Press release

Indonesia Peer-to-Peer Lending Market is expected to Reach IDR 430 Trillion in terms of Credit Disbursed by 2024: Ken Research

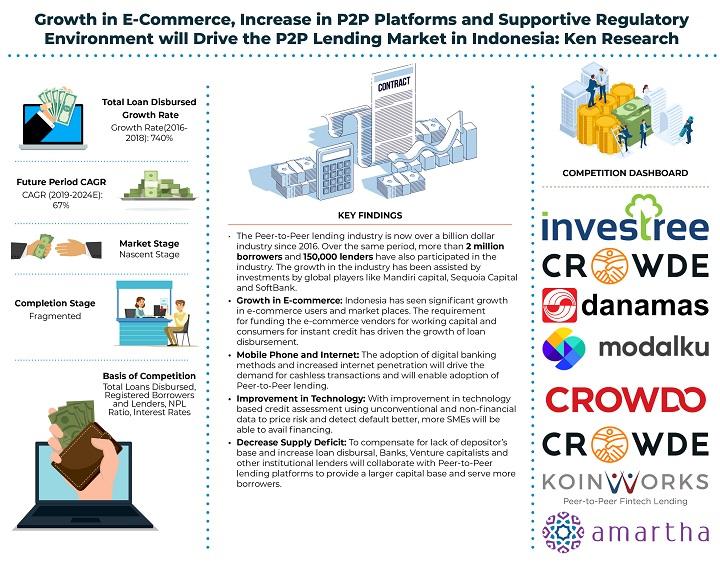

KEY FINDINGS• It is expected that by the year ending 2024, the amount of loans disbursed by the Peer-to-Peer Lending platforms will be IDR 430 Trillion, more than quadrupling from the amount in 2018.

• Improvement in internet and mobile phone penetration will improve credit access to remote regions on Indonesia and help narrow the funding gap faced by Small and Medium industries.

• Major marketing strategies adopted by Peer-to-Peer Lending platforms will include partnerships with institutional lenders and banks to gain access to a larger capital base as well as partnerships with e-commerce sellers to provide financing to sellers and vendors.

Growth in E-commerce: The growth in the Loan Disbursement by Peer-to-Peer Lending platform operators will be driven by growth in internet and mobile phone penetration across remote areas in Indonesia. The demand for funding will increase as more customers turn to e-commerce for their consumption needs, thereby increasing seller activity and hence an increase in need for working capital funding. Indonesia’s e-commerce roadmap aims to improve the e-commerce market and lead to adoption of digital technology.

Entry of Peer-to-Peer Lending Players: With more than 100 platforms currently registered with the OJK and more than 100 still in pipeline to obtain registration, the loan disbursement is set to increase in the coming years owing to reaching a wider borrower base. The Sandbox testing mechanism introduced by OJK to test operational reliability against fraud and platform breakdown due to technological failures will help these platforms gain regulatory and operational acceptance.

Partnership with Banks and Financial Institutions: To tackle the disadvantage of lack of depositor’s base like banks, Peer-to-Peer lending platforms will continue to look to collaborate and partner with major financial institutions and banks to gain access to a larger capital base to cater to the demand of borrowers. Banks are set to gain from these partnerships by reaching out to a wider borrower base, reduce costs related to credit assessment by outsourcing such activities to the platform operators.

The market for Peer-to-Peer lending has grown at a significant growth rate during the period CY’2016-CY’2018. The industry is still in the emerging phase. With stricter norms kicking in due to OJK regulations and improved connectivity in mobile phones and internet penetration, the market would increase further as newer geographies will be catered. The market for Peer-to-Peer lending would increase further for the period CY’2019E-2024E. With the Indonesian government rolling out an e-Commerce roadmap, aided by adoption of digital technology, more borrowers and lenders are set to participate in the Peer-to-Peer lending market.

Analysts at Ken Research in their latest publication “Competition Benchmarking: Indonesia Peer-to-Peer Lending Market Outlook to 2024” believe growth in e-commerce activity driving seller activity, adoption, and integration of digital technology with e-commerce, entry of new platform operators and their ability to cover a wider geography, improvement in internet and mobile phone penetration and increased participation of banks and financial institutions are some of the factors that will drive the market to register a near 50% CAGR in terms of loan disbursement for the period 2019-2024.

For more information on the market research report please refer to the below link:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-peer-to-peer-lending-market-outlook/243554-93.html

Key Segments Covered

• By Location of Loan Disbursed

Inside Java

Outside Java

Key Target Audience

• Existing Peer-to-Peer Lending Platforms

• New Market Entrants- Domestic Platforms

• New Market Entrants- International Platforms

• Banks and Financial Institutions

• Government Bodies

• Investors & Venture Capital Firms

• Third Party Technology Providers

• MSMEs and E-commerce Sellers

Time Period Captured in the Report:

• Historical Period: 2016 -2018

• Forecast Period: 2019-2024

Companies Covered:

• Investree

• Modalku

• Koinworks

• Danamas

• Mekar

• Crowde

• Crowdo

• Akseleran

• Aktivaku

• Amartha

Key Topics Covered in the Report

• Indonesia Peer-to-Peer Lending Market Value Chain Analysis

• Indonesia Peer-to-Peer Lending Market Overview

• Indonesia Peer-to-Peer Lending Market Ecosystem

• Indonesia Peer-to-Peer Lending Market Future and Projections

• Regulatory Framework in Indonesia Peer-to-Peer Lending Market

• Issues and Challenges in Indonesia Peer-to-Peer Lending Market

• Competitive Landscape in Indonesia Peer-to-Peer Lending Market

Other Related Reports:

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-financial-brokerage-market-report/29331-93.html

https://www.kenresearch.ae/media-and-entertainment/advertising/indonesia-online-advertising-market-report/88375-94.html

https://www.kenresearch.com/technology-and-telecom/it-and-ites/indonesia-on-demand-services-market/116748-105.html

Contact Us:

Ken Research Private Limited

Ankur Gupta, Head Marketing

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Peer-to-Peer Lending Market is expected to Reach IDR 430 Trillion in terms of Credit Disbursed by 2024: Ken Research here

News-ID: 1862643 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…