Press release

Sales Tax Software Market Surprising Growth| APEX Analytix, AvalaraCCH, Vertex,Zoho, Sales Tax DataLINK

Data Bridge Market Research Released a new report on Global Sales Tax Software Market helps the clients to take business decisions and to understand strategies of major players in the industry. The report also calls for market – driven results deriving feasibility studies for client needs. Data Bridge Market Research ensures qualified and verifiable aspects of market data operating in the real- time scenario. The analytical studies are conducted ensuring client needs with a thorough understanding of market capacities in the real- time scenario. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of the Leading key Company’s Covered for this Research are APEX Analytix, AvalaraCCH INCORPORATED., IntuitLegalRaasta.com, LumaTax,Ryan, LLC, Sage Intacct, Sales Tax DataLINK, Sovos Compliance, LLC, Thomson Reuters, Vertex,Zoho Corporation Pvt. Ltd., Xero Limited, The Federal Tax Authority, LLC d/b/a TaxCloud, Wolters Kluwer, CFS Tax SoftwareService Objects,TaxJar.Global sales tax software market is expected to rise to an estimated value of USD 9.29 billion by 2026, registering a healthy CAGR in the forecast period of 2019-2026.

Request a sample Report of Sales Tax Software Market at: https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-sales-tax-software-market

Sales Tax Software Market Data Collection Matrix

We looked for primary and secondary sources from both the supply and demand sides of the global Sales Tax Software market for collecting data and information to prepare this encyclopedic research study. From the supply side, our primary sources were technology distributors and wholesalers and manufacturers, whereas our secondary sources were economic and demographic data reports, independent investigations, government publications, and company publications and reports. From the demand side, we relied on mystery shopping, consumer surveys, and end-user surveys for primary research and reference customers and case studies for secondary research.

What are the pivotal drivers and challenges of the Sales Tax Software market that are detailed in the research study

Market Drivers:

Increasing complications in regulations and compliances resulting in major enterprises preferring automation of tax filling is expected to drive the growth of the market

Significant penetration of internet and cloud computing resulting in greater adoption of these services is expected to positively affect the growth of the market

Rise in the levels of quantities of transactions and the amounts pertaining to these transactions results in complicated process of tax filing, requiring a simplified tax filing service

Market Restraints:

Absence of quality infrastructure required for efficient operations of these services is expected to restraint the growth of the market

Requirement of knowledgeable professionals to provide efficient workflow of services and maintaining the operational cycle is expected to act as a restraint to the growth

Global Sales Tax Software Market Segmentation:

By Solution: Consumer Use Tax Management, Automatic Tax Filings, Exemption Certificate Management, Others

By Deployment Model: On-Premises, Cloud-Based, SaaS

By Platform Type: Web, Mobile), Industrial Vertical: BFSI, Transportation, Retail, Telecommunication & IT, Healthcare, Manufacturing, Food Services, Energy & Utilities, Others

By Application: Small Business, Midsize Enterprise, Large Enterprise

By End-Users: Individuals, Commercial Enterprises

Competitive Analysis:

The key players are highly focusing innovation in production technologies to improve efficiency and shelf life. The best long-term growth opportunities for this sector can be captured by ensuring ongoing process improvements and financial flexibility to invest in the optimal strategies. Company profile section of players such as APEX Analytix, AvalaraCCH INCORPORATED., IntuitLegalRaasta.com, LumaTax,Ryan, LLC, Sage Intacct,Sales Tax DataLINK, Sovos Compliance, LLC, Thomson Reuters, Vertex,Zoho Corporation Pvt. Ltd., Xero Limited, The Federal Tax Authority, LLC d/b/a TaxCloud, Wolters Kluwer, CFS Tax SoftwareService Objects,TaxJar.

Browse for Full Report at @: https://www.databridgemarketresearch.com/toc/?dbmr=global-sales-tax-software-market

Global Sales Tax Software Market Table of Contents

Chapter 1 provides an overview of Sales Tax Software market, containing global revenue, global production, sales, and CAGR. The forecast and analysis of Sales Tax Software market by type, application, and region are also presented in this chapter.

Chapter 2 is about the market landscape and major players. It provides competitive situation and market concentration status along with the basic information of these players.

Chapter 3 provides a full-scale analysis of major players in Sales Tax Software industry. The basic information, as well as the profiles, applications and specifications of products market performance along with Business Overview are offered.

Chapter 4 gives a worldwide view of Sales Tax Software market. It includes production, market share revenue, price, and the growth rate by type.

Chapter 5 focuses on the application of Sales Tax Software, by analyzing the consumption and its growth rate of each application.

Chapter 6 is about production, consumption, export, and import of Sales Tax Software in each region.

Sales Tax Software Market Research Methodology

Our analysts have used advanced primary and secondary research techniques and tools to compile this report. The research sources and tools that we use are highly reliable and trustworthy. The report offers effective guidelines and recommendations for players to secure a position of strength in the global Sales Tax Software market.

Primary Research:

The primary sources involves the industry experts from the Global Sales Tax Software industry including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

Secondary Research:

In the Secondary research crucial information about the industries value chain, total pool of key players, and application areas. It also assisted in market segmentation according to industry trends to the bottom-most level, geographical markets and key developments from both market and technology oriented perspectives.

Buy this research @ https://www.databridgemarketresearch.com/checkout/buy/enterprise/global-sales-tax-software-market

The generated Sales Tax Software report is firmly based on primary research, interviews with top executives, news sources and information insiders. Secondary research techniques are implemented for the better understanding and clarity for data analysis. The Scope of the report extends from market scenario to comparative pricing between major players, cost and profit of the specified market regions. Powerful market analysis tools such as SWOT analysis, Port’s five analysis, Pest analysis, are carried out while developing this Sales Tax Software report.

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Contact:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sales Tax Software Market Surprising Growth| APEX Analytix, AvalaraCCH, Vertex,Zoho, Sales Tax DataLINK here

News-ID: 1837481 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

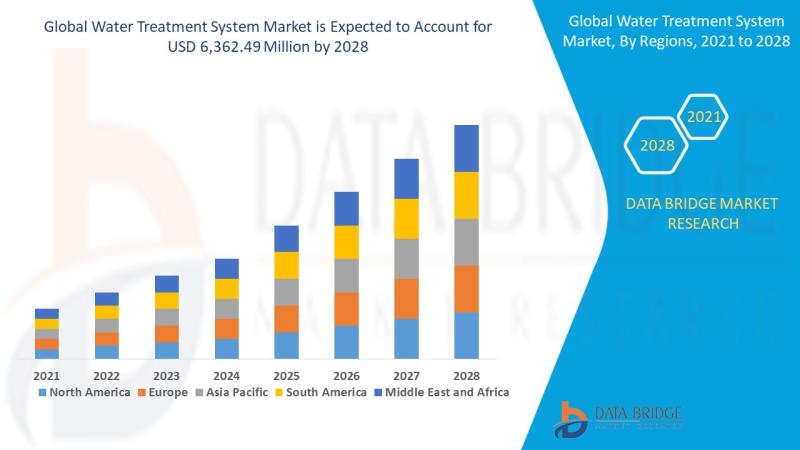

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…