Press release

Third-Party Risk Management Market Insights | Key players: RSA, Genpact, MetricStream, Deloitte and KPMG

According to recent research "Third-Party Risk Management Market by Component (Solution (Financial Control, Contract, Operational Risk, Audit, and Compliance) and Service (Professional & Managed)), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2024", published by MarketsandMarkets, the global Third-Party Risk Management (TPRM) market size is projected to grow from USD 3.2 billion in 2019 to USD 6.8 billion by 2024, at a CAGR of 15.9% during the forecast period. The major factors driving the market include the increasing adoption of virtual applications; technological advancements, including automation, data analytics, and smart contracts; and soaring need to counter fraudulent activities in several verticals.Browse 126 market data Tables and 46 Figures spread through 184 Pages and in-depth TOC on "Third-Party Risk Management Market”

https://www.marketsandmarkets.com/Market-Reports/third-party-risk-management-market-222423768.html?utm_source=Openpr

Based on solutions, the financial control segment is estimated to lead the Third-Party Risk Management Market in 2019

Financial control management can be defined as a system that manages and limits the financial effects of the budget on user operations in such a way that it aligns the user toward the achievement of goals related to finances. Organizations depend on several vendors, which poses operational and credit risks for organizations. Financial control management solutions help reduce an organization’s operational costs while managing and selecting a third-party or any vendor.

Better financial control provides better auditing and detection of fraudulent activities. Financial control management solutions provide managers with a proper view of the cash flow and better cost optimization for various business processes to increase the business output. Financial control management assists users to maintain and assess its debt collection period and the creditors payment period.

Based on verticals, the BFSI vertical is expected to dominate the TPRM market size during the forecast period

BFSI is one of the major adopters of TPRM solutions. It has been a highly regulated and competitive vertical that always focuses on delivering enhanced customer experience. The changing ways of the BFSI vertical are operating, increasing digitalization, and adopting advanced technologies have exposed this industry to different types of risks. The need to keep up with the changing regulatory environment and penalties associated with non-compliance has changed the way how risk is viewed and managed. These factors, coupled with the increasing challenges, such as cyber threats, third-party risks, and regulatory compliances, are expected to fuel the demand for TPRM solutions in the BFSI vertical.

Ask for Sample Pages@ https://www.marketsandmarkets.com/requestsampleNew.asp?id=222423768&utm_source=Openpr

North America is expected to hold the highest Third-Party Risk Management Market share during the forecast period

North America is the largest revenue contributor to the TPRM industry, as the growth in the region is being driven by the rising internet penetration and increasing adoption of cloud-based and IoT applications across verticals. Countries in North America are well-established economies, which enable investments in advanced technologies.

The demand for Third-Party Risk Management services is expected to increase in enterprises, as the adoption of solutions is growing across North America. Various organizations operating in different industrial domains across the US and Canada have been considering the implementation of effective solutions to manage their partner ecosystem for minimizing the risks associated with the management of third-parties.

Market Players:

The major vendors covered in the TPRM market include RSA (US), Genpact (US), MetricStream (US), Deloitte (US), KPMG (Netherlands), BitSight Technologies (US), Ernst & Young (UK), PwC (UK), ProcessUnity (US), Venminder (US), Resolver (Canada), NAVEX Global (US), Riskpro (India), SAI Global (US), RapidRatings (US), Optiv (US), Aravo (US), OneTrust (US and UK), Galvanize (Canada), and Prevalent (US).

Mr. Shelly Singh

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

Email: newsletter@marketsandmarkets.com

MnM Blog: https://mnmblog.org/

Content Source: https://www.marketsandmarkets.com/PressReleases/third-party-risk-management.asp

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Third-Party Risk Management Market Insights | Key players: RSA, Genpact, MetricStream, Deloitte and KPMG here

News-ID: 1901576 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

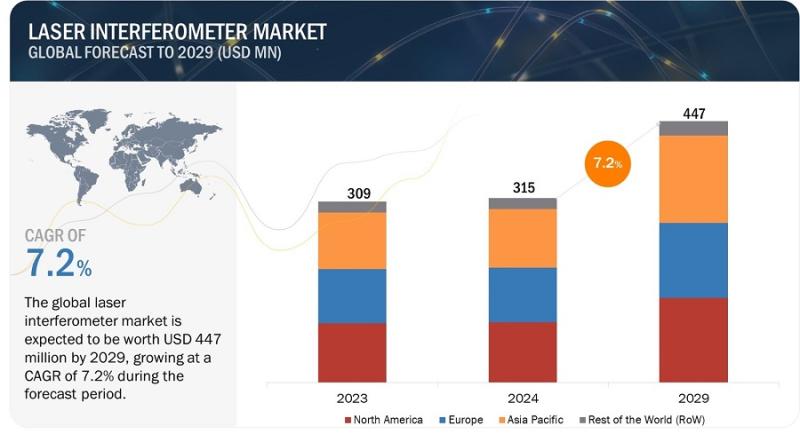

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

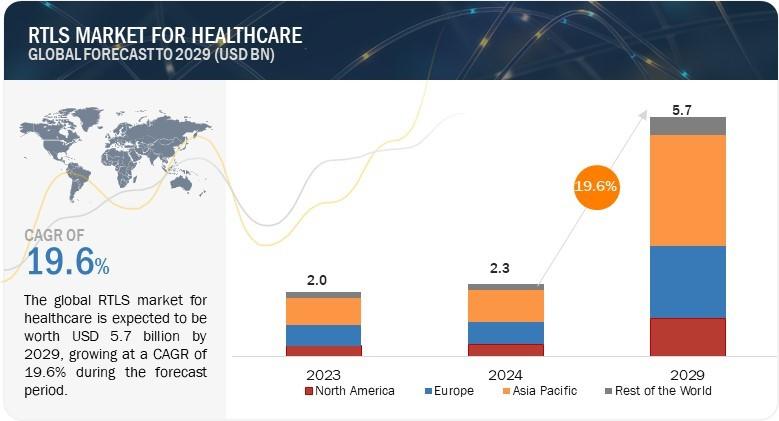

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for Risk

The Risk Side of Crypto Trading: Safety Tips + Risk Management

The Risk Side of Crypto Trading: Safety Tips + Risk Management

Cryptocurrency trading can be exciting, fast-moving, and potentially profitable. But it also carries serious risks that many beginners underestimate.

From dramatic price swings in Bitcoin to rapid market shifts in Ethereum, crypto markets are among the most volatile financial environments in the world.

If you're entering crypto trading - especially short-term or automated trading - understanding the risk side is not optional.

In…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…