Press release

Payment Processing Software Market 2019-Innovative Trends, Latest Innovation, Top Companies-Amazon Payments, PayPal, Stripe, CyberSource, Square, AppFrontier, Southern Payment Systems, FIS, BluePay Processing, JPMorgan Chase, Sage Group, OPay

Payment Processing Software Market 2019 Industry Research Report explores the expert analysis of Payment Processing Software Industry on the basis of shares, revenue, demand and Forecasts period of 2019 to 2025. Finally the feasibility of new investment projects are assessed and overall research conclusions offered. This report also presents product specification, management process, and cost structure.For More Info, Get Sample Report Here https://www.orianresearch.com/request-sample/888209

The Global Payment Processing Software Market Report Includes the Following Details:

The overview of global Payment Processing Software market: some of the important elements such as definition, classification, application, and other basic information are covered in this report. The Global Payment Processing Software market analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status. Development policies, plans, strategy, manufacturing or production process and drivers are also analyzed in this report.

The Payment Processing Software Industry Report covers following Key Players (can be customized as per requirement):

• Amazon Payments

• PayPal

• Stripe

• CyberSource

• Square

• AppFrontier

• Southern Payment Systems

• FIS

• BluePay Processing

• JPMorgan Chase

• Heartland Payment Systems

• Sage Group

• OPay

• ProPay

• .….

This report also provides import/export consumption, supply and demand Figures, cost, price, rate of production, revenue and gross margins. This report also states statistical analysis of the market supply, demand, cost, sales, revenue, and gross margin. This report also focused on market production, sales, import, and consumption by region as well global.

Inquire More or Share Questions If Any before the Purchase on This Report @ https://www.orianresearch.com/enquiry-before-buying/888209

The Payment Processing Software Market research report also providing information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information. With this Payment Processing Software Industry Market report, one is sure to keep up with information on the dogged competition for market share and control, between elite manufacturers. As long as you are in search of key Industry data and information that can readily be accessed, you can rest assured that this report got them covered.

Finally the feasibility of new investment projects are assessed and overall research conclusions offered.

Regional Insights:

The Global Payment Processing Software 2019 market report gives analytical data that can diverse the forceful elements in the market and will furthermore give a geological distribution North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa of the general market on an overall assessment. It also gives short-term and long-term marketing goals and procedure along with SWOT analysis of the top companies.

No of Pages: 127

Market segment by Type, the product can be split into

• On-premise

• Cloud-based

Market segment by Application, split into

• Individual

• Enterprise

• Others

Order a Copy of Global Payment Processing Software Market Report @ https://www.orianresearch.com/checkout/888209

There are 15 Chapters to display the Global Payment Processing Software market 2019:-

Chapter 1. Industry Overview of Global Payment Processing Software Market.

Chapter 2. Payment Processing Software Manufacturing Cost Structure, Raw Material and Suppliers, Manufacturing procedure, Industry Chain Structure.

Chapter 3. Market Trend Analysis, Regional Market Trend, Market Trend by Product Type

Chapter 4. Regional Marketing Type Analysis, International Trade Type Analysis, Supply Chain Analysis

Chapter 5. North America Payment Processing Software Industry Report Development Status and Outlook.

Chapter 6. Latin America Payment Processing Software Industry Report Development Status and Outlook.

Chapter 7. Development Status and improvements of Payment Processing Software in North America, Latin America.

Chapter 8. Europe, Asia-Pacific Payment Processing Software Market Improvement Status and Outlook.

Chapter 9. The Middle East and Africa Payment Processing Software Market Report Development Status and Outlook.

Chapter 10. Consumers Analysis of Global Payment Processing Software 2019.

Chapter 11. Overall Market Analysis, Volume Analysis, Sales Analysis, Sales Price Analysis.

Chapter 12. Payment Processing Software Market Factors Analysis.

Chapter 13. Payment Processing Software Market Dynamics.

Chapter 13, 14 and 15: Global Payment Processing Software sales channel, distributors, dealers, traders, Research Findings and Conclusion, appendix and data source.

Customization Service of the Report:

Orian Research provides customization of reports as per your need. This report can be personalized to meet your requirements. Get in touch with our sales team (info@orianresearch.com), who will guarantee you to get a report that suits your necessities.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Processing Software Market 2019-Innovative Trends, Latest Innovation, Top Companies-Amazon Payments, PayPal, Stripe, CyberSource, Square, AppFrontier, Southern Payment Systems, FIS, BluePay Processing, JPMorgan Chase, Sage Group, OPay here

News-ID: 1843772 • Views: …

More Releases from Orian Research

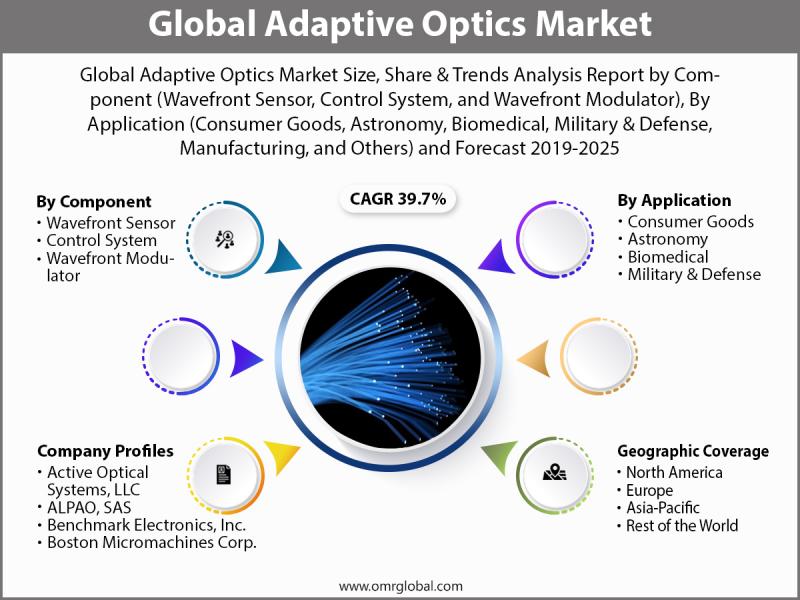

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

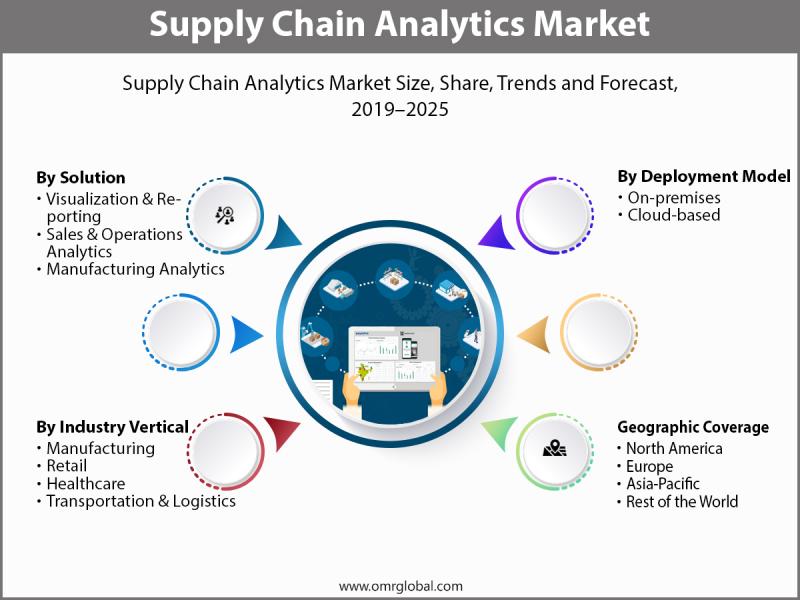

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

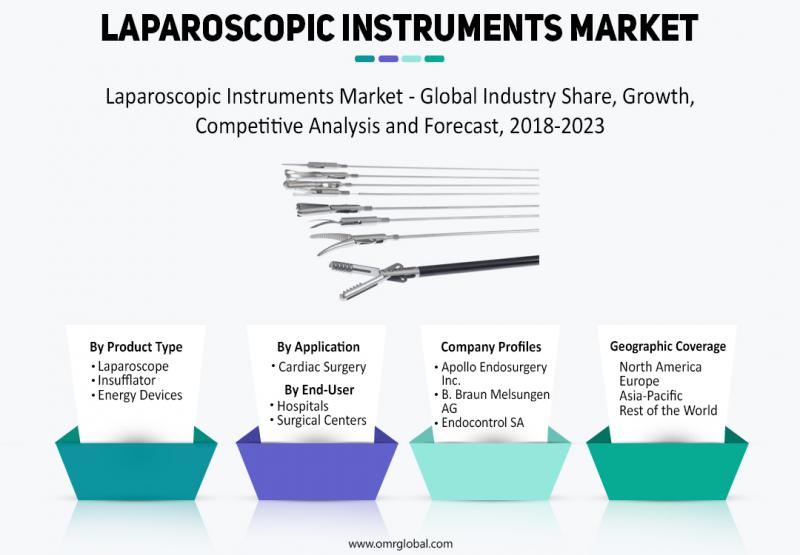

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…