Press release

Digitization in Lending Market Analysis 2020 - Comprehensive Analysis covering Top Companies: Opportunity Financial, Prosper Marketplace, RISE, Speedy Cash, The Business Backer

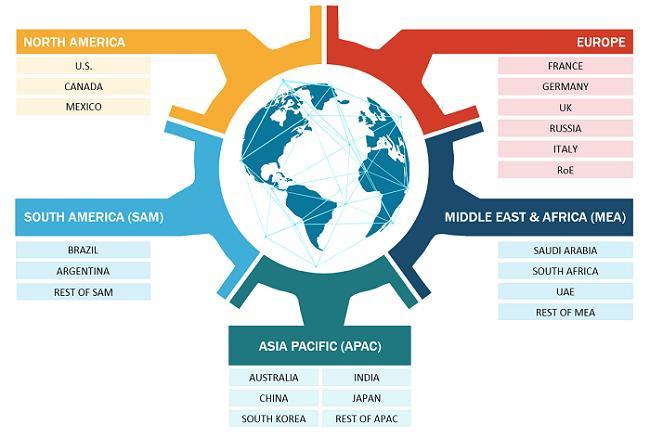

Digitization in Lending Market to 2027 - Global Analysis and Forecasts by Loan Type (Auto Loans, Personal Loans, Business Loans) and GeographyThe report provides a detailed overview of the industry including both qualitative and quantitative information. It provides an overview and forecast of the global digitization in lending market based on various segments. It also provides market size and forecast estimates from the year 2017 to 2027 with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. The digitization in lending market by each region is later sub-segmented by respective countries and segments. The report covers the analysis and forecast of 18 countries globally along with the current trend and opportunities prevailing in the region.

Digitization in Lending Market to 2027 - Global Analysis and Forecasts by Loan Type (Auto Loans, Personal Loans, Business Loans) and Geography

Get Sample PDF Copy at https://www.theinsightpartners.com/sample/TIPRE00007235?OpenPR+10051

The digitization in lending has led to a revolution in the banking industry, reducing paperwork and eliminating manual efforts. Digital lending is gaining momentum with a high proliferation of smartphones and improved customer experience. Robust startup scenario across the globe and easy accessibility of business and personal loans is a crucial factor boosting the market growth. The rapid adoption of artificial intelligence and machine learning for enhanced user experience is expected to benefit the market players in the future.

The global digitization in lending market is projected to grow in the forecast period on account of increased use of smartphones and digitalization in the banking sector. Automation of complex procedures and reduced paperwork further propels the growth of the digitization in lending market. However, the lack of interoperability and standards may negatively influence the market growth during the forecast period. Nevertheless, an increasing number of small and mid-sized businesses offer lucrative growth prospects for the key players of the digitization in lending market in the coming years.

The "Global Digitization in Lending Market Analysis to 2027" is a specialized and in-depth study of the technology, media and telecommunications industry with a special focus on the global market trend analysis. The report aims to provide an overview of digitization in lending market with detailed market segmentation by loan type and geography. The global digitization in lending market is expected to witness high growth during the forecast period. The report provides key statistics on the market status of the leading digitization in lending market players and offers key trends and opportunities in the market.

The report also includes the profiles of key digitization in lending companies along with their SWOT analysis and market strategies. In addition, the report focuses on leading industry players with information such as company profiles, components and services offered, financial information of the last three years, key developments in the past five years.

- Avant, LLC

- Kabbage Inc.

- Lending Stream (GAIN Credit LLC)

- Lendio, Inc.

- LendUp (Flurish Inc.)

- Opportunity Financial, LLC

- Prosper Marketplace, Inc.

- RISE (Elevate Credit, Inc.)

- Speedy Cash

- The Business Backer, LLC

Buy Complete Report at https://www.theinsightpartners.com/buy/TIPRE00007235?OpenPR+10051

Contact us –

Phone : +1-646-491-9876

Email Id : sales@theinsightpartners.com

Website: https://www.theinsightpartners.com

About Us - The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digitization in Lending Market Analysis 2020 - Comprehensive Analysis covering Top Companies: Opportunity Financial, Prosper Marketplace, RISE, Speedy Cash, The Business Backer here

News-ID: 1900987 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…