Press release

Tax Management Market revenues expected to be $27.0 billion by 2024

According to a new market research report "Tax management market by Component (Software and Services), Tax Type (Indirect Tax and Direct Tax), Deployment Mode (Cloud and On-premises), Organization Size (SMEs and Large Enterprises), Vertical, and Region - Global Forecast to 2024", published by MarketsandMarkets(TM), the Tax Management Market expected to grow from $15.5 billion in 2019 to $27.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 11.7% during the forecast period. Factors driving the growth of the Tax management market include the increasing volume of financial transactions across verticals due to digitalization, complex nature of existing tax systems, and increased vigilance of tax administrators.Browse in-depth TOC on "Tax management market"

123- Tables

37- Figures

154- Pages

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=230446693

Software segment to hold a larger market size during the forecast period

Tax management software facilitate the completion of tax returns for companies operating across verticals. The software provides automated tax compliance with local accounting legislations and standards. Organizations across the globe have started adopting tax management software to keep up with the rapidly changing legislative regulations and shifts in product taxability.

Indirect tax segment to hold a larger market size during the forecast period

Indirect taxes are levied on the manufacture or sale of goods and services. These taxes are paid by an intermediary to the government. Indirect taxes are passed on the end user by adding the amount of tax paid to the value of goods and services. Some indirect taxes considered include excise duty, sales tax, customs duty, entertainment tax, service tax, and Value Added Tax (VAT). Indirect taxes are paid more frequently than direct taxes; hence, they require advanced software for faster and accurate calculations.

Cloud deployment mode to hold a larger market size during the forecast period

Enterprises prefer deploying tax management solutions in the cloud to improve mobility and decentralize data storage and computing. Security is a critical issue that restricts the adoption of cloud services. However, this issue is gradually being eradicated through rigorous security tests with the highest standards by third parties. Rapid advancements in the cloud technology, with security as a priority, and increasing costs of support and maintenance of on-premises solutions to drive the growth of cloud-based tax management software.

North America to account for the largest market size during the forecast period

North America is estimated to dominate global tax management. The US and Canada are expected to be the major revenue contributors in the North American Tax management market. The adoption of tax management solutions offers benefits, such as reduced deductible amount, easy tax calculation, saving time, automatic tax filing, and reduction in the number of errors. Developed economies in North America have been witnessing more adoption of tax management solutions as compared to other countries across the globe.

Browse Full Report @ https://www.marketsandmarkets.com/Market-Reports/tax-management-market-230446693.html

The Tax management market comprises major providers, such as Avalara (US), Automatic Data Processing (US), Wolters Kluwer N.V (Netherlands), Thomson Reuters (Canada), Intuit (US), H&R Block (US), SAP SE (Germany), Blucora (US), Sovos Compliance (US), Vertex (US), Sailotech (US), Defmacro Software (India), DAVO Technologies (US), Xero (New Zealand), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), and TaxJar (US). The study includes the in-depth competitive analysis of these key players in the Tax management market with their company profiles, recent developments, and key market strategies.

Contact:

Mr. Sanjay Gupta

MarketsandMarkets(TM) INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

MnM Blog: https://mnmblog.org

Content Source: https://www.marketsandmarkets.com/PressReleases/tax-management.asp

About MarketsandMarkets(TM)

MarketsandMarkets(TM) provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets(TM) for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets(TM) are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets(TM) now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, and strategic players) annually in high growth emerging segments. MarketsandMarkets(TM) is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market revenues expected to be $27.0 billion by 2024 here

News-ID: 1952493 • Views: …

More Releases from MarketsandMarkets(TM)

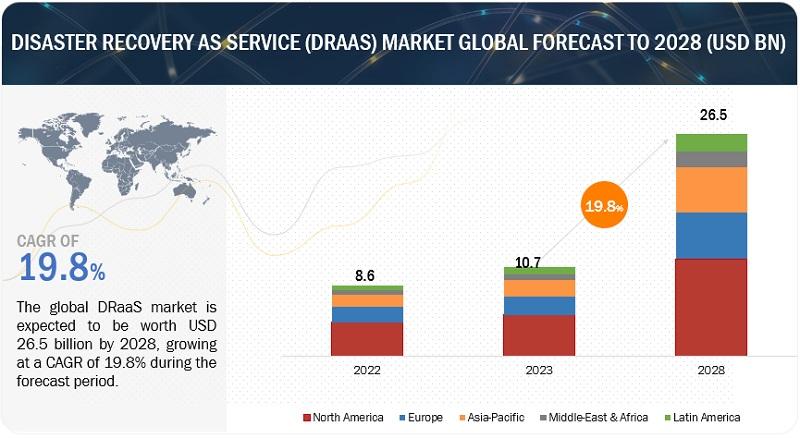

Disaster Recovery as a Service (DRaaS) Market Trends, Drivers, Strategies, Appli …

According to a research report "Disaster Recovery as a Service (DRaaS) Market by Service Type (Backup & Restore, Real-Time Replication, Data Protection), Deployment Mode (Public Cloud, Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the DRaaS market size is expected to grow from USD 10.7 billion in 2023 to USD 26.5 billion by 2028 at a compound annual growth rate (CAGR) of 19.8%…

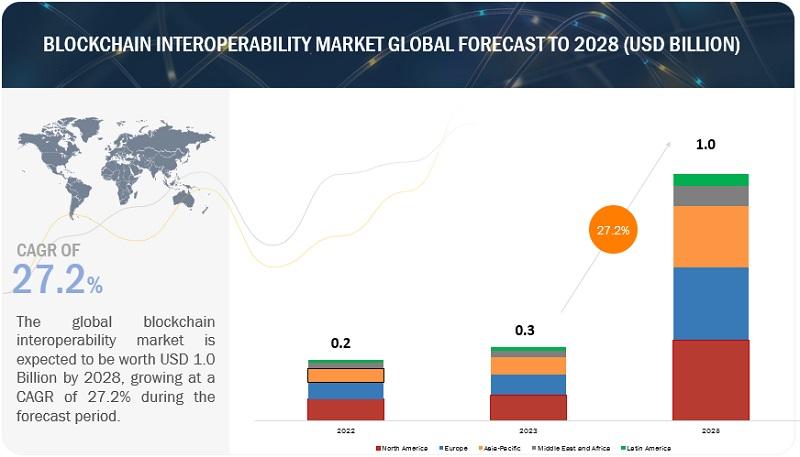

Blockchain Interoperability Market Size to Witness a Pronounce Growth by 2028

According to a research report "Blockchain Interoperability Market by Solution (Cross-chain Bridging, Cross-chain APIs, Federated or Consortium Interoperability), Application (dApps, Digital Assets/NFTs, Cross-chain Trading & Exchange), Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the global blockchain interoperability market size is projected to grow from USD 0.3 billion in 2023 to USD 1.0 billion by 2028 at a CAGR of 27.2% during the forecast period.

Download PDF Brochure…

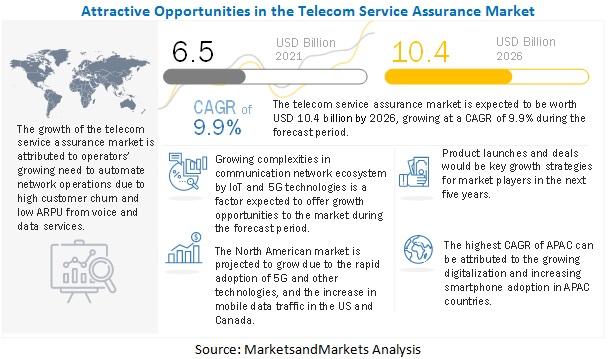

Telecom Service Assurance Market Growth, Opportunities Business Scenario, Share, …

According to a research report "Telecom Service Assurance Market Trends by Component (Solutions (Fault and Event Management, Performance Management, and Quality and Service Management) and Services), Operator Type, Deployment Type, Organization Size, and Region - Global Forecast to 2026" published by MarketsandMarkets, the global Telecom service assurance Market size to grow from USD 6.5 billion in 2021 to USD 10.4 billion by 2026, at a Compound Annual Growth Rate (CAGR)…

Casino Management Systems Market predicted to obtain $13.7 billion by 2025

According to a new market research report "Casino Management Systems Market by Component (Solutions and Services), Application (Accounting, Security and Surveillance, Player Tracking, Hotel and Hospitality, Analytics, and Digital Content Management), End User, and Region - Global Forecast to 2025" published by MarketsandMarkets™, the market size projected to grow from USD 6.4 billion in 2020 to USD 13.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 16.4%…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…