Press release

Global Tax Management Market Reviews, Methodology and Technological advancements forecast 2024

According to Market Study Report, Tax Management market provides a comprehensive analysis of the Tax Management market segments, including their dynamics, size, growth, regulatory requirements, technological trends, competitive landscape, and emerging opportunities of global industry. This report also provides market landscape and market share information in the Tax Management market.This report spread across 154 Pages, Profiling 20 Companies and Supported with 123 Tables and 37 figures is now available in this research.

Get instant Sample Report in PDF Format @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=2905844

The Global Tax Management Market is expected to grow from US$ 15.5 Billion in 2019 to US$ 27.0 Billion by 2024, at a Compound Annual Growth Rate (CAGR) of 11.7% during the forecast period. Top key players profiled in the Tax Management market include are Avalara (US), Automatic Data Processing (US), Wolters Kluwer N.V (Netherlands), Thomson Reuters (Canada), Intuit (US), H&R Block (US), SAP SE (Germany), Blucora (US), Sovos Compliance (US), Vertex (US), Sailotech (US), Defmacro Software (India), DAVO Technologies (US) and Others.

Small and medium-sized enterprises segment to grow at a higher CAGR during the forecast period

The intensely competitive market scenario has encouraged Small and Medium-sized Enterprises (SMEs) to adopt tax management software and services for faster and cost-effective compliance. For instance, the Internal Revenue Service (IRS) estimates that businesses with less than USD 1 million in revenue have to incur almost two-thirds of business compliance costs. Usually, such costs are larger, relative to revenues or assets, for SMEs than for large enterprises.

Banking, Financial Services and Insurance vertical to hold the highest market share in 2019

Banking, Financial Institutes and Insurance (BFSI) is a vertical characterized by the digitalization and an increasing number of customers using various banking applications. This has resulted in the exponential growth of data in the banking and financial services vertical. Government regulations in this sector are complex and sensitive. BFSI includes domestic and foreign banks, insurance and reinsurance companies, asset management companies, non-banking finance companies.

Use (FEB20) Coupon Code for 20% Discount at https://www.reportsnreports.com/contacts/discount.aspx?name=2905844

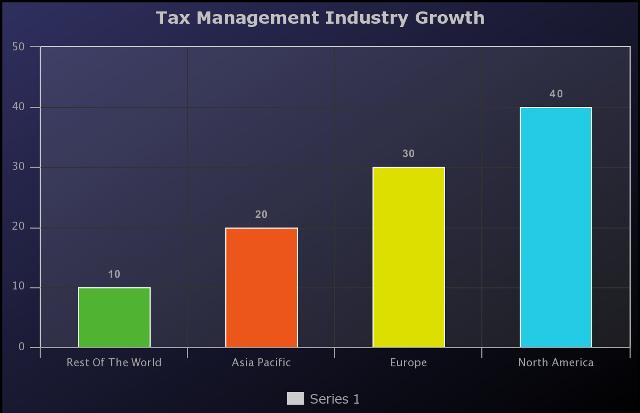

Asia Pacific tax management market to grow at the highest CAGR during the forecast period

The high growth of the market in Asia Pacific (APAC)is attributed to the increasing adoption of tax management software to match the rapid pace of advancement. However, low awareness about the benefits of tax management software and services poses a big hurdle in tax management software adoption across the region.

Competitive Landscape of Tax Management market:

1 Introduction

2 Competitive Scenario

2.1 New Product/Solution Launches and Product Enhancements

2.2 Business Expansions

2.3 Acquisitions

3 Competitive Leadership Mapping

3.1 Visionary Leaders

3.2 Dynamic Differentiators

3.3 Innovators

3.4 Emerging Companies

Inquire more or share questions if any before the purchase on this report @ https://www.reportsnreports.com/contacts/inquirybeforebuy.aspx?name=2905844

Reason to access this report:

The report would help market leaders/new entrants in this market with the information on the closest approximations of the revenue numbers for the overall tax management market and the sub segments. This report would help stakeholders understand the competitive landscape and gain insights to better position their businesses and plan suitable go-to-market strategies.

Corporate Headquarters

Tower B5, office 101,

Magarpatta SEZ,

Hadapsar, Pune-411013, India

About Us:-

ReportsnReports.com is your single source for all market research needs. Our database includes 500,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Tax Management Market Reviews, Methodology and Technological advancements forecast 2024 here

News-ID: 1924613 • Views: …

More Releases from ReportsandReports

The Growing Importance of Smart Wearable Equipment - Global Market: Today's Worl …

The report presents detailed information regarding the prominent players and potential competitors in the Smart Wearable Equipment - Global market. It includes comprehensive insights into their worldwide presence, economic performance, strategies, upcoming product releases, research and development initiatives, and a SWOT analysis. Additionally, the report analyses revenue share and contact details for each player.

This comprehensive report aims to evaluate and forecast the market size for Fuel Monitoring Systems. It analyses…

Vegetable Glycerin - Global Market 2023 Driving Factors Forecast Research 2029

This comprehensive report thoroughly assesses various regions, estimating the volume of the global Vegetable Glycerin - Global market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role…

Underground Concrete - Global Market Booming Worldwide with Latest Trend and Fut …

The report presents detailed information regarding the prominent players and potential competitors in the Underground Concrete - Global market. It includes comprehensive insights into their worldwide presence, economic performance, strategies, upcoming product releases, research and development initiatives, and a SWOT analysis. Additionally, the report analyses revenue share and contact details for each player.

This comprehensive report aims to evaluate and forecast the market size for Fuel Monitoring Systems. It analyses revenue,…

Eucalyptol - Global Market was Led by the Solution Category

This comprehensive report thoroughly assesses various regions, estimating the volume of the global Eucalyptol - Global market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role in…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…