Press release

Tax Management Software Industry 2020 Global Key Players, Trends, Share, Market Size, Segmentation, Opportunities, Forecast To 2026

Global Tax Management Software Market Report 2020-2026 advanced studies covers deep evaluation on market drivers, challenges and trends. In Tax Management Software Report Market driving force impact, developing demand from key regions, key programs and ability industries, opportunities and challenges are also studied. How Tax Management Software industry will grow in future and what will be the market size (value and volume) by regions; and forecast analysis 2026 are given completelyAccess sample of the report @ https://www.orianresearch.com/request-sample/1472884

This report focuses on the global Tax Management Software status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Tax Management Software development in North America, Europe, China, Japan, Southeast Asia, India and Central & South America.

The key players covered in this study-, Avalara, Outright, Shoeboxed, SAXTAX, H&R Block, CrowdReason, Paychex, Inc., Drake Software, Taxify, Accurate Tax, Canopy, Beanstalk, CCH, ClearTAX, Credit Karma, Empower, Exactor, Longview Solution, RepaidTax, Rethink Solutions, Scivantage, TaxACT, SureTAX

Market segment by Type, the product can be split into

o Cloud, SaaS

o Installed-PC

o Installed-Mobile

Market segment by Application, split into

o Personal Use

o Commercial Use

Market segment by Regions/Countries, this report covers

o North America

o Europe

o China

o Japan

o Southeast Asia

o India

o Central & South America

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/1472884

The study objectives of this report are:

o To analyze global Tax Management Software status, future forecast, growth opportunity, key market and key players.

o To present the Tax Management Software development in North America, Europe, China, Japan, Southeast Asia, India and Central & South America.

o To strategically profile the key players and comprehensively analyze their development plan and strategies.

o To define, describe and forecast the market by type, market and key regions.

In this study, the years considered to estimate the market size of Tax Management Software are as follows:

o History Year: 2015-2019

o Base Year: 2019

o Estimated Year: 2020

o Forecast Year 2020 to 2026

For the data information by region, company, type and application, 2020 is considered as the base year. Whenever data information was unavailable for the base year, the prior year has been considered.

Order a Copy of this Report @ https://www.orianresearch.com/checkout/1472884

Table of Contents

1 Report Overview

2 Global Growth Trends by Regions

3 Competition Landscape by Key Players

4 Breakdown Data by Type (2015-2026)

5 Tax Management Software Breakdown Data by Application (2015-2026)

6 North America

7 Europe

8 China

9 Japan

10 Southeast Asia

11 India

12 Central & South America

13Key Players Profiles

14Analyst's Viewpoints/Conclusions

15Appendix

Customization Service of the Report:

Orian Research provides customization of reports as per your need. This report can be personalized to meet your requirements. Get in touch with our sales team, who will guarantee you to get a report that suits your necessities.

Contact Us:

Ruwin Mendez

Vice President - Global Sales & Partner Relations

Orian Research Consultants

US: +1 (415) 830-3727 | UK: +44 020 8144-71-27

Email: info@orianresearch.com

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Software Industry 2020 Global Key Players, Trends, Share, Market Size, Segmentation, Opportunities, Forecast To 2026 here

News-ID: 1931597 • Views: …

More Releases from Orian Research

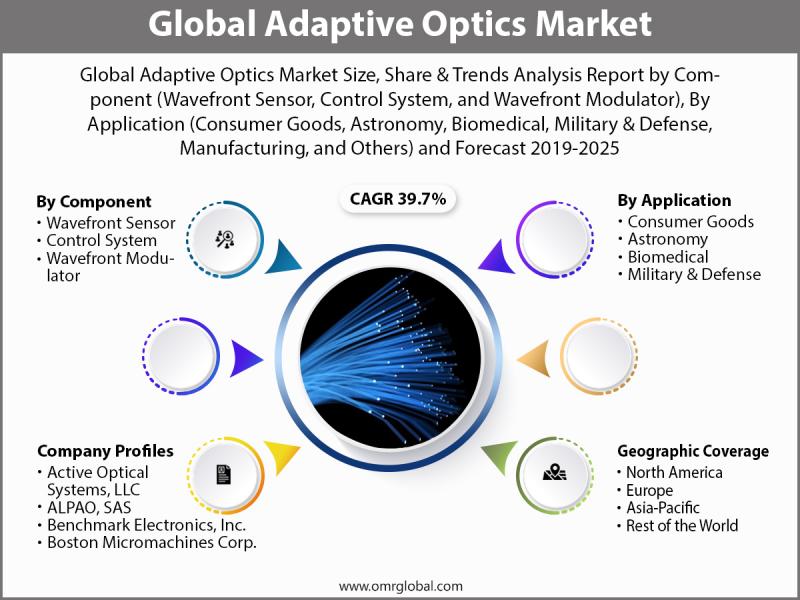

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

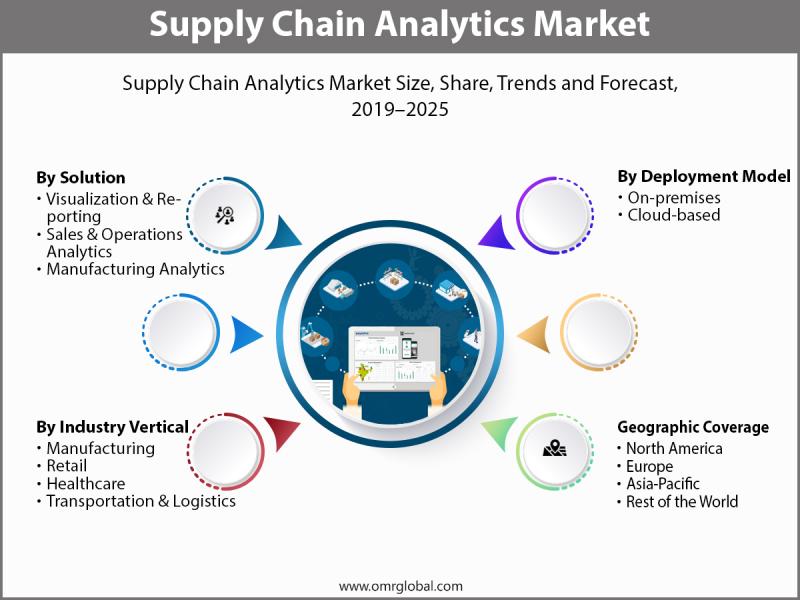

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

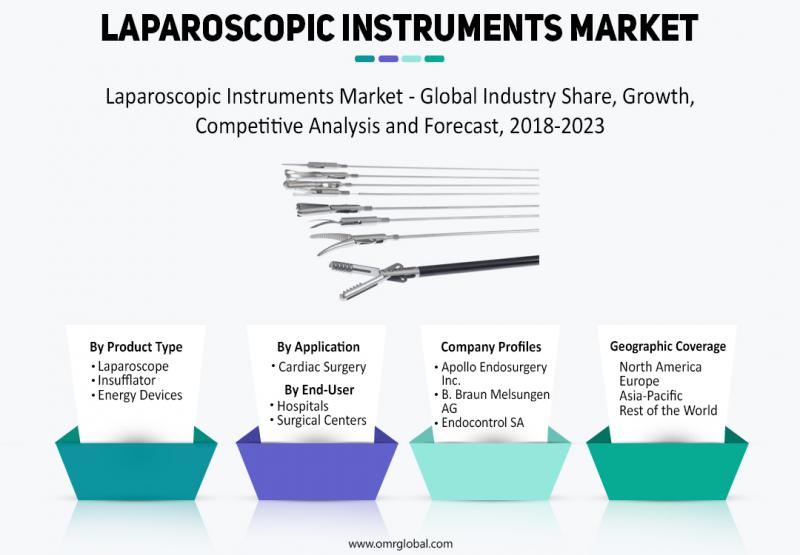

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…