Press release

Installment Payment Solutions (Merchant Services) Market 2019 Industry Players (Sap SE, Universum, AsiaPay Limited, Elavon, Afterpay Touch Group, Global Payment Direct Inc., Splitit, Affirm Inc., PayPal Credit) |Demand Insights 2026

The Global Installment Payment Solutions (Merchant Services) Market was estimated to be valued at USD XX million in 2019 and is projected to reach USD XX million by 2026, at a CAGR of XX% during 2019 to 2026. The global Installment Payment Solutions (Merchant Services) market is primarily segmented based on different deployment, end-user, and regions.Get Sample Copy of this Report @ https://www.orianresearch.com/request-sample/1112107

Surge in focus on customer retaining and middleman elimination is driving market globally. Lack of awareness about installment payment solutions and government regulations are factors hindering market growth.

The key players profiled in the market include:

• Payfort International FZ LLC, Sap SE, Universum, AsiaPay Limited, Elavon, Afterpay Touch Group, Global Payment Direct Inc., Splitit, Affirm Inc. and PayPal Credit

On the basis of types, the market is split into:

• E-Commerce Merchant

• Brick & Mortar Merchant

On the basis of applications, the market is split into:

• Small & Medium Enterprises

• Large Enterprises

These enterprises are focusing on growth strategies, such as new product launches, expansions, acquisitions, and agreements & partnerships to expand their operations across the globe.

Global Installment Payment Solutions (Merchant Services) Market is spread across 121 pages

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/1112107

Key Benefits of the Report:

• Global, regional, country, product type, and application market size and their forecast from 2014-2025

• Identification and detailed analysis on key market dynamics, such as, drivers, restraints, opportunities, and challenges influencing growth of the market

• Detailed analysis on industry outlook with market specific Porter’s Five Forces analysis, PESTLE analysis, and Value Chain, to better understand the market and build expansion strategies

• Identification of key market players and comprehensively analyze their market share and core competencies, detailed financial positions, key products, and unique selling points

• Analysis on key player’s strategic initiatives and competitive developments, such as joint ventures, mergers, and new product launches in the market

• Expert interviews and their insights on market shift, current and future outlook, and factors impacting vendors short term and long term strategies

• Detailed insights on emerging regions, product types, applications with qualitative and quantitative information and facts

• Identification of the key patents filed in the field of Installment Payment Solutions (Merchant Services)

Target Audience:

• Installment Payment Solutions (Merchant Services) Providers

• Research and Consulting Firms

• Government and Research Organizations

• Associations and Industry Bodies

Order a Copy of this Report @ https://www.orianresearch.com/checkout/1112107

Table Of Content:

1. Executive Summary

2. Methodology and Scope

3. Global Installment Payment Solutions (Merchant Services) Market — Market Overview

4. Installment Payment Solutions (Merchant Services) Market by Merchant Type Outlook

5. Installment Payment Solutions (Merchant Services) Market by Application Outlook

6. Installment Payment Solutions (Merchant Services) Market Regional Outlook

7. Competitive Landscape

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: www.linkedin.com/company-beta/13281002/

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Installment Payment Solutions (Merchant Services) Market 2019 Industry Players (Sap SE, Universum, AsiaPay Limited, Elavon, Afterpay Touch Group, Global Payment Direct Inc., Splitit, Affirm Inc., PayPal Credit) |Demand Insights 2026 here

News-ID: 1790141 • Views: …

More Releases from Orian Research

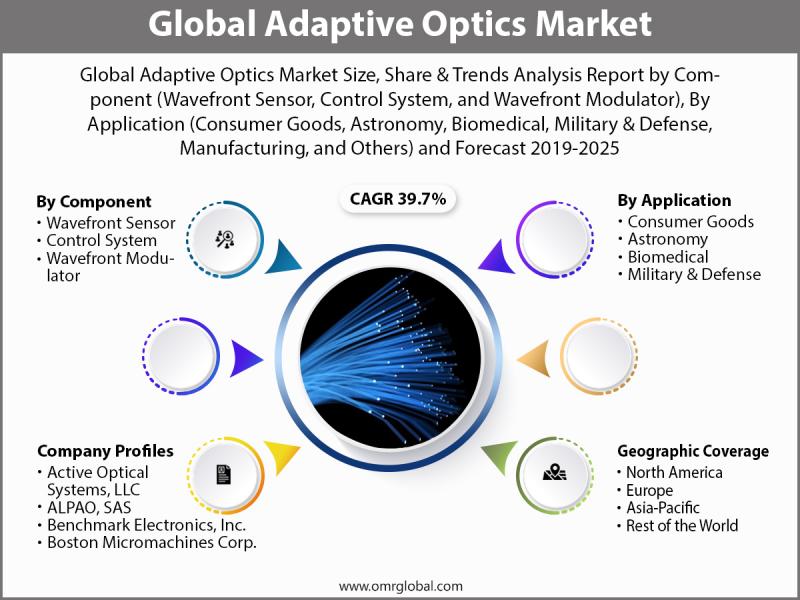

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

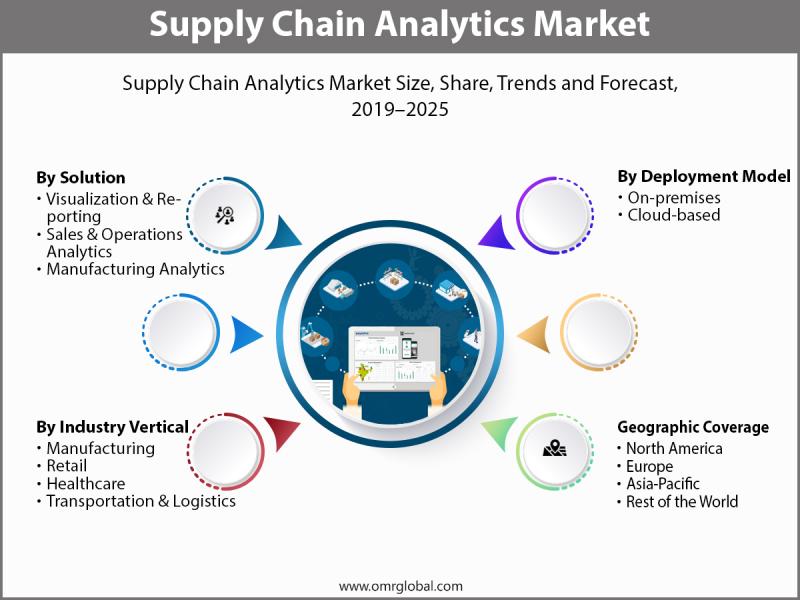

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

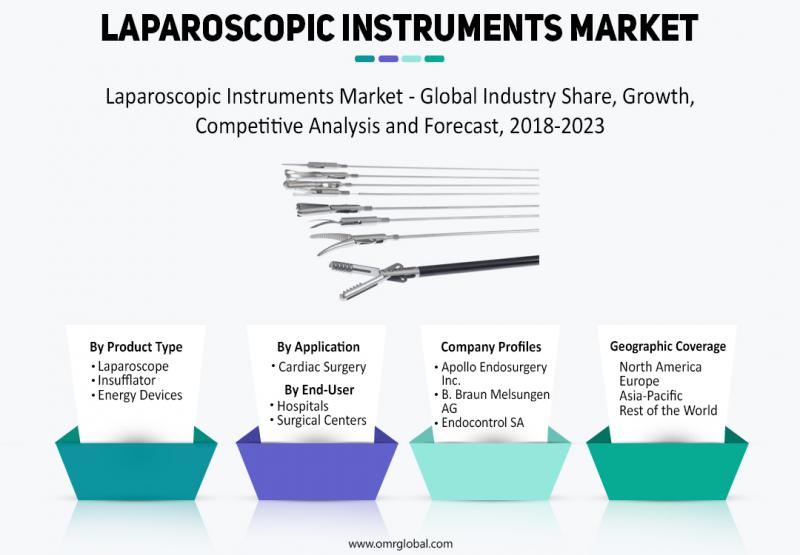

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Merchant

Easy Merchant Funds Empowers Small Businesses with Fast and Flexible Merchant Ca …

In today's fast-paced business environment, access to quick and dependable funding can mean the difference between growth and stagnation. Easy Merchant Funds proudly announces its commitment to supporting small and medium-sized businesses through its streamlined merchant cash advance solutions, designed to deliver the capital entrepreneurs need - when they need it most.

Revolutionizing Business Financing

Traditional loans often involve lengthy applications, strict requirements, and slow approval times - challenges that small business…

Emerging Merchant Acquiring Market Trend 2025-2034: Strategic Alliance Enhances …

How Is the Merchant Acquiring Market Projected to Grow, and What Is Its Market Size?

The size of the merchant acquiring market has seen a swift expansion in the past few years. The market size is projected to increase from $25.43 billion in 2024 to $28.2 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 10.9%. The substantial growth in the historical period is due to factors such as…

Merchant Services Market May Set New Growth Story: PayPal, Chase Payment solutio …

The capacity of the merchant services industry to respond to the quickly shifting payment environment has been a major growth driver over the past few years. The fast surge of digitization across sectors, which has boosted the use of non-cash payments internationally, has led to an increase in merchant acquirer multiples. The adoption of integrated payments, value-added services, mobile digital transactions, and eCommerce are some more important growth drivers for…

Merchant Acquiring Market Outlook 2021 | Covid19 Impact Analysis | Growth by Top …

Merchant Acquiring Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Merchant Acquiring market across the globe, including valuable facts and figures. Merchant Acquiring Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends.

The report provides a comprehensive overview including Definitions, Scope, Application, Production and CAGR (%)…

Merchant account solutions

Acqualtscards As a favorable self-ruling Pro independent association of portion courses of appropriate action, we mutually support you at every independent movement of your business development.Since its private foundation, Acqualtscards has substantiated itself and to its potential clients to be one of the fundamental worldwide providers of re-appropriating and white imprint answers for electronic portion trades.

Acqualtscards offers Credit cards processing for Online business around the globe, including those for retailers/maker…

Prepared Food Wholesaler Receives Large $200,000 Merchant Cash Advance from Indu …

Merchant Cash and Capital, LLC www.merchantcashandcapital.com, a recognized leader in the merchant cash advance industry, recently advanced $200,000 to a wholesaler of prepared foods located on the west coast. Despite a series of past credit issues, MCC, upon careful research and working individually with the owner, found the business viable and made the merchant cash advance happen.

The business has operated for 24 years, although it did file (and emerge…