Press release

Credit Risk Systems Market 2025-Deep Analysis of Current Technology Trends, Future Plans, Statistic, Revenue Growth and Future Demand by Top Key Players-IBM, Oracle, SAP, SAS, Experian, Misys, Fiserv, Kyriba, Active Risk, Pegasystems, TFG Systems

Global Credit Risk Systems Market 2019 Report provides a in-depth outline of the market with respect to the key drivers influencing the revenue graph of this business domain of finance and Banking sector. The current trends of Credit Risk Systems Market 2019 in combination with the geographical landscape, demand scale, recompense scale, and growth graph of this erect have also been included in this report.For More Info, Get Sample Report Here https://www.orianresearch.com/request-sample/984213

Market Participants:

The MAJOR BUSINESS PLAYERS associated with the Credit Risk Systems Market are

• IBM

• Oracle

• SAP

• SAS

• Experian

• Misys

• Fiserv

• Kyriba

• Active Risk

• Pegasystems

• TFG Systems

• Palisade Corporation

• Resolver

• ….

The Credit Risk Systems Industry Report is an in-depth study analyzing the current state of the Credit Risk Systems Market. It provides a brief overview of the market focusing on definitions, classifications, product specifications, manufacturing processes, cost structures, market segmentation, end-use applications and industry chain analysis. The study on Credit Risk Systems Market provides analysis of market covering the industry trends, recent developments in the market and competitive landscape.

Order a Copy of Global Credit Risk Systems Market Report @ https://www.orianresearch.com/checkout/984213

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins. Competitive analysis includes competitive information of leading players in Credit Risk Systems market, their company profiles, product portfolio, capacity, production, and company financials.

In addition, report also provides upstream raw material analysis and downstream demand analysis along with the key development trends and sales channel analysis. Research study on Credit Risk Systems Market also discusses the opportunity areas for investors.

No of Pages: 102

Market segment by Type, the product can be split into

• On-Premise

• Cloud

Market segment by Application, split into

• Small Business

• Midsize Enterprise

• Large Enterprise

• Other

The market study is being classified by Type, by Application and major geographies with country level break-up that includes South America (Brazil, Argentina, Rest of South America), Asia Pacific (China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific), Europe (Germany, France, Italy, United Kingdom, Netherlands, Rest of Europe), MEA (Middle East, Africa), North America (United States, Canada, Mexico).

Inquire More or Share Questions If Any before the Purchase on This Report @ https://www.orianresearch.com/enquiry-before-buying/984213

Important Aspects of Credit Risk Systems Report:

1. Top factors like revenue, supply-demand ratio, market status and market value is reflected.

2. All the top Global Credit Risk Systems market players are analysed with their competitive structure, development plans and regional presence.

3. The market analysis from 2014-2019 and forecast analysis from 2019-2025 is conducted with the base year as 2019.

4. Top regions and countries which have huge growth potential are studied in this report.

5. The SWOT analysis of regions and players will lead to an analysis of growth factors and market risks.

6. The segmented market view based on product type, application and region will provide a simpler market overview.

7. The market outlook, Credit Risk Systems gross margin study, price and type analysis is explained.

8. The distributors, traders, dealers and manufacturers of Credit Risk Systems are profiled on a global scale.

9. The forecast analysis by type, application and region is conducted to present the sales margin, market share, revenue and growth rate.

10. The information on mergers & acquisitions in Credit Risk Systems, product launches, new industry plans and policies as well as the development status is analysed in the report.

Why To Select This Report:

• Complete analysis on market dynamics, market status and competitive Credit Risk Systems view is offered.

• Forecast Global Credit Risk Systems Industry trends will present the market drivers, constraints and growth opportunities.

• The five-year forecast view shows how the market is expected to grow in coming years.

• All vital Global Credit Risk Systems Industry verticals are presented in this study like Product Type, Applications and Geographical Regions.

Customization Service of the Report:

Orian Research provides customization of reports as per your need. This report can be personalized to meet your requirements. Get in touch with our sales team (info@orianresearch.com), who will guarantee you to get a report that suits your necessities.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Risk Systems Market 2025-Deep Analysis of Current Technology Trends, Future Plans, Statistic, Revenue Growth and Future Demand by Top Key Players-IBM, Oracle, SAP, SAS, Experian, Misys, Fiserv, Kyriba, Active Risk, Pegasystems, TFG Systems here

News-ID: 1851229 • Views: …

More Releases from Orian Research

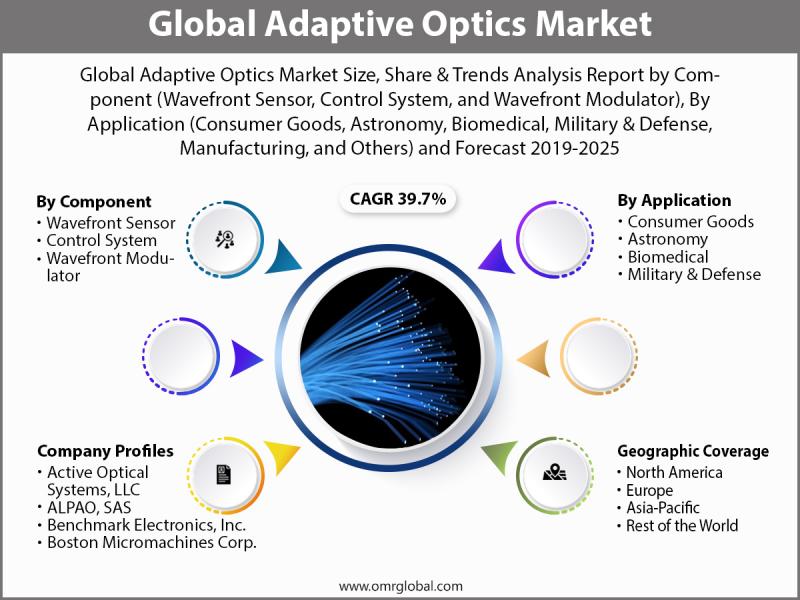

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

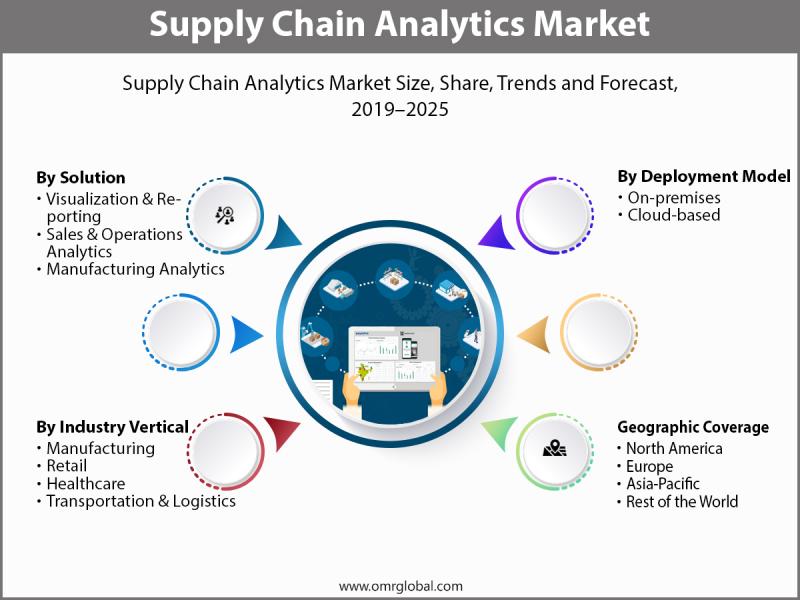

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

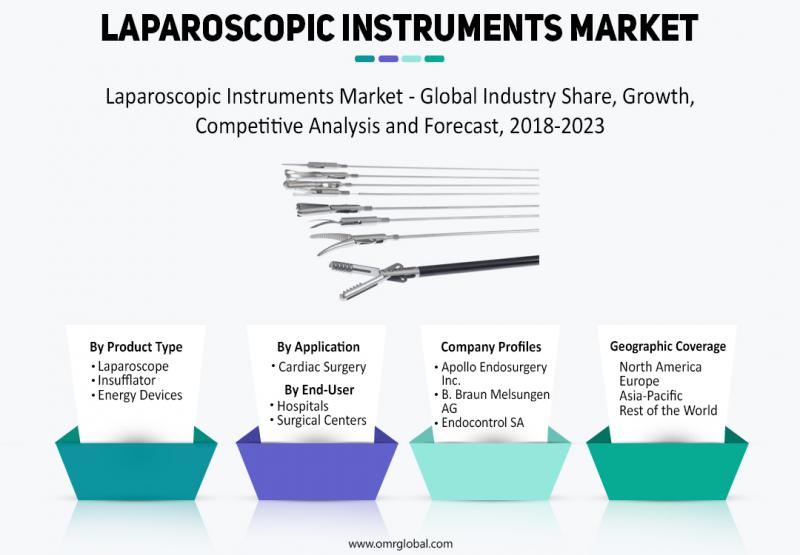

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Risk

RiskWatch Launches Risk Management Software: Streamlined Risk Assessments and In …

RiskWatch International, a leading provider of compliance and risk management solutions, has announced the launch of its comprehensive Risk Management Software. This user-friendly platform empowers organizations of all sizes to proactively identify, assess, and mitigate risks, fostering a culture of resilience and success.

RiskWatch Risk Management Software delivers a robust suite of features, including:

● Comprehensive Risk Templates: Build a customized library of risk templates tailored to your specific needs, encompassing…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…