Press release

FinTech Blockchain Market Projected to reach $ 6,228.2 Million by 2023 | Key players include IBM, Microsoft, Earthport, AWS and BTL Group

According to recent research "FinTech Blockchain Market by Provider, Application (Payments, Clearing, and Settlement, Exchanges and Remittance, Smart Contract, Identity Management, and Compliance Management/KYC), Organization Size, Vertical, and Region - Global Forecast to 2023", The FinTech blockchain market size is expected to grow from USD 370.3 Million in 2018 to USD 6,228.2 Million by 2023, at a Compound Annual Growth Rate (CAGR) of 75.9% during the forecast period. The key factors driving the market include its high compatibility with the financial industry ecosystem, faster transactions, reduced total cost of ownership, and the rising crypto-currency market cap and Initial Coin Offering (ICO).Browse 49 market data Tables and 34 Figures spread through 141 Pages and in-depth TOC on "FinTech Blockchain Market”

https://www.marketsandmarkets.com/Market-Reports/fintech-blockchain-market-38566589.html?utm_source=Openpr

The payment, clearing, and settlement segment is estimated to account for the largest market size in the FinTech blockchain market in 2018.

The payment, clearing, and settlement segment is expected to dominate the overall market in terms of share. This domination by the segment is attributed to the blockchain technology applications, which are predominantly finding use in the payment industry to reduce risks and improve the efficiency and transparency in payment systems across different verticals. Additionally, the shift from the centralized technical infrastructure to the distributed, ecosystem-enabling platform is laying the foundation for new business models in the payment industry.

The application and solution providers segment is expected to grow at the highest CAGR in the global FinTech blockchain market during the forecast period.

The market has been segmented on the basis of providers into 3 categories: application and solution providers, middleware providers, and infrastructure and protocols provider. These providers offer infrastructure to develop in the blockchain-based platforms. Among these types, the application and solution providers segment is the fastest-growing segment in the overall market. The introduction of technologically advanced blockchain solutions has witnessed a certain level of adoption in commercial banks, investment banks, and insurance companies, thereby fueling the overall market growth.

Ask for Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=38566589&utm_source=Openpr

North America is expected to account for the largest market size in the FinTech blockchain market during the forecast period.

North America is expected to account for the largest share of the overall market in 2018. This region is considered the most advanced with regard to technology adoption and infrastructure. The wide presence of the key industry players of blockchain technology solutions in this region is the major driving factor responsible for the growth of the market. All the major financial institutions in this region are moving toward the adoption of the blockchain technology to develop business applications, due to the recognition of the blockchain technology’s potential for safer transactions and low infrastructure cost.

The major FinTech blockchain technology vendors include AWS (US), IBM (US), Microsoft (US), Ripple (US), Chain (US), Earthport (UK), Bitfury (US), BTL Group (Canada), Oracle (US), Digital Asset Holdings (US), Circle (Ireland), Factom (US), AlphaPoint (US), Coinbase (US), Abra (US), Auxesis Group (India), BitPay (US), BlockCypher (US), Applied Blockchain (UK), RecordesKeeper (Spain), Symbiont (US), Guardtime (Estonia), Cambridge Blockchain (US), Tradle (US), and Blockchain Advisory Mauritius Foundation (Mauritius).

Mr. Shelly Singh

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

Email: newsletter@marketsandmarkets.com

MnM Blog: https://mnmblog.org/

Content Source: https://www.marketsandmarkets.com/PressReleases/fintech-blockchain.asp

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Blockchain Market Projected to reach $ 6,228.2 Million by 2023 | Key players include IBM, Microsoft, Earthport, AWS and BTL Group here

News-ID: 1876690 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

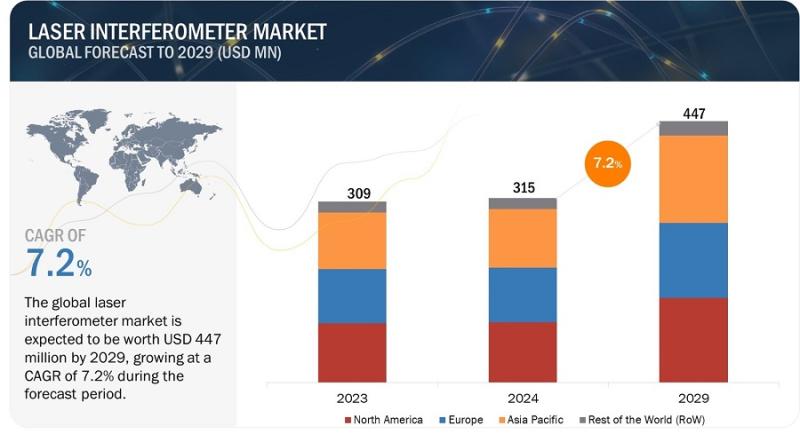

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

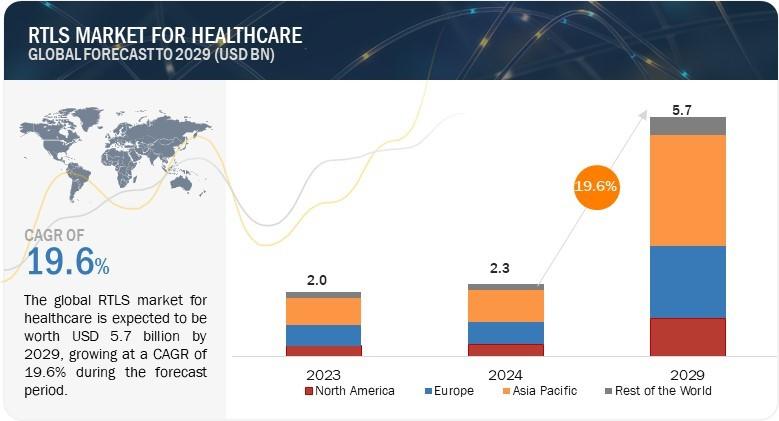

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…