Press release

Global Cross-Border Fintech: Regulation and the Law Market 2019 Top Key Vendors are Tortious Interference,Trademark and Copyright Infringement,Contract Disputes,Fraud,Negligence, Wrongful Death,Industrial Product Liability,Construction Claims

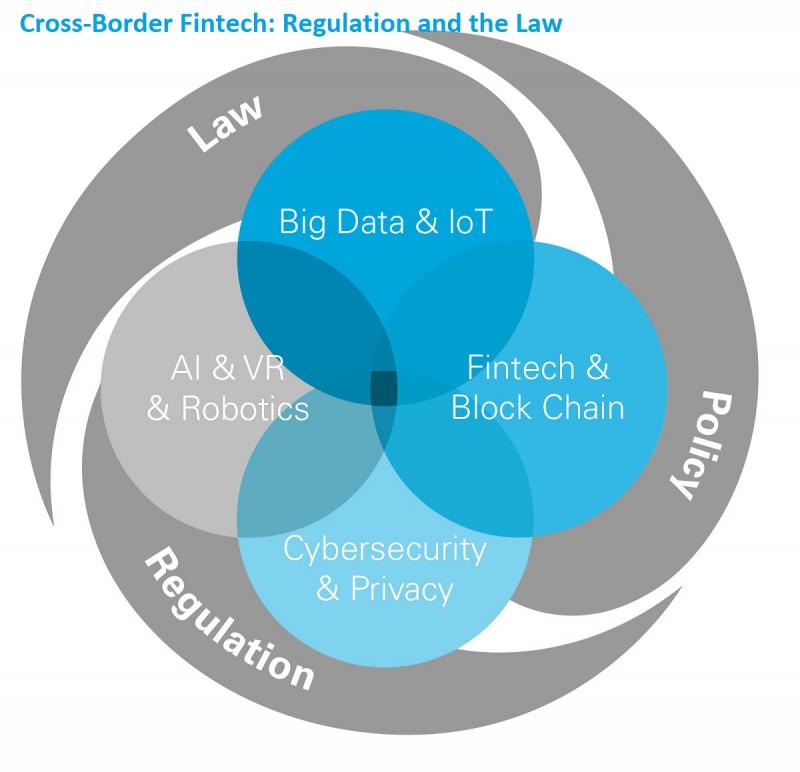

Cross-Border Fintech: Regulation and the LawThe most promising trends of financial technology services on a global market.

This report explains the key market drivers, trends, restraints and opportunities to give a precise data which is required and expected. It also analyzes how such aspects affect the market existence globally helping make a wider and better choice of market establishment. The Cross-Border Fintech: Regulation and the Law markets growth and developments are studied and a detailed overview is been given.

This Report covers the Companies data, including: shipment, price, revenue, gross profit, interview record, business distribution etc., these data help the consumer know about the competitors better. This report also covers all the regions and countries of the world, which shows a regional development status, including market size, volume and value, as well as price data.

Get sample copy of this report: https://www.reportsandmarkets.com/sample-request/cross-border-fintech-regulation-and-the-law-global-market-research-report-2019?utm_source=openPR&utm_medium=SuRaJ

Some of the leading players in the Cross-Border Fintech: Regulation and the Law market include: Tortious Interference,Trademark and Copyright Infringement,Contract Disputes,Fraud,Negligence, Wrongful Death,Industrial Product Liability,Construction Claims,Anti-Competitive Suits, UKJT

It provides a refined view of the classifications, applications, segmentations, specifications and many more for Cross-Border Fintech: Regulation and the Law Industry. Recent developments and policies with respect to this market are elucidated with maximum data.

The increasing demand in the well-established and emerging regions as well as latest technological advent Cross-Border Fintech: Regulation and the Law, and the growing insistence of the end-use industries are all together driving the growth of the Cross-Border Fintech: Regulation and the Law Industry.

This report however describes a brief summary of market and explains the major terminologies of the Cross-Border Fintech: Regulation and the Law Industry. However an accurate analysis of the market trends, drivers, challenges and opportunities has derived the most reasonable outlook of the Cross-Border Fintech: Regulation and the Law market.

The study objectives are:

To analyze and research the global Cross-Border Fintech: Regulation and the Law status and future forecast involving, production, revenue, consumption, historical and forecast.

To present the key Cross-Border Fintech: Regulation and the Law manufacturers, production, revenue, market share, and recent development.

To split the breakdown data by regions, type, manufacturers and applications.

To analyze the global and key regions market potential and advantage, opportunity and challenge, restraints and risks.

To identify significant trends, drivers, influence factors in global and regions.

To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

Get Complete Report: https://www.reportsandmarkets.com/sample-request/cross-border-fintech-regulation-and-the-law-global-market-research-report-2019?utm_source=openPR&utm_medium=SuRaJ

In this study, the years considered to estimate the market size of Cross-Border Fintech: Regulation and the Law:

History Year: 2014–2018

Base Year: 2018

Estimated Year: 2019

Forecast Year: 2019–2025

Table of Contents:

Global Cross-Border Fintech: Regulation and the Law Market Size, Status and Forecast 2019-2025

1 Report Overview

2 Global Growth Trends

3 Market Share by Key Players

4 Breakdown Data by Type and Application

5 North America

6 Europe

7 China

8 Japan

9 Southeast Asia

10 India

11 Central & South America

12 International Players Profiles

13 Market Forecast 2019-2025

14 Analyst's Viewpoints/Conclusions

15 Appendix

Contact Us:

Sanjay Jain

Manager - Partner Relations & International Marketing

www.reportsandmarkets.com

info@reportsandmarkets.com

Ph: +44-020-3286-9338 (UK)

Ph: +1-214-736-7666 (US)

About Us:

Market research is the new buzzword in the market, which helps in understanding the market potential of any product in the market. Reports And Markets is not just another company in this domain but is a part of a veteran group called Algoro Research Consultants Pvt. Ltd. It offers premium progressive statistical surveying, market research reports, analysis & forecast data for a wide range of sectors both for the government and private agencies all across the world.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Cross-Border Fintech: Regulation and the Law Market 2019 Top Key Vendors are Tortious Interference,Trademark and Copyright Infringement,Contract Disputes,Fraud,Negligence, Wrongful Death,Industrial Product Liability,Construction Claims here

News-ID: 1825065 • Views: …

More Releases from REPORTSANDMARKETS

Micro Hotels Market Is Expected to Boom | Nine Hours in Japan, Dean Hotel Dublin …

This report studies the Micro Hotels Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Micro Hotels Market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

IT Consulting and Integration Services Market Overview by Advance Technology, Fu …

This report studies the IT Consulting and Integration Services Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete IT Consulting and Integration Services Market analysis segmented by companies, region, type and applications in the report.

The report offers valuable insight into the…

Bumping Services Market Growth, Overview with Detailed Analysis 2022-2028| ASE G …

This report studies the Bumping Services market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Bumping Services market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

Laser Powder Bed Fusion (LPBF) Technology Market Overview by Advance Technology, …

This report studies the Laser Powder Bed Fusion (LPBF) Technology market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Laser Powder Bed Fusion (LPBF) Technology market analysis segmented by companies, region, type and applications in the report.

New vendors in the market…

More Releases for Fintech:

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…