Press release

Covid-19: Potential Impact On Lending And Payments Market: Reporting And Evaluation Of Recent Industry Developments

The Business Research Company offers "Lending And Payments Global Market Report 2020-30: Covid 19 Impact And Recovery" in its research report store. It is the most comprehensive report available on this market and will help gain a truly global perspective as it covers 60 geographies. The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by region and by country. It also compares the market's historic and forecast growth, and highlights important trends and strategies that players in the market can adopt.The global lending and payments market is expected to decline from $7597.3 billion in 2019 to $7473.6 billion in 2020 at a compound annual growth rate (CAGR) of -1.7%. The decline is mainly due to economic slowdown across countries owing to the COVID-19 outbreak and the measures to contain it. The market is then expected to recover and grow at a CAGR of 6% from 2021 and reach $8838 billion in 2023.

Place a DIRECT PURCHASE ORDER of The Entire 140+ Pages Report @ https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=1886

The lending and payments market consists of sales of lending and payments services by entities (organizations, sole traders and partnerships) that engage in lending and payments related activities such as lending, payments and money transfer services. The lending and payments industry is categorized on the basis of the business model of the firms present in the industry. Some firms offering lending services may offer other services, financial or otherwise.

This growth is collectively driven by increasing competition between payment card issuers, mobile operators and smartphone manufacturers such as Apple and Samsung. Improving contactless payments infrastructure and security features such as host card emulation (HCE) also drove the growth of NFC-based mobile payments.

Lending And Payments Market Segmentation: -

By Type

1. Lending

2. Cards & Payments

By End User

1. B2B

2. B2C

Browse Complete Report @ https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report-2020-30-covid-19-impact-and-recovery

Few Points From Table Of Content

1. Executive Summary

2. Report Structure

3. Lending And Payments Market Characteristics

4. Lending And Payments Market Product Analysis

5. Lending And Payments Market Supply Chain

......

20. Lending And Payments Market Competitive Landscape

21. Key Mergers And Acquisitions In The Lending And Payments Market

22. Market Background: Financial Services Market

23. Recommendations

24. Appendix

25. Copyright And Disclaimer

The report covers the trends and market dynamics of the lending and payments market in major countries - Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA. The report also includes consumer surveys and various future opportunities for the market.

Request for a Sample Copy of This Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=1886&type=smp

Some of the key players involved in the lending and payments market are Industrial and Commercial Bank of China; Agricultural Bank of China; Bank of China; JP Morgan; Wells Fargo

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on Blog: http://blog.tbrc.info/

About US:

The Business Research Company has published over 1000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets after WHO declared COVID-19 as a pandemic.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Covid-19: Potential Impact On Lending And Payments Market: Reporting And Evaluation Of Recent Industry Developments here

News-ID: 2040455 • Views: …

More Releases from The Business research company

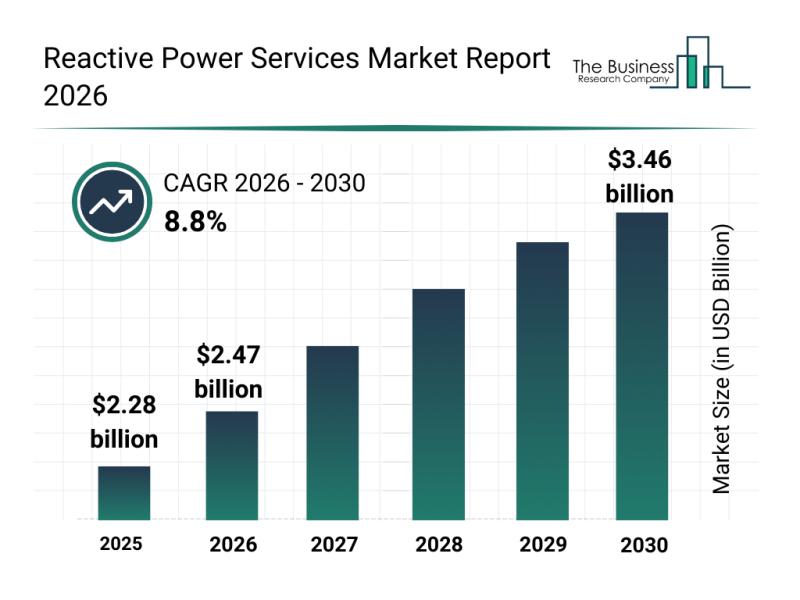

Future Perspective: Key Trends Shaping the Reactive Power Services Market up to …

The reactive power services market is set for significant expansion in the coming years as the energy sector evolves to meet modern demands. With increasing renewable energy adoption and advancements in grid technologies, this market is becoming a critical component in ensuring power system reliability and efficiency. Let's explore the market size forecast, key companies involved, influential trends, and the various segments shaping this industry.

Projected Growth and Market Size of…

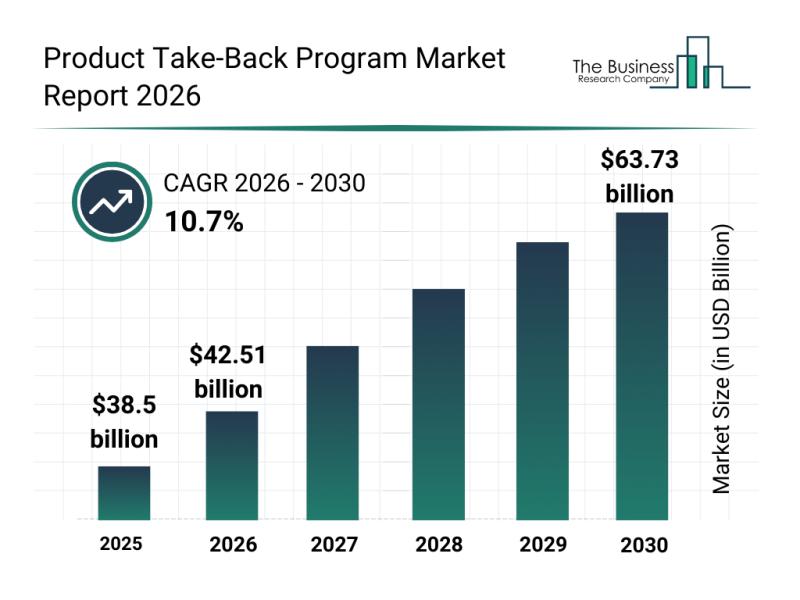

Analysis of Key Market Segments Driving the Product Take-Back Program Market

The product take-back program market is gaining significant attention as sustainability becomes a higher priority for businesses and consumers alike. With increasing efforts to promote circular economy models, this sector is set for impressive growth and innovation over the coming years. Let's explore the market's size projections, major players, key drivers, notable trends, and segmentation details to better understand its evolving landscape.

Forecasted Growth and Market Size of the Product Take-Back…

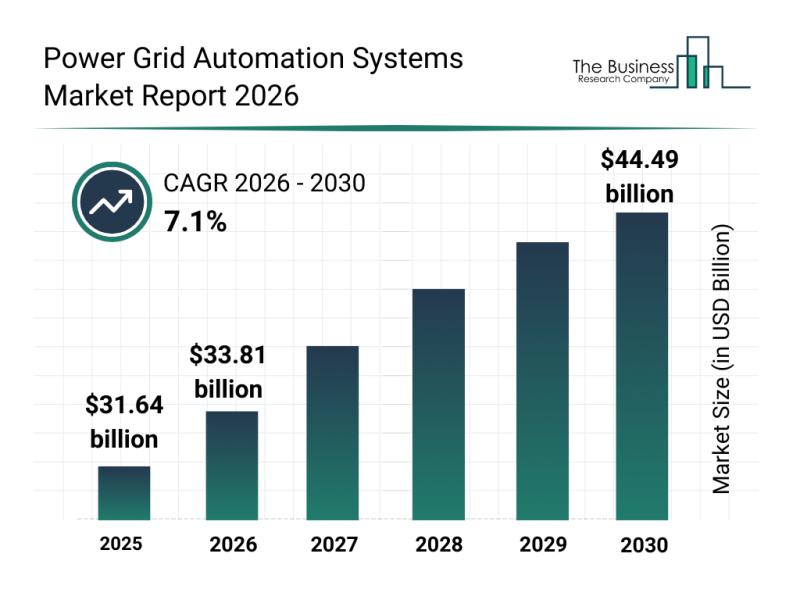

Global Drivers Analysis: The Rapid Evolution of the Power Grid Automation System …

The power grid automation systems market is on the verge of significant expansion, driven by technological advancements and increasing demands for smarter, more resilient energy networks. This sector is evolving rapidly as utilities and energy providers adopt innovative solutions to manage and optimize power grids more effectively. Below, we explore the market's projected value, key industry players, emerging trends, and the detailed segmentation shaping its future.

Projected Growth and Valuation of…

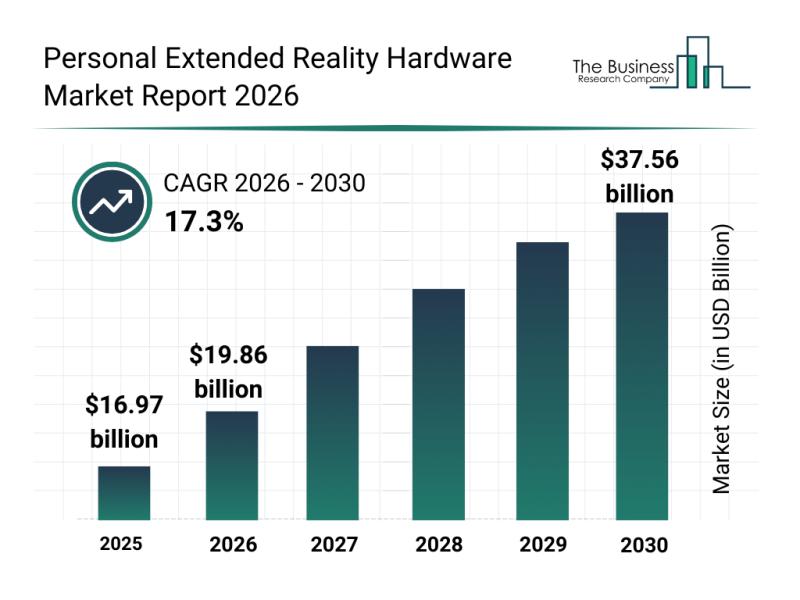

Leading Companies Consolidating Their Roles in the Personal Extended Reality Har …

The personal extended reality hardware market is on the cusp of remarkable expansion, driven by technological advancements and growing user demand. As industries and consumers increasingly embrace extended reality (XR) technologies, this market is expected to experience significant growth in the coming years. Let's delve into the anticipated market size, the key players shaping the landscape, current trends, and important segmentation within this evolving sector.

Projected Growth Trajectory of the Personal…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…