Press release

Dreaming of Buying a Vineyard? Lean About New Fractional Vineyard Ownership Hybrid Investment Funds

Vini Sileo Vineyard Fund: How many of us have dreamed of owning a vineyard, picturing ourselves leisurely walking among our very own vines, hand picking grapes at harvest …Dreaming about the possibility of owning a vineyard is a universal dream shared by millions of people around the world, and has been occupying their fanciful thoughts for thousands of years.

But as we well know reality often smothers the flames of fantasy and by the time we are ready to make our move, for example buying a vineyard in France , Italy , Portugal, or Napa Valley, the price for that “dream” has already soared beyond the reach of most peoples bank accounts, and way outside of our comfort zone of what we consider a “prudent investment” for our hard earned money.

Vinito Capital Management has build a revolutionary investment fund to help investors enjoy their dream vineyard while reducing all the risks that are associated with vineyard ownership.

VCM vineyard investment funds are a hybrid of Fractional Ownerships. VCM builds alternative investment vineyard funds that have a fractional ownership component. This component unlike many investments, the investor has the ability to enjoy the vineyards in our funds. Yes that’s right for an investment as little as €5000 you can treat your friends and family to your own vineyard retreat.

The use of fractional ownership has become very popular for many reasons and understandably a viable alternative to traditional vineyard real estate ownership. Knowing that one will not be using their vineyard all year long but still being expected to pay 100% for the vineyard followed by 100% all expenses has motivated many investors not to abandon their dreams, and look for alternative ways to pursue their dream of vineyard ownership and the VCM SPV ( Special Investment Vehicle) does just that!

Example how traditional fractional ownership is evolving:

Luxury Condos and Homes

Luxury Exotic Cars (Ferrari and Lamborghini)

Luxury Yachts

Luxury Private Jets

Luxury Art (yes, you can have a Van Gogh, Picasso, and Warhol on your wall part of the year)

VCM’s Vini Sileo Vineyard Fund is the best way for investors dreaming of vineyard ownership to “test drive your dream” and later on if you want to take the “leap” and purchase a vineyard of your own Vinito Capital Management is here to help you reach your dreams.

Vini Sileo Winery LLC Executive Summary

Vini Sileo LLC, is a vertically integrated boutique Vini Sileo LLC 100% organic vineyard and winery located in Haute Saone in the region Franche - Comte Bourgogne. Our annual goal is to produce, market and sell 12,000 bottles of distinctive, rich, organic artisan French wines (€49 to €89 a bottle) directly from the winery’s tasting room (retail) to progressive wine consumers. We will also use area already established network of high end organic / vegan restaurants along with hotels throughout Europe and Asia. Vini Sileo LLC partnership with Vinito Wines gives Vini Sileo LLC access to an established international distributor, and sales network. for international sales. We plan to begin production August 2019 and to start fulfilling orders sales by November 2019.

Global Wine Market Will Reach USD 423.59 Billion by 2023: Zion Market Research According to the report, the global wine market was valued at approximately USD 302.02 billion in 2017 and is expected to generate revenue of around USD, 423.59 billion by the end of 2023, growing at a CAGR of around 5.8% between 2017 and 2023.

The IWSR Organic Wine Report, published this month, includes findings presented at the Millesime Sudvinbio fair earlier this year, and forecasts that by 2022, worldwide consumption of still wine is projected to reach 2.43bn nine-litre cases. The organic wine subcategory is expected to post the strongest increases (+9.2% compound annual growth 2017-2022).

The villa, vineyard, and winery is located on the stunning rolling hills of Franche - Comte Bourgogne. This area use to belong to the famed Burgundy wine growing region until it was annexed in 2016.

300 vines are producing for fall 2019 and all operational requirements for labels bottling and labour is in place. Over 20 hectors of new land adjacent to the vineyard is ready for us to purchase for expansion.

What can I expect if I only invest the minimum €5000 into the fund.

Can I earn return on my investment?

This is an excellent question and the answer depends of many variables, however, there are certain equations that can be utilized to arrive at realistic income estimates and that are employed by many large, long established vineyards. We try to keep it simple, our funds earn investors 8%-25% a year.

Before you delve into the figures bear in mind that enhanced vineyard profitability requires vineyard development, plus a worker’s house, tractor with implements, several vineyard workers, Vineyard Manager, Agronomist, Accountant and an Enologist to help produce great wine.

It may sound like a lot, but hey, this is why you're not buying a vineyard yourself. We take all these headaches away and then for you is a running vineyard you make money from and get to enjoy. There is zero additional costs to our investors to visit the vineyards, your investment amount determines the level of use investors are able to have of the vineyard. The use of vineyard varies from a simple weekend stay to as grand as a family or business function on the property.

IRA and ISA Qualified

Yes, VCM vineyard funds are IRA and ISA qualified. To insure our clients IRA and ISA needs are met we have partnered with Rocketdollar, the premier self directed IRA platform for self-directed 401(k) and IRA investors.

*Per Individual Investment

This is for informational purposes only and in no way a solicitation to invest. There are always risks with all investments and you should seek the advice of your lawyer and account before making any financial decisions.

Vini Sileo Winery Mission

To affect positive change in the lives of all who enjoy a great bottle of wine. To create with absolute certitude high-quality organic products for siping, aging, and food pairing. To eschew half-hearted, mass produced plonk and to adhere to rigorous goals of viniferous pleasure for all seekers of the highest good.

https://invest-wine.com/vineyard-investment-vini-sileo-winery/

Vinito Capital Management

Via Pigntelli Aragon 7

Palermo Italy 94101

Erick Sabelskjold CEO

+995 555 224 690

invest-wine.com/vineyard-fund/

Since inception, Vinito Capital Management team has been obsessed with searching for the most promising vineyards to build revolutionary investment vehicles for public and institutional investors. Raising vineyard funds of this size is a testament to the growing confidence in the alternative crowd investing market – which VCM has pioneered from the start – and their unique strategy of partnering with extraordinary partners to help them build successful global wine portfolio funds.

VCM equity funds are designed to preserve and grow our clients capital, provide financial security for retirees, sovereign wealth funds, and other institutional and individual investors, and contribute to overall international economic growth. VCM is the world's leading crowd investing platforms for vineyard funds as an alternative investment. We seek to create positive economic impact and long-term value for our investors. We build and manage premium vineyard funds to help our clients reach their financial goals.

invest-wine.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Dreaming of Buying a Vineyard? Lean About New Fractional Vineyard Ownership Hybrid Investment Funds here

News-ID: 1808055 • Views: …

More Releases from Vinito Capital Management

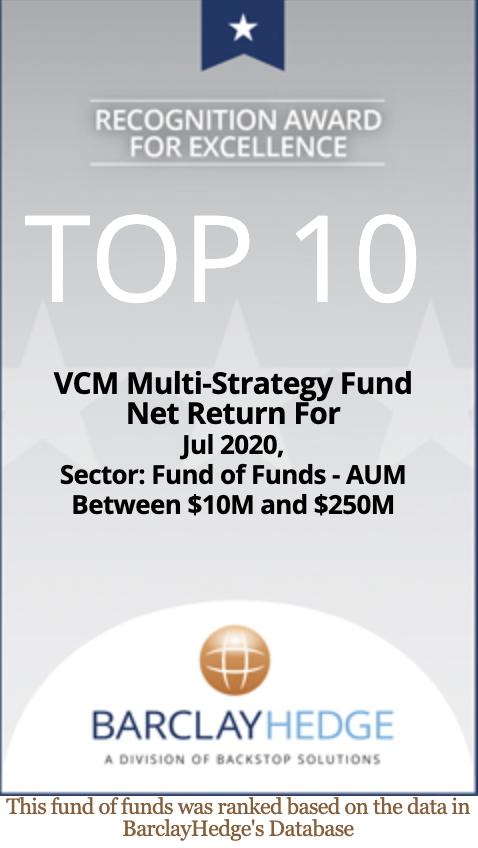

VCM Multi-strategy fund performance wins Top 10 BarclayHedge award

In July, VCM’s Multi-Strategy (MS) Fund performed so well that it ranked among BarclayHedge’s top 10 “Fund of Funds” for the $10M-$250M category. The Barclay Fund of Funds Index is a measure of the average return of all funds in the Barclay database. Ranked number 8, VCM’s MS Fund outperformed the 551 other funds that make up this index.

You don’t have to be good at math to know that ranking…

VCM #1 in Morgan Hedge Fund's top 10 list of alternative hedge funds.

One Glass is Not Enough... but it IS enough to rank us #1 in Morgan Hedge Fund's list of top 10 alternative hedge funds in the last 36 months.

n just three months, from September to November 2019, our One Glass is Not Enough fund moved from #3 to #1 on this list. This ranking shows that our funds are consistently among the best performing high yield alternative investments in the…

Eurekahedge Launches Wine and Vineyard Funds From Vinito Capital Management

Singapore, September 12, 2019 - Alternative asset and fund manager Vinito Capital Management (VCM) has officially launched their highly sought after wine and vineyard funds on the EurekaHedge Platform. VCM is excited about the newly formed partnership with the worlds leading fund sourcing platform Eurekahedge.

Vinito Capital Management equity long/short strategy will aim for returns of 20-35% while attempting to keep volatility between 3-7%. The market neutral strategy will…

Diversifying Self-Directed IRA Investment With Exciting New Offering From VCM

Vinito Capital Management, an online marketplace for direct equity investment in commercial real estate (CRE), specifically vineyard / wineries, launched its latest IRA self directed qualified vineyard funds this month. VCM has spent years building these new offerings focusing on making self directed IRA and 401K investor friendly for investing into exciting vineyard investment funds. These new vineyard investment smart funds offer new options that make it easier for…

More Releases for Vini

Italy Wine Market Expectation Surges with Rising Demand and Changing Trends

Latest publication on 'Italy Wine - Market Assessment and Forecasts to 2025' is added in HTF MI research repository provides in-depth analysis, Competitive scenario, and future market trends and strategies. The market Study is segmented by key a region that is accelerating the marketization. The regional analysis includes countries like Italy and many other countries along with major players profiled such as CAVIRO Soc Coop Agricola, CANTINE RIUNITE & CIV…

Wine and Brandy Market Growth 2020-2025: Constellation Brands, E&J Gallo Winery, …

Wine and Brandy Industry

Description

Wiseguyreports.Com Adds “Wine and Brandy -Market Demand, Growth, Opportunities and Analysis Of Top Key Player Forecast To 2024” To Its Research Database

Wine is a fruit wine made from grapes. Brandy is a distilled wine, with fruit as the raw matieerial, after fermentation, distillation, storage after brewing.

The global Wine and Brandy market is valued at xx million US$ in 2018 and will reach xx million US$ by the…

Wine and Brandy Market Growing Popularity and Emerging Trends | Torres Wines, Pe …

A new business intelligence report released by HTF MI with title "Global Wine and Brandy Market Insights, Forecast to 2025" is designed covering micro level of analysis by manufacturers and key business segments. The Global Wine and Brandy Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative…

Wine Market 2019 by Manufacturers: Treasury Wine Estates, E&J Gallo Winery, Pern …

The research report on the topic of Wine, gives a comprehensive study of various factors of the Wine market. The market report is created and written keeping in consideration various important factors. The reports are written after an in depth market study and analysis. It testifies the constant growth in the Wine market, in spite of the current unsteady market scenario in terms of revenue.

Get PDF Sample copy of…

Global Wine Market outlook to 2023 | Industry Top Key Players – Treasury Wine …

Global Wine Market by Manufacturers, Regions, Type and Application, Forecast to 2023

Wiseguyreports.Com Adds “Wine - Market Demand, Growth, Opportunities, Manufacturers and Analysis of Top Key Players to 2023” To Its Research Database

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (M USD), market share and growth rate of Wine in these regions, from 2012 to 2023 (forecast), covering

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia…

Wine Market 2018 Analysis by Popular Brands : Treasury Wine Estates, E&J Gallo W …

With the slowdown in world economic growth, the Wine industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Wine market size to maintain the average annual growth rate of 4.62% from 11570 million $ in 2014 to 13250 million $ in 2017, Research analysts believe that in the next few years, Wine market size will be further expanded, we expect that…