Press release

Latest Report on FinTech Investment Market 2019 Size, Share, Trends, Global Industry Demand by Top Key Players - Oscar, Qufenqi, Wealthfront, ZhongAn, Atom Bank, Avant, Funding Circle, Klarna, Kreditech, OurCrowd, WeCash, H2 Ventures, KPMG

The Global FinTech Investment Market is valued at xx million USD in 2017 and is expected to reach xx million USD by the end of 2023, growing at a CAGR of xx% between 2017 and 2023.Financial technology (FinTech or fintech) is the new technology and innovation that aims to compete with traditional financial methods in the delivery of financial services.

FinTech is a new industry that uses technology to improve activities in finance.

Get Sample Copy of this report at - https://www.orianresearch.com/request-sample/703993

Scope of the report -

This report studies the FinTech Investment industry status and outlook of Global and major regions, from angles of players, countries, product types and end industries; this report analyzes the top players in global market, and splits the FinTech Investment market by product type and applications/end industries.

The P2P lending segment accounted for more than 56% of the market share and is expected to retain its market leadership. P2P lending is among the most used models by borrowers, and it includes entities like borrowers, P2P lending platforms, and investors in the market, and offers clear visibility in terms of the level of risk attached to the investments.

No.of Pages - 134

No of Key Players – 13

The Manufacturers Analyzed in Global FinTech Investment Market are –

• Oscar

• Qufenqi

• Wealthfront

• ZhongAn

• Atom Bank

• Avant

• Funding Circle

• Klarna

• Kreditech

• OurCrowd

• WeCash

• H2 Ventures

• KPMG

• Others.

What you can expect from our report:

• Total Addressable Market [ Present Market Size forecasted to 2026 with CAGR ]

• Regional level split [North America, Europe, Asia Pacific, South America, Middle East & Africa]

• Country wise Market Size Split [Important countries with major market share]

• Market Size Breakdown by Product/ Service Types – [ ]

• Market Size by Application/Industry verticals/ End Users – [ ]

• Market Share and Revenue/Sales of 10-15 Leading Players in the Market

• Production Capacity of Leading Players whenever applicable

• Market Trends – Emerging Technologies/products/start-ups, PESTEL Analysis, SWOT Analysis, Porter’s Five Forces, etc.

• Pricing Trend Analysis – Average Pricing across regions

• Brandwise Ranking of Major Market Players globally

Reasons to buy the Global FinTech Investment Market Report -

• This report focuses on FinTech Investment volume and value at global level, regional level and company level. From a global perspective.

• This report represents overall FinTech Investment market size by analyzing historical data and future prospect.

• Regionally, this report focuses on several key regions: North America, Europe, Asia-Pacific, South America and Middle East and Africa.

• At company level, this report focuses on the production capacity, ex-factory price, revenue and market share for each manufacturer covered in this report.

Some Major Points covered in the FinTech Investment Market report -

• The Americas dominated the market, accounting for more than 79% of the market share. In this region, the traditional financial services are at risk as there is a vast number of new technology-enabled entrants.

• This region is also expected to witness a huge number of partnerships, acquisitions, and competition during the forecast period.

• Many start-ups have started offering student loans and other types of financing through various FinTech platforms. This is anticipated to increase the deal volumes of investment in the Americas during the forecast period.

• The Asia-Pacific will occupy for more market share in following years, especially in China, also fast growing India and Southeast Asia regions.

• North America, especially The United States, will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of FinTech Investment.

• Europe also play important roles in global market, with market size of xx million USD in 2017 and will be xx million USD in 2023, with a CAGR of xx%.

Direct Purchase this Report @ https://www.orianresearch.com/checkout/703993

Market Segment by Regions, regional analysis covers –

• North America (United States, Canada and Mexico)

• Europe (Germany, France, UK, Russia and Italy)

• Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

• South America (Brazil, Argentina, Colombia etc.)

• Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Market Segment by Type, covers –

• Crowdfunding

• Peer-to-peer Lending

• Online Acquiring and Mobile Wallets

• Other

Market Segment by Applications, can be divided into –

• Large Enterprises

• SMEs

You can Get Direct Flat 40% Discount: https://www.orianresearch.com/discount/703993

[Avail flat 40% discount on this report. Offer for limited period only]

Table of Contents:

1 FinTech Investment Market Overview

1.1 Product Overview and Scope of FinTech Investment

1.2 Classification of FinTech Investment by Types

1.2.1 Global FinTech Investment Revenue Comparison by Types (2017-2023)

1.2.2 Global FinTech Investment Revenue Market Share by Types in 2017

1.2.3 Crowdfunding

1.2.4 Peer-to-peer Lending

1.2.5 Online Acquiring and Mobile Wallets

1.2.6 Other

1.3 Global FinTech Investment Market by Application

1.3.1 Global FinTech Investment Market Size and Market Share Comparison by Applications (2013-2023)

1.3.2 Large Enterprises

1.3.3 SMEs

2 Manufacturers Profiles

2.1 Oscar

2.1.1 Business Overview

2.1.2 FinTech Investment Type and Applications

2.1.2.1 Product A

2.1.2.2 Product B

2.1.3 Oscar FinTech Investment Revenue, Gross Margin and Market Share (2016-2017)

2.2 Qufenqi

2.2.1 Business Overview

2.2.2 FinTech Investment Type and Applications

2.2.2.1 Product A

2.2.2.2 Product B

2.2.3 Qufenqi FinTech Investment Revenue, Gross Margin and Market Share (2016-2017)

2.3 Wealthfront

2.3.1 Business Overview

2.3.2 FinTech Investment Type and Applications

2.3.2.1 Product A

2.3.2.2 Product B

2.3.3 Wealthfront FinTech Investment Revenue, Gross Margin and Market Share (2016-2017)

2.4 ZhongAn

2.4.1 Business Overview

2.4.2 FinTech Investment Type and Applications

2.4.2.1 Product A

2.4.2.2 Product B

2.4.3 ZhongAn FinTech Investment Revenue, Gross Margin and Market Share (2016-2017)

2.5 Atom Bank

2.5.1 Business Overview

2.5.2 FinTech Investment Type and Applications

3 Global FinTech Investment Market Competition, by Players

3.1 Global FinTech Investment Revenue and Share by Players (2013-2018)

3.2 Market Concentration Rate

3.2.1 Top 5 FinTech Investment Players Market Share

3.2.2 Top 10 FinTech Investment Players Market Share

3.3 Market Competition Trend

4 Global FinTech Investment Market Size by Regions

4.1 Global FinTech Investment Revenue and Market Share by Regions

4.2 North America FinTech Investment Revenue and Growth Rate (2013-2018)

4.3 Europe FinTech Investment Revenue and Growth Rate (2013-2018)

4.4 Asia-Pacific FinTech Investment Revenue and Growth Rate (2013-2018)

4.5 South America FinTech Investment Revenue and Growth Rate (2013-2018)

4.6 Middle East and Africa FinTech Investment Revenue and Growth Rate (2013-2018)

5 North America FinTech Investment Revenue by Countries

5.1 North America FinTech Investment Revenue by Countries (2013-2018)

5.2 USA FinTech Investment Revenue and Growth Rate (2013-2018)

5.3 Canada FinTech Investment Revenue and Growth Rate (2013-2018)

5.4 Mexico FinTech Investment Revenue and Growth Rate (2013-2018)

6 Europe FinTech Investment Revenue by Countries

6.1 Europe FinTech Investment Revenue by Countries (2013-2018)

6.2 Germany FinTech Investment Revenue and Growth Rate (2013-2018)

6.3 UK FinTech Investment Revenue and Growth Rate (2013-2018)

6.4 France FinTech Investment Revenue and Growth Rate (2013-2018)

6.5 Russia FinTech Investment Revenue and Growth Rate (2013-2018)

6.6 Italy FinTech Investment Revenue and Growth Rate (2013-2018)

7 Asia-Pacific FinTech Investment Revenue by Countries

7.1 Asia-Pacific FinTech Investment Revenue by Countries (2013-2018)

7.2 China FinTech Investment Revenue and Growth Rate (2013-2018)

7.3 Japan FinTech Investment Revenue and Growth Rate (2013-2018)

7.4 Korea FinTech Investment Revenue and Growth Rate (2013-2018)

7.5 India FinTech Investment Revenue and Growth Rate (2013-2018)

7.6 Southeast Asia FinTech Investment Revenue and Growth Rate (2013-2018)

……………….Continued

Customization Service of the Report:

Orian Research provides customisation of reports as per your need. This report can be personalised to meet your requirements. Get in touch with our sales team, who will guarantee you to get a report that suits your necessities.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (832) 380-8827 | UK: +44 0161-818-8027

Email: info@orianresearch.com

Website: www.orianresearch.com/

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latest Report on FinTech Investment Market 2019 Size, Share, Trends, Global Industry Demand by Top Key Players - Oscar, Qufenqi, Wealthfront, ZhongAn, Atom Bank, Avant, Funding Circle, Klarna, Kreditech, OurCrowd, WeCash, H2 Ventures, KPMG here

News-ID: 1866816 • Views: …

More Releases from Orian Research

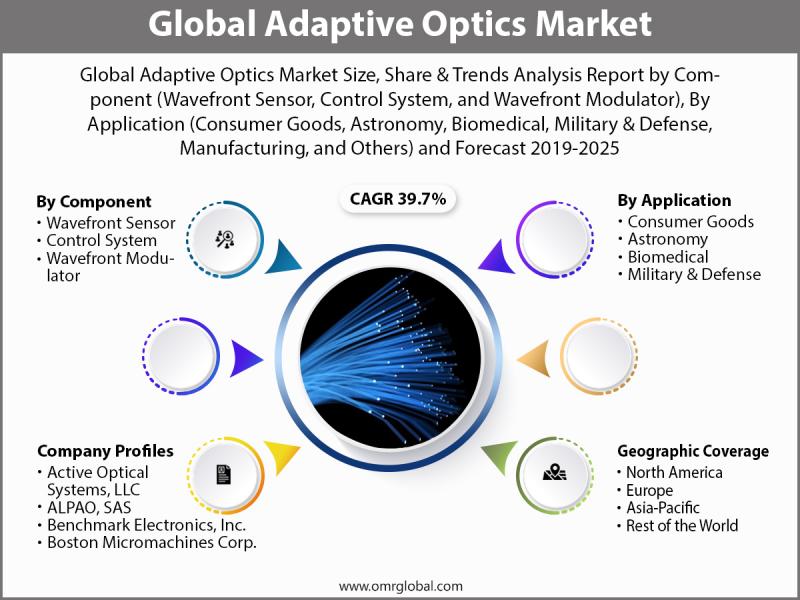

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

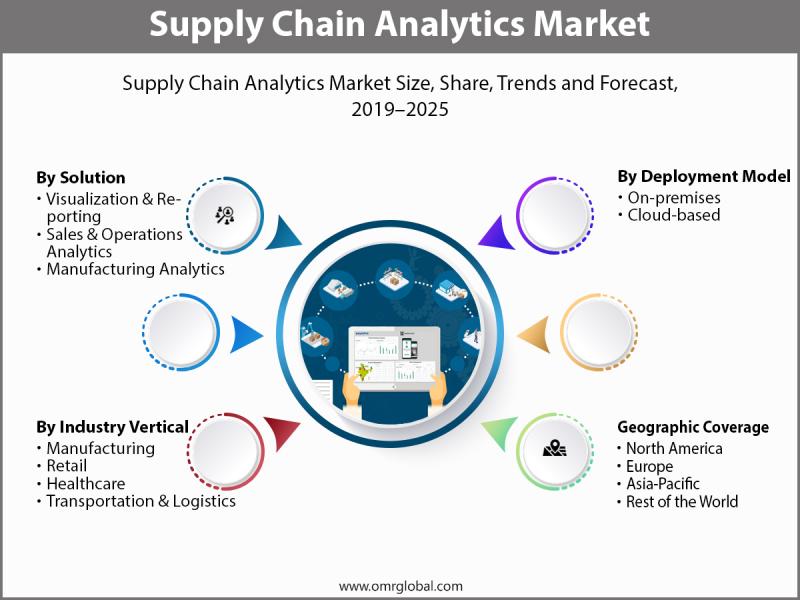

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

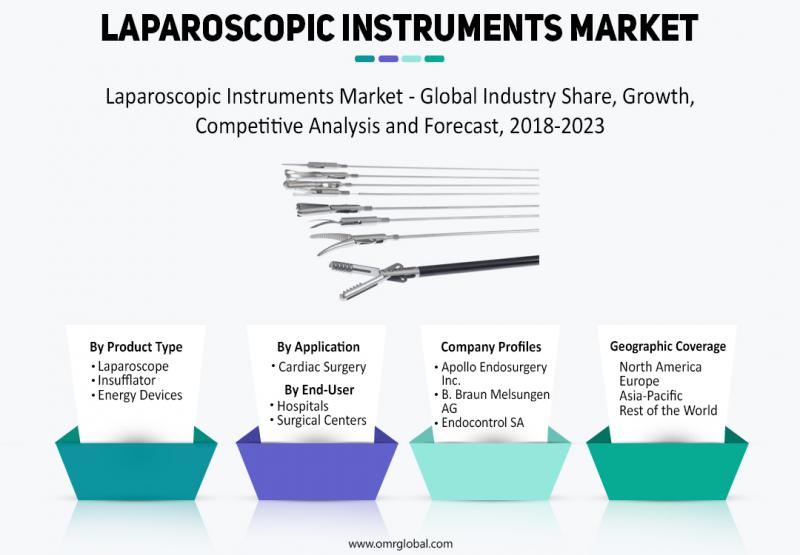

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…