Press release

Mobile Payment Technologies Market 2020 Growth Factors, Ongoing Trends, Opportunities and Key Players Includes - Google, Tencent, Vodafone Group, Fiserv, Inc., Microsoft, First Data Corporation, BlueSnap Inc., Global Payments Inc., Paytm

The Global Mobile Payment Technologies †Market has witnessed continuous growth in the past few years and is projected to grow even further during the forecast period (2020-2027. The Mobile Payment Technologies †report includes a range of inhibitors as well as driving forces of the market which are analysed in both qualitative and quantitative approach so that readers and users get precise information and insights about industry. Statistical data mentioned in the report is symbolized with the help of graphs which simplifies the understanding of facts and figures. The Mobile Payment Technologies report helps define commerce strategies to the businesses of small, medium as well as large size. The analysis and estimations conducted via this report help to get an idea about the product launches, future products, joint ventures, marketing strategy, developments, mergers and acquisitions and effect of the same on sales, marketing, promotions, revenue, import, export, and CAGR values. Few of the major competitors currently working in the global Mobile Payment Technologies †market are Visa; Ant Financial; Airtel India; Boku Inc.; Apple Inc.; AT&T Intellectual Property; Mastercard; Google; Fortumo; American Express Company; PayPal; Tencent; Vodafone Group; Fiserv, Inc.; Microsoft; First Data Corporation; BlueSnap Inc.; Global Payments Inc.; Paytm; SIX Card Solutions; Worldpay, LLC; Wirecard; ACI Worldwide, Inc.; Novatti Group Limited; PayUmoney; Paysafe Holdings UK Limited; Stripe; Dwolla; MTN Group Management Services (Pty) Ltd; Orange; Millicom; Safaricom; Comviva and among others.Complete study compiled with over 100+ pages, list of tables & figures, profiling 10+ companies. Ask for FREE Sample Copy† @† https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-mobile-payment-technologies-market

Global mobile payment technologies market is expected to register a healthy CAGR of 35.48% in the forecast period of 2019-2026. Mobile payment technologies are the services provided by various financial institutions, network providers and digital financial merchants wherein the users can transact with individuals & organisations with the help of their smartphones, smart devices in the financial sense for the exchange of products & services availed by the user.†

Global Mobile Payment Technologies Market Dynamics:

Market Drivers: Mobile Payment Technologies Market

Increased levels of users of smartphones, smart devices availing the usage of internet is expected to drive the growth of the market

Availability of innovative methods of usage and advancements in technology; the market is expected to be driven by this factor

Market Restraints: Mobile Payment Technologies Market

Concerns regarding security and threats of hacking private information is expected to restrain the growth of the market

Lack of regulations and standards to transact with individuals and organisations in different regions or across borders; this factor is expected to restrain the growth of the market

Important Features of the Global Mobile Payment Technologies Market Report:

1) What all companies are currently profiled in the report?

List of players that are currently profiled in the report- Visa; Ant Financial; Airtel India; Boku Inc.; Apple Inc.; AT&T Intellectual Property; Mastercard; Google; Fortumo; American Express Company; PayPal; Tencent; Vodafone Group; Fiserv, Inc.; Microsoft; First Data Corporation; BlueSnap Inc.; Global Payments Inc.; Paytm; SIX Card Solutions; Worldpay, LLC; Wirecard; ACI Worldwide, Inc.; Novatti Group Limited; PayUmoney; Paysafe Holdings UK Limited; Stripe; Dwolla; MTN Group Management Services (Pty) Ltd; Orange; Millicom; Safaricom; Comviva and among others.

** List of companies mentioned may vary in the final report subject to Name Change / Merger etc.

2) What all regional segmentation covered? Can specific country of interest be added?

Currently, research report gives special attention and focus on following regions:

North America, Europe, Asia-Pacific etc.

** One country of specific interest can be included at no added cost. For inclusion of more regional segment quote may vary.

3) Can inclusion of additional Segmentation / Market breakdown is possible?

Yes, inclusion of additional segmentation / Market breakdown is possible subject to data availability and difficulty of survey. However a detailed requirement needs to be shared with our research before giving final confirmation to client.

** Depending upon the requirement the deliverable time and quote will vary.

Global Mobile Payment Technologies Market Segmentation:

By Type

Proximity Payment

Near Field Communication (NFC)

QR Code Payment

Remote Payment

Short Message Service-Based (SMS-Based)

Direct Operator Billing

Digital Wallet

Unstructured Service Supplementary Data/Sim Tool Kit (USSD/STK)

By Purchase Type

Airtime Transfers & Top-Ups

Merchandise & Coupons

Money Transfers & Payments

Travel & Ticketing, Others

By End-Use

Banking, Financial Services & Insurance (BFSI)

Retail

Media & Entertainment

Hospitality & Tourism

Education

Healthcare

IT & Telecommunications

Others

For Complete table of Contents please click here @ https://www.databridgemarketresearch.com/toc/?dbmr=global-mobile-payment-technologies-market

The Goal Of The Report: The main goal of this research study is to provide a clear picture and a better understanding of the market for research report to the manufacturers, suppliers, and the distributors operational in it. The readers can gain a deep insight into this market from this piece of information that can enable them to formulate and develop critical strategies for the further expansion of their businesses.

There are 15 Chapters to display the Global Mobile Payment Technologies market

Chapter 1, Definition, Specifications and Classification of Mobile Payment Technologies , Applications of Mobile Payment Technologies , Market Segment by Regions;

Chapter 2, Manufacturing Cost Structure, Raw Material and Suppliers, Manufacturing Process, Industry Chain Structure;

Chapter 3, Technical Data and Manufacturing Plants Analysis of Mobile Payment Technologies , Capacity and Commercial Production Date, Manufacturing Plants Distribution, R&D Status and Technology Source, Raw Materials Sources Analysis;

Chapter 4, Overall Market Analysis, Capacity Analysis (Company Segment), Sales Analysis (Company Segment), Sales Price Analysis (Company Segment);

Chapter 5 and 6, Regional Market Analysis that includes United States, China, Europe, Japan, Korea & Taiwan, Mobile Payment Technologies Segment Market Analysis (by Type);

Chapter 7 and 8, The Mobile Payment Technologies Segment Market Analysis (by Application) Major Manufacturers Analysis of Mobile Payment Technologies

Chapter 9, Market Trend Analysis, Regional Market Trend, Market Trend by Product Type Invasive Mobile Payment Technologies, Non-Invasive Mobile Payment Technologies, Market Trend by Application;

Chapter 10, Regional Marketing Type Analysis, International Trade Type Analysis, Supply Chain Analysis;

Chapter 11, The Consumers Analysis of Global Mobile Payment Technologies ;

Chapter 12, Mobile Payment Technologies Research Findings and Conclusion, Appendix, methodology and data source;

Chapter 13, 14 and 15, Mobile Payment Technologies sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

Key Regions and Countries Studied in this report:

To comprehend Global Mobile Payment Technologies market dynamics in the world mainly, the worldwide Mobile Payment Technologies †market is analyzed across major global regions. DBMR also provides customized specific regional and country-level reports for the following areas.

North America - U.S., Canada, Mexico

Europe : U.K, France, Italy, Germany, Russia, Spain, etc.

Asia-Pacific - China, Japan, India, Southeast Asia etc.

South America - Brazil, Argentina, etc.

Middle East & Africa - Saudi Arabia, African countries etc.

Key Developments in the Market:

In May 2019, ACI Worldwide, Inc. announced that they had acquired Speedpay from Western Union for USD 750 million approximately. This transaction will help in expanding their consumers and service offerings by combining Speedpay's bill payment platform. ACI will be able to provide expanded payment services across verticals like consumer finance, insurance, healthcare, higher education, utilities, government and mortgage.

In April 2019, PayUmoney announced that they had acquired Wibmo, establishing a market leader of financial services due to the combination in expertise of both the companies. Wibmo is a leader of digital transactional security globally and PayUmoney has an established network of merchants utilizing their financial services. This acquisition will provide better operations of transactions and faster processing due to their combination.

Other important Mobile Payment Technologies Market data available in this report:

Market share and year-over-year growth†of key players in promising regions

Emerging opportunities,†competitive landscape,†revenue and share of main manufacturers.

Key performing regions (APAC, EMEA, Americas) along with their sub-regions are detailed in this report.

Strategic recommendations, forecast & growth areas†of the Mobile Payment Technologies Market.

This report discusses the market†summary, market†scope& gives a brief†outline†of the†Mobile Payment Technologies Market

Challenges for the new entrants,†trends†& market†drivers.

Competitive developments such as†expansions,†agreements, new product†launches & acquisitions.

Contact:

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Technologies Market 2020 Growth Factors, Ongoing Trends, Opportunities and Key Players Includes - Google, Tencent, Vodafone Group, Fiserv, Inc., Microsoft, First Data Corporation, BlueSnap Inc., Global Payments Inc., Paytm here

News-ID: 1959991 • Views: ‚Ķ

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home DeŐĀcor Tr ‚Ķ

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

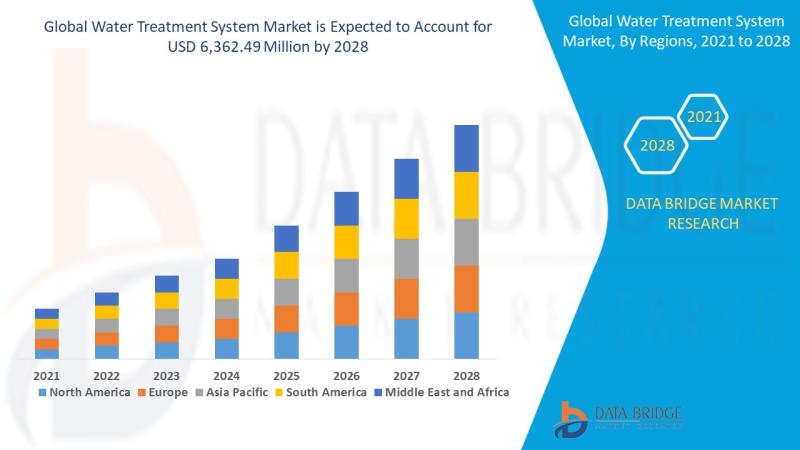

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, ‚ÄúGlobal Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024‚ÄĚ, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.‚Ķ

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, ‚ÄúReportsnReports‚ÄĚ, one of the world‚Äôs prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the‚Ķ

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled ‚ÄúOnline Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).‚ÄĚ The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating‚Ķ