, 2024-2032."

Request a Free Sample…

Streetwear Market Size, Share, Analysis, Overview, Demand, Report, 2032 | Compan …

The streetwear market size was valued at USD 325.28 billion in 2023 and is expected to be worth USD 347.14 billion in 2024. The market is projected to reach USD 637.13 billion by 2032, recording a CAGR of 7.89% during the forecast period.

Streetwear is youth-inspired clothing that is highly popular among hip-hop enthusiasts and skateboarders. It is popular for its vibrant colors, bold logo graphics, and unconventional designs. Streetwear is…

Perfume Market Size, Share, Growth, Demand, Overview, Report, 2032 | Companies- …

The global perfume market size was valued at USD 48.05 billion in 2023 and is projected to grow from USD 50.45 billion in 2024 to USD 77.52 billion by 2032, exhibiting a CAGR of 5.51% during the forecast period.

Perfumes are pleasant smelling solutions made by using oils, fragrances, and other ingredients to create a pleasing aroma. Increasing demand for high-quality beauty and grooming products globally is expected to boost the…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…