Press release

Mobile Payment Market 2016-2022 / Growth, Emerging Trends, Forecast And Key Players Are Orange S.A. (France), Vodacom Group Limited (South Africa), Mastercard Incorporated (U.S.) And Bharti Airtel Limited (India)

The widespread use of mobile devices like laptops, tablets and phones has led to the growth of Global Mobile Payment Market. Mobile Payment Market is expected to grow to a market of $3388 Billion and at a CAGR of 36% in the forecasted period of five years. Expanded market of cell phones, development in m-trade industry, change in way of life, and the requirement for brisk and bother free transactions are the main considerations that drive the market growth. Keeping in mind the end goal to grow their market share, worldwide players have launched new mobile payment apps and mobile wallet that enable clients to make payments and money transfer with their cell phone.Download Sample of This Strategic Report:https://www.kennethresearch.com/sample-request-10065196

End-user/Technology

With the boom of technology, almost 54% of all mobile users are now opting for mobile payment apps for various transactions. Tech-savvy consumers now opt to shop online through their smartphones. Consumers often do their travel bookings through mobile apps.

Ascend in disposable income, tumultuous way of life, and infiltration of mobile phones combined with expanded web utilization has encouraged individuals and organizations to opt for mobile transactions as it is speedy and bother free.

Market Dynamics

Despite the way that the mobile payment market is flourishing, there is an absence of engagement among customers about adopting the new advancement. It is one of the major constraining components for the improvement of the market. Customers are in like manner put off by the deferrals in return some still cash transactions to coordinate the trade. Both the customers and shippers are not totally aware of the working structure of the mobile payment innovation and that is an explanation behind stress for the general improvement of the market.

Market Segmentation

The market for Mobile Payment can be segmented based on three aspects: by type, application and product type. Based on the type, the market can be segmented into two segments, Proximity Payment and Remote Payment. Proximity payment can be further sub-segmented into QR Code Payment and Near Field Communication (NFC). Remote Payment can be further sub-segmented into four sub segments: SMS Based, USSD/TSK, Direct Operator Billing and Digital Wallet.

Request For Full Report:https://www.kennethresearch.com/sample-request-10065196

Based on the application of the mobile payment, the market can be segmented into six segments: Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality & Transportation and others. Based on the product type, the market can be segmented into five segments: Money Transfers and Payments, Airtime Transfers and Top-ups, Travel and Ticketing, Merchandise and Coupons and others.

Regional/Geographic Analysis

The major regions of the Global Mobile Payment Market are North America, South America, Europe, Asia Pacific, Middle East and Africa.

Key Players

The key players in the Global Mobile Payment Market are Orange S.A. (France), Vodacom Group Limited (South Africa), MasterCard Incorporated (U.S.), Bharti Airtel Limited (India), MTN Group Limited (South Africa), Safaricom Limited (Kenya), PayPal Holdings, Inc. (U.S.), Econet Wireless Zimbabwe Limited (South Africa), Millicom International Cellular SA (Luxembourg), and Mahindra Comviva (India).

Contact Us

David

Email: Sales@kennethresearch.com

Phone: +1 313 462 0609

About Kenneth Research:

Kenneth Research provides market research reports to different individuals, industries, associations and organizations with an aim of helping them to take prominent decisions. Our research library comprises of more than 10,000 research reports provided by more than 15 market research publishers across different industries. Our collection of market research solutions covers both macro level as well as micro level categories with relevant and suitable market research titles. As a global market research reselling firm, Kenneth Research provides significant analysis on various markets with pure business intelligence and consulting services on different industries across the globe. In addition to that, our internal research team always keep a track on the international and domestic market for any economic changes impacting the products’ demand, growth and opportunities for new and existing players.

David

sales@kennethresearch.com

Kenneth Research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Market 2016-2022 / Growth, Emerging Trends, Forecast And Key Players Are Orange S.A. (France), Vodacom Group Limited (South Africa), Mastercard Incorporated (U.S.) And Bharti Airtel Limited (India) here

News-ID: 1898327 • Views: …

More Releases from Kenneth Research

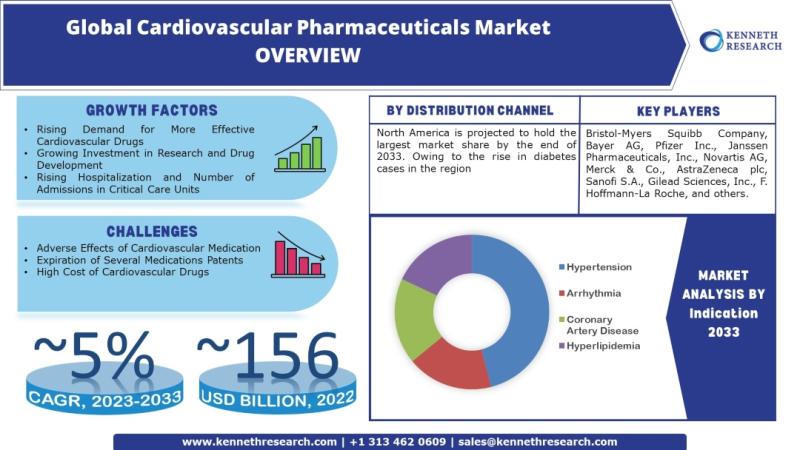

Global Cardiovascular Pharmaceuticals Market to be Propelled by Growing Investme …

Kenneth Research published a report titled "Cardiovascular Pharmaceuticals Market: Global Demand Analysis & Opportunity Outlook 2033" which delivers detailed overview of the global cardiovascular pharmaceuticals market in terms of market segmentation by drug class, distribution channel, indication and by region.

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, supply and demand risk, along with detailed discussion on current and future market trends that are associated with…

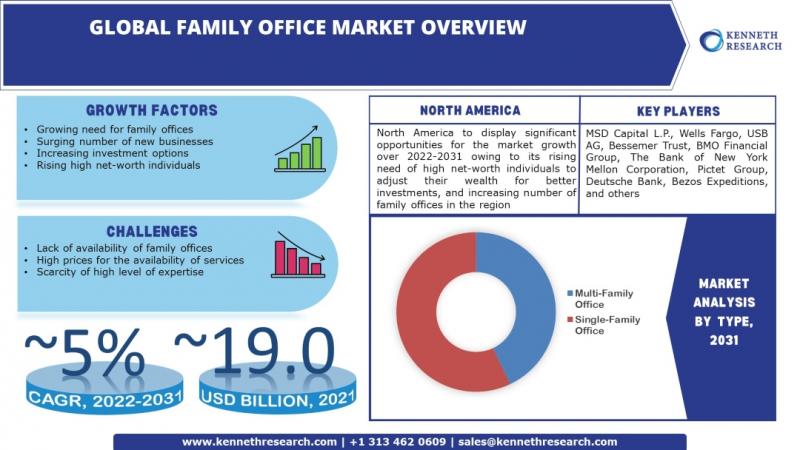

Global Family Office Market to be Propelled by Surging Number of New Businesses …

Kenneth Research published a report titled "Family Office Market: Global Demand Analysis & Opportunity Outlook 2031" which delivers detailed overview of the global family office market in terms of market segmentation by services, type, net worth managed, and by region.

Access Full Description: https://www.kennethresearch.com/report-details/family-office-market/10346745

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, supply and demand risk, along with detailed discussion on current and future market trends that…

Photomask Market Growth Analysis by Revenue, Size, Share, Scenario on Latest Tre …

Kenneth Research provides an extensive study by our analysts which offers forecast assessment by correlating the historical data with key market dynamics. The Photomask Market further includes trends and opportunities that are highlighted, along with the market valuation. The market is segmented by segments and portrays the industry overview along with elaborate description of the market for the forecast period 2020-2025. The report also constitutes future growth statistics which is…

Embedded Systems Market 2020 New Innovations Trends, Research, Global Share and …

Kenneth Research provides an extensive study by our analysts which offers forecast assessment by correlating the historical data with key market dynamics. The Embedded Systems Market further includes trends and opportunities that are highlighted, along with the market valuation. The market is segmented by segments and portrays the industry overview along with elaborate description of the market for the forecast period 2020-2025. The report also constitutes future growth statistics which…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…