Press release

Eurekahedge Launches Wine and Vineyard Funds From Vinito Capital Management

Singapore, September 12, 2019 - Alternative asset and fund manager Vinito Capital Management (VCM) has officially launched their highly sought after wine and vineyard funds on the EurekaHedge Platform. VCM is excited about the newly formed partnership with the worlds leading fund sourcing platform Eurekahedge.Vinito Capital Management equity long/short strategy will aim for returns of 20-35% while attempting to keep volatility between 3-7%. The market neutral strategy will attempt to hedge most of the general market risk and volatility (including ones similar to the wild swings as of late) out of the wine and vineyard funds. The new funds expects to raise €50 million by early 2020, with a target of €100 million or more by year end 2020. Capacity of the VCM funds is expected reach €450 million.

Some of the much sought after features of Vinito Capital Management funds include independent tier 1 service provider, transparency, monthly liquidity, no lockups, oversight by an outside risk manager, and a financially strong custodian to protect the assets. One of VCM fund's independent administrators manages €5 billion in funds internationally, and grants trading only access to the investor funds. This is especially beneficial in today's climate.

Vinito Capital Management is a socially responsible, multi-strategy investment and wealth advisory firm created to provide alternative asset management exclusively, in fine French wine and vineyards, for institutional investors, retirement plan sponsors as well as certain qualified individual investors. All VCM funds are open to new investors.

By reinvesting some of the firm's profits into growing wine industry village economies, VCM will help give these once struggling areas the boost they need to grow at an exponential rate. Vinito Capital Management is not only vested in the wine and vineyard markets we work in, but also the geographical and family communities they support.

Vinito Capital Management was formed as a Master Feeder structure Special Purpose Vehicle (SPV) to accommodate U.S., non-U.S. and U.S. tax exempt investors. VCM funds are self directed IRA and 401K qualified, with the help of our U.S. partners Rocketdollar. VCM funds also qualify for the the special England Enterprise Investment Scheme (EIS)

Erick Sabelskjold is the managing partner and chief investment officer of Vinito Capital Management and serves as portfolio manager for the fund.

Using a blend of fundamental and technical analysis, VCM will seek to generate positive absolute returns in rising, falling and volatile, range-bound markets.

"The market deleveraging has left many pricing dislocations within the capital structure, specifically in the less explored area of fine French wine and vineyard investing marketplace. As a result there are multiple opportunities to capitalize on mispriced fine wine and vineyard assets. Much of the global equity, debt, currency and commodity markets still retain valuable relative value and unique opportunities," says Erick Sabelskjold.

Mr. Sabelskjold advises niche groups of wealthy clients representing several hundred million dollars in investment assets spanning equities, commodities, cryptocurrencies, and alternative investments.

VCM has vineyard funds in Italy, France, and Portugal, along with 3 active fine French wine funds with several more launching early 2020.

About Vinito Capital Management

VCM is an award-winning premium provider of online commercial vineyard / winery real estate investment marketplace, technology and professional services. Investors can directly access institutional-quality commercial real estate offerings specific to vineyard and winery investment funds.

Vinito Capital Management maximizes opportunities for investors by diversifying outside of the traditional avenues of the stock market, better distributing risk and fundamentally transforming real estate investing through technology. VCM is creating a community where individual investors and vineyard owners are working together to maximize wealth through commercial real estate. For more information, please visit https://invest-wine.com

This document has been prepared and issued by VCM for the sole purpose of announcing to the public certain matters relating to the activities of VCM, and not for the purpose of soliciting any investment from any person in any jurisdiction.

This document has not been prepared by or issued on behalf of the Fund or the General Partner, does not constitute any offer or solicitation to purchase or subscribe for the interests in the Fund and does not and is not intended to contain the information that may be desirable, necessary or required to properly evaluate a potential investment in the Fund. This document is not intended to be relied upon as the basis for any investment decision. The contents of this document are not to be construed as legal, business or tax advice.

Without limiting the foregoing, this document does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The interests in the Fund referred to above (when and if established), and will not be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration thereunder or an applicable exemption from registration requirements.

In the United Kingdom, the promotion of interests in an unregulated collective investment scheme by an unauthorized person is prohibited by s. 21 of Financial Services and Markets Act 2000. Information relating to the Fund will be provided to investors in the United Kingdom only to the extent that it can be provided lawfully in accordance with the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. It will therefore be communicated only to (a) persons who receive it outside the United Kingdom, (b) investment professionals, and (c) high net worth undertakings.

The information in this document is true and accurate at the time of publication, and subject to change. This document may contain certain forward-looking statements that are based on assumptions and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Assumptions should not be construed to be indicative of the actual events which will occur. Expected terms contained herein are for informational purposes only, are expected terms only and are not intended to be complete and are qualified in their entirety by reference to the Fund's Private Placement Memorandum and Limited Partnership Agreement, which should be reviewed in their entirety prior to making an investment in the Fund. An investment in the Fund may only be made on the basis of the information contained in the Private Placement Memorandum and Limited Partnership Agreement, as and when available.

Vintio Wines LTD

Via Pignatelli Aragona #7,

90141 Palermo PA

Erick Sabelskjold

whatsapp +49 179 742 8448

https://invest-wine.com

Vinito Capital Management is a socially responsible, multi-strategy investment and wealth advisory firm created to provide alternative asset management exclusively, in fine French wine and vineyards, for institutional investors, retirement plan sponsors as well as certain qualified individual investors. All VCM funds are open to new investors.

By reinvesting some of the firm's profits into growing wine industry village economies, VCM will help give these once struggling areas the boost they need to grow at an exponential rate. Vinito Capital Management is not only vested in the wine and vineyard markets we work in, but also the geographical and family communities they support.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Eurekahedge Launches Wine and Vineyard Funds From Vinito Capital Management here

News-ID: 1833886 • Views: …

More Releases from Vinito Capital Management

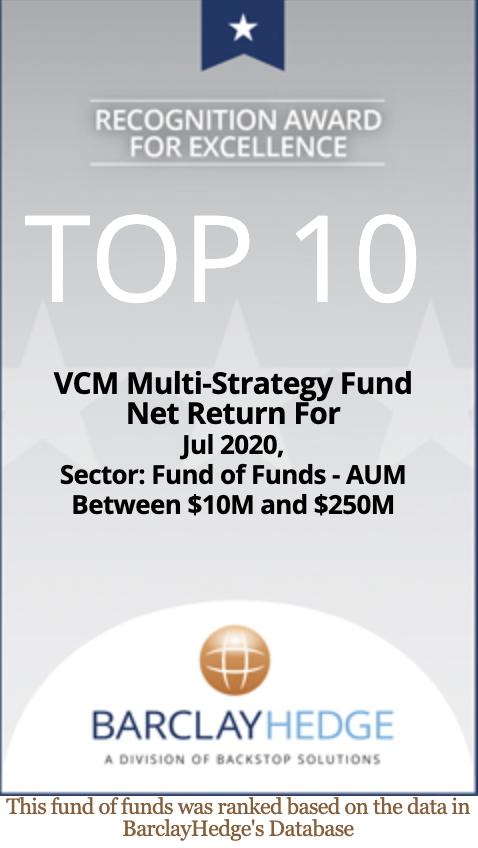

VCM Multi-strategy fund performance wins Top 10 BarclayHedge award

In July, VCM’s Multi-Strategy (MS) Fund performed so well that it ranked among BarclayHedge’s top 10 “Fund of Funds” for the $10M-$250M category. The Barclay Fund of Funds Index is a measure of the average return of all funds in the Barclay database. Ranked number 8, VCM’s MS Fund outperformed the 551 other funds that make up this index.

You don’t have to be good at math to know that ranking…

VCM #1 in Morgan Hedge Fund's top 10 list of alternative hedge funds.

One Glass is Not Enough... but it IS enough to rank us #1 in Morgan Hedge Fund's list of top 10 alternative hedge funds in the last 36 months.

n just three months, from September to November 2019, our One Glass is Not Enough fund moved from #3 to #1 on this list. This ranking shows that our funds are consistently among the best performing high yield alternative investments in the…

Diversifying Self-Directed IRA Investment With Exciting New Offering From VCM

Vinito Capital Management, an online marketplace for direct equity investment in commercial real estate (CRE), specifically vineyard / wineries, launched its latest IRA self directed qualified vineyard funds this month. VCM has spent years building these new offerings focusing on making self directed IRA and 401K investor friendly for investing into exciting vineyard investment funds. These new vineyard investment smart funds offer new options that make it easier for…

Want to Be Like Brad Pitt and Buy A Vineyard? It's Easier and Cheaper Than You T …

Do you think buying a vineyard is just for the Hollywood famous elite?

Well based on this short list of famous vineyard owners most people probably believe vineyard ownership is out of their league.

Mario Andretti

Dan Aykroyd

Gérard Depardieu

Jeff Gordon

Madonna

Arnold Palmer

Nancy Pelosi

Donald Trump

Sting

Well lucky for you… not any more thanks to Vinito Capital Management Vineyard Smart Investment Funds! VCM now gives the opportunity of vineyard ownership to anyone!!

DIVERSIFY YOUR ASSETS BY…

More Releases for VCM

Track Vinyl Chloride Monomer (VCM) Price Index Historical and Forecast

Vinyl Chloride Monomer (VCM) Price Trend and Forecast Report | Global Market Outlook, Regional Analysis, and Procurement Insights

Executive Summary

The global Vinyl Chloride Monomer (VCM) market witnessed significant volatility between Q4 2024 and Q3 2025, shaped by diverging demand cycles, feedstock cost movements, supply-chain constraints, and regional construction activity. While North America maintained relative stability supported by balanced supply and strong PVC production, the Asia-Pacific region experienced pronounced price swings due…

Voice Coil Motor (VCM) Market Report 2025

Global Info Research's report offers key insights into the recent developments in the global Voice Coil Motor (VCM) market that would help strategic decisions. It also provides a complete analysis of the market size, share, and potential growth prospects. Additionally, an overview of recent major trends, technological advancements, and innovations within the market are also included. Our report further provides readers with comprehensive insights and actionable analysis on the…

Vinyl Chloride Monomer (VCM) Market: A Comprehensive Overview

Introduction

Vinyl Chloride Monomer (VCM) is a critical chemical compound primarily used to produce polyvinyl chloride (PVC), one of the most widely used thermoplastic polymers. PVC is essential in numerous applications ranging from pipes, flooring, and packaging materials to electrical cables and medical equipment. The VCM market plays an integral role in the global chemical industry, with demand closely tied to the development of the PVC industry. This guest post will…

Unveiling Lucrative Horizons: Voice Coil Motor (VCM) Market Growth

𝐆𝐫𝐨𝐰𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬, a renowned Market research firm, introduces its latest research report on the Voice Coil Motor (VCM) Market, providing a detailed guide for businesses seeking growth progression. This report is meticulously crafted to aid in investment decisions, offering crucial insights and encouraging strategic investment discretion for new entrants aiming for seamless Market penetration.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐭𝐡𝐞 𝐕𝐨𝐢𝐜𝐞 𝐂𝐨𝐢𝐥 𝐌𝐨𝐭𝐨𝐫 (𝐕𝐂𝐌) 𝐑𝐞𝐩𝐨𝐫𝐭 𝐏𝐃𝐅 𝐟𝐨𝐫 𝐯𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 @ https://growthmarketreports.com/request-sample/5311?utm=Openpr

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬 𝐨𝐟 𝐕𝐨𝐢𝐜𝐞 𝐂𝐨𝐢𝐥…

Voice Coil Motor (VCM) Market Size, Share, Development by 2023

Voice Coil Motor (VCM) is an electronic component that adjusts focus by moving multiple lens holders according to the change in current via magnets and a coil built into the component.

LPI (LP Information)' newest research report, the "Voice Coil Motor (VCM) Industry Forecast" looks at past sales and reviews total world Voice Coil Motor (VCM) sales in 2022, providing a comprehensive analysis by region and market sector of projected Voice…

VCM Multi-strategy fund performance wins Top 10 BarclayHedge award

In July, VCM’s Multi-Strategy (MS) Fund performed so well that it ranked among BarclayHedge’s top 10 “Fund of Funds” for the $10M-$250M category. The Barclay Fund of Funds Index is a measure of the average return of all funds in the Barclay database. Ranked number 8, VCM’s MS Fund outperformed the 551 other funds that make up this index.

You don’t have to be good at math to know that ranking…