Press release

Global payment innovation covered in a new report by yStats.com

“Global Payment Innovation Trends 2019” is a new report published by yStats.com, a leading secondary market research firm based in Hamburg, Germany. Yücel Yelken, CEO & Founder of yStats.com, shares the observation that “technology innovations like Artificial Intelligence, the Internet of Things and blockchain are rapidly transforming the payments industry worldwide”.AI and IoT disrupt the global payments industry

The integration of virtual voice assistants like Alexa, Google Assistant and Siri into billions of consumer electronic devices has led to the emergence of a new form of AI-powered payments using voice command. Voice-activated payments are projected to see rapid growth between 2019 and 2023, according to a forecast included in the yStats.com report. In addition, a double-digit share of respondents to a recent survey were interested in paying via a connected car or a smart fridge, indicating that IoT payments will soon become more commonplace.

Biometric payments gaining traction, while cryptocurrency payments are yet to rise

The biometrics feature of consumer smartphones, like fingerprint or iris scan, is increasingly used in mobile payments to confirm transactions made with mobile wallets like Apple Pay, Google Pay and others. As a result, biometric payments are projected to increase at a rapid double-digit growth rate over the next five years, according to a forecast cited by yStats.com. Another innovative payment method, cryptocurrency, has not yet gained much popularity as both consumers and merchants are wary of the high volatility of Bitcoin and similar virtual currencies. Nevertheless, more merchants are starting to accept this mean and a small double-digit share of connected shoppers show interest in using it.

For further information, see: https://www.ystats.com/wp-content/uploads/2019/07/2019.07.17_Product-Brochure-Order-Form_Global-Online-Payment-Innovation-Trends-2019.pdf

Press Contact:

yStats.com GmbH & Co. KG

Behringstrasse 28a, D-22765 Hamburg

Phone: +49 (0)40 - 39 90 68 50

Fax: +49 (0)40 - 39 90 68 51

E-Mail: press@ystats.com

Internet: www.ystats.com

Twitter: www.twitter.com/ystats

LinkedIn: www.linkedin.com/company/ystats

Facebook: www.facebook.com/ystats

“Global Payment Innovation Trends 2019” is a new report published by yStats.com, a leading secondary market research firm based in Hamburg, Germany. Yücel Yelken, CEO & Founder of yStats.com, shares the observation that “technology innovations like Artificial Intelligence, the Internet of Things and blockchain are rapidly transforming the payments industry worldwide”.

AI and IoT disrupt the global payments industry

The integration of virtual voice assistants like Alexa, Google Assistant and Siri into billions of consumer electronic devices has led to the emergence of a new form of AI-powered payments using voice command. Voice-activated payments are projected to see rapid growth between 2019 and 2023, according to a forecast included in the yStats.com report. In addition, a double-digit share of respondents to a recent survey were interested in paying via a connected car or a smart fridge, indicating that IoT payments will soon become more commonplace.

Biometric payments gaining traction, while cryptocurrency payments are yet to rise

The biometrics feature of consumer smartphones, like fingerprint or iris scan, is increasingly used in mobile payments to confirm transactions made with mobile wallets like Apple Pay, Google Pay and others. As a result, biometric payments are projected to increase at a rapid double-digit growth rate over the next five years, according to a forecast cited by yStats.com. Another innovative payment method, cryptocurrency, has not yet gained much popularity as both consumers and merchants are wary of the high volatility of Bitcoin and similar virtual currencies. Nevertheless, more merchants are starting to accept this mean and a small double-digit share of connected shoppers show interest in using it.

For further information, see: https://www.ystats.com/wp-content/uploads/2019/07/2019.07.17_Product-Brochure-Order-Form_Global-Online-Payment-Innovation-Trends-2019.pdf

Press Contact:

yStats.com GmbH & Co. KG

Behringstrasse 28a, D-22765 Hamburg

Phone: +49 (0)40 - 39 90 68 50

Fax: +49 (0)40 - 39 90 68 51

E-Mail: press@ystats.com

Internet: www.ystats.com

Twitter: www.twitter.com/ystats

LinkedIn: www.linkedin.com/company/ystats

Facebook: www.facebook.com/ystats

About yStats.com

Founded in 2005 and headquartered in Hamburg, Germany, yStats.com is one of the world's leading secondary market research companies. We are committed to providing the most up-to-date and objective data on Global B2C E-Commerce and Online Payment markets to sector-leading companies worldwide.

Our multilingual staff researches, gathers, filters and translates information from thousands of reputable sources to synthesize accurate and timely reports in our areas of expertise, covering more than 100 countries and all global regions. Our market reports focus predominantly on online retail and payments, but also cover a broad range of related topics including M-Commerce, Cross-Border E-Commerce, E-Commerce Delivery, Online Gaming and many others. In addition to our wide selection of market reports, we also provide custom market research services.

We are proud to cooperate with companies like Bloomberg and Thomson Reuters. Given our numerous citations in leading media sources and journals worldwide, including Forbes and the Wall Street Journal, we are considered one of the most highly-reputed international secondary market research companies with an expertise in the areas of B2C E-Commerce and Online Payment.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global payment innovation covered in a new report by yStats.com here

News-ID: 1807517 • Views: …

More Releases from yStats.com GmbH & Co. KG

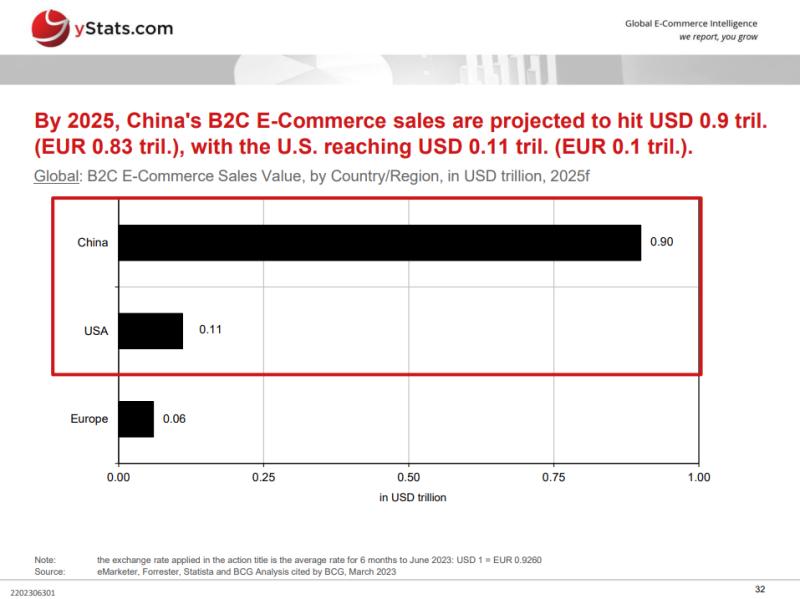

The global B2C E-Commerce market is expected to double from 2022 to 2025: New re …

[Hamburg, Germany - September 14, 2023] - The latest release from Hamburg-based market research company yStats.com, titled "Global B2C E-Commerce Market 2023," provides an overview of global trends in the B2C E-Commerce market and insights into the growth potential of various markets through key figures, forecasts, and trends.

B2C E-Commerce market initially experiences strong growth followed by a moderate growth outlook.

While the world witnessed a boom in online shopping during the…

B2C E-Commerce sales in Eastern Europe projected to rise in 2019, reports yStats …

yStats.com, Hamburg-based desk research firm specialized in E-Commerce & Online Payment market intelligence, has released a new publication: “Eastern Europe B2C E-Commerce Market 2019”. According to this report’s findings, online retail sales in the countries of Eastern Europe are expected to maintain double-digit growth in 2019.

More consumers in Eastern Europe shop online

Online shopper penetration is on the rise across Eastern Europe, but remains behind that of Western Europe. In the…

New report from yStats.com suggests continued expansion of online retail in Viet …

A recent publication from Hamburg-based business intelligence company yStats.com, “Vietnam B2C E-Commerce Market 2019,” projects continued strong growth of the online retail sector in the Southeast Asia nation through the middle of the next decade. Factors contributing to the growth include the entry of regional and global online merchants in Vietnam, plus the growing Internet connectivity through mobile phones.

Online retail sales year on year to increase at a double-digit…

Online retail sales in Thailand projected to continue strong growth: yStats.com …

The latest publication from Hamburg-based research firm yStats.com, “Thailand B2C E-Commerce Market 2019,” reveals the expectation of continued year-to-year online retail sales increases. Thailand’s mobile and social shopping trends make it one of the leaders in the region in total web-base sales.

Internet connection increase and social media shopping result in more online shoppers

Thailand’s constant rate of growth of internet connectivity and the growing comfort of connected individuals in making purchases…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…