Press release

Global Sales Tax Software Market To Witness Towering Growth And Surpass USD 8,285 Million By 2025

A leading research firm Zion Market research added a recent report on "Global Sales Tax Software Market Is Expected To Reach Around USD 8,285 Million By 2025" to its research database. The Sales Tax Software Market comprehensive is perceptible among the most immensely gathered market globally. The Sales Tax Software Market report gives the exchange information and the progressing business chain information in the overall market. The report gives a thought with respect to the advancement of the free market movement of significant players of the Sales Tax Software Market. A noteworthy examination of the market relies upon general plans, which have been of late organized to the investigation of Sales Tax Software Market, is furthermore incorporated into the report.FREE | Request Sample is Available @ https://www.zionmarketresearch.com/sample/sales-tax-software-market#utm_source=kavita%2FMARCH&utm_medium=ref

Some of the Major Sales Tax Software Market Players Are:

APEX Analytix, Avalara, CCH Incorporated, eDocSolutions, eGov Systems, Exactor, LegalRaasta.com, LumaTax, Inc., Ryan, Sage Intacct, Inc., Sales Tax DataLINK, Sovos Compliance, Thomson Reuters, Vertex, Inc., Xero, and Zoho Corporation

The Sales Tax Software Market report thinks about the present execution of the overall market notwithstanding the novel examples and furthermore a complete bifurcation product, its end-users, applications, and others of the market; additionally, the factual studying report does predictions on the accompanying power of the market reliant on this examination. The Sales Tax Software Market measurable looking over examination incorporates all parts of the overall market, which starts from perception the Sales Tax Software Market, collaborating with customers, and assessing the data of the overall market.

The worldwide geological [Latin America, North America, Asia Pacific, Middle & East Africa, and Europe] analysis of the Sales Tax Software Market plan has furthermore been done cautiously in this report. The dynamic establishment of the overall Sales Tax Software Market depends on the assessment of item circulated in various markets, limitations, general benefits made by every association, and future aspirations. The major application areas of Sales Tax Software Market are also covered on the basis of their implementation. The report gives the ideology about different factors and inclinations affecting the development course of the worldwide Sales Tax Software Market. A review of the impact of the administrative regulations and policies on the Sales Tax Software Market operations is also included in this report. The Sales Tax Software Market report offers a complete analysis of competitive dynamics that are modifying and places the patrons ahead of competitors.

Download Free PDF Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/sales-tax-software-market#utm_source=kavita%2FMARCH&utm_medium=ref

Promising Regions & Countries Mentioned In The Sales Tax Software Market Report:

North America ( United States)

Europe ( Germany, France, UK)

Asia-Pacific ( China, Japan, India)

Latin America ( Brazil)

The Middle East & Africa

What our Sales Tax Software Market report offers:

Sales Tax Software Market share assessments for the regional and country level segments

Sales Tax Software Market share analysis of the top industry players

Sales Tax Software Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

Strategic recommendations in key business segments based on the Sales Tax Software Market estimations

Competitive landscaping Young, Olding the key common trends

Company profiling with detailed strategies, and recent developments

Inquire more about this report @ https://www.zionmarketresearch.com/inquiry/sales-tax-software-market#utm_source=kavita%2FMARCH&utm_medium=ref

Key Topics Covered:

1. Introduction

2. Executive Summary

3. Sales Tax Software Market Market Dynamics

4. Global Sales Tax Software Market Competitive Landscape

5. Global Sales Tax Software Market Therapy Type Segment Analysis

6. Global Sales Tax Software Market Therapeutic Area Segment Analysis

7. Global Sales Tax Software Market End-User Segment Analysis

8. Global Sales Tax Software Market Regional Segment Analysis

Request Report TOC (Table of Contents) @ https://www.zionmarketresearch.com/toc/sales-tax-software-market#utm_source=kavita%2FMARCH&utm_medium=ref

Reason to Buy

Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global Sales Tax Software Market

Highlights key business priorities in order to assist companies to realign their business strategies.

The key findings and recommendations highlight crucial progressive industry trends in the Sales Tax Software Market, thereby allowing players to develop effective long term strategies.

Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

Also, Research Report Examines:

Competitive companies and manufacturers in global market

By Product Type, Applications & Growth Factors

Industry Status and Outlook for Major Applications / End Users / Usage Area

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Browse detail report @ https://www.zionmarketresearch.com/report/sales-tax-software-market#utm_source=kavita%2FMARCH&utm_medium=ref

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us--after all--if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Sales Tax Software Market To Witness Towering Growth And Surpass USD 8,285 Million By 2025 here

News-ID: 1986306 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

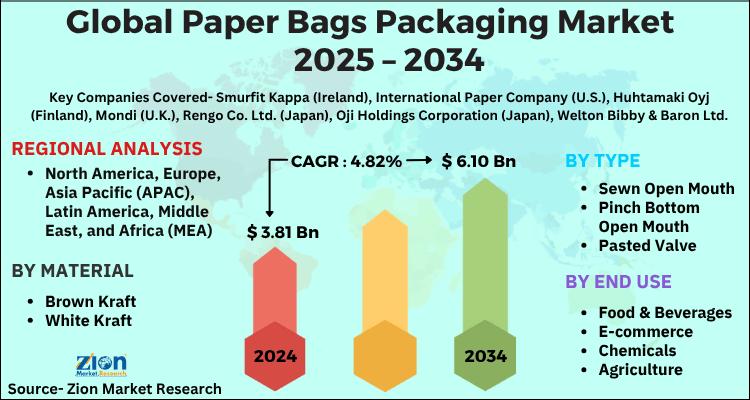

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

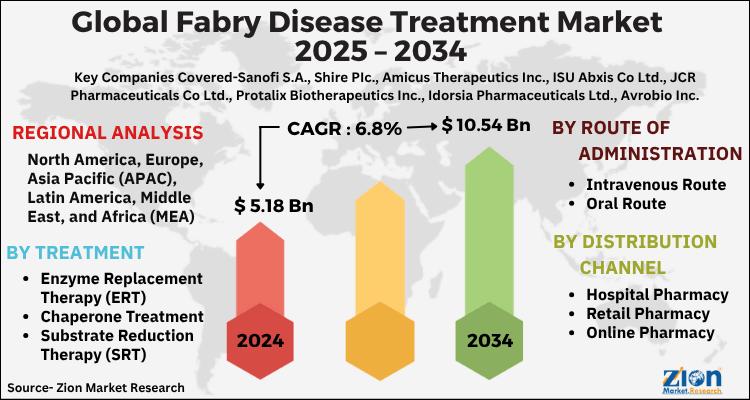

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…