Press release

P2P Payment Market To Witness Astonishing Growth With Key Players|PayPal, Tencent, Square

A latest survey on Global P2P Payment Market is conducted covering various organizations of the industry from different geographies to come up with 100+ page report. The study is a perfect mix of qualitative and quantitative information highlighting key market developments, challenges that industry and competition is facing along with gap analysis and new opportunity available and may trend in P2P Payment market. The report bridges the historical data from 2013 to 2018 and forecasted till 2025*. Some are the key & emerging players that are part of coverage and have being profiled are PayPal Pte. Ltd., Tencent., Square, Inc., Circle Internet Financial Limited, SnapCash, Dwolla, Inc., TransferWise Ltd., CurrencyFair LTD & One97 Communications Ltd..Click to get Global P2P Payment Market Research Sample PDF Copy Here @: https://www.htfmarketreport.com/sample-report/1916192-global-p2p-payment-market-2

Analyst at HTF MI have classified and compiled the research data for both perspective i.e. Qualitative and Quantitative.

Quantitative Data:

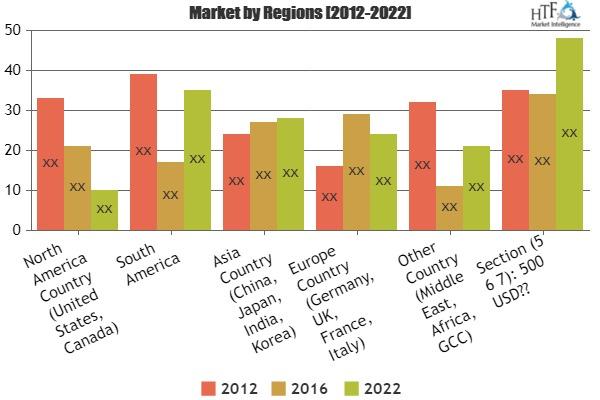

Market Data breakdown by key geographies, Type & Application/End-users

• P2P Payment Market Revenue & Growth Rate by Type [, NFC/Smartcard, SMS, Mobile Apps, Industry Segmentation, Retail Payments, Travels & Hospitality Payments, Transportation & Logistics Payments, Energy & Utilities Payments, Channel (Direct Sales, Distributor) Segmentation, Section 8: 400 USD Trend (2018-2023), Section 9: 300 USD Product Type Detail, Section 10: 700 USD Downstream Consumer, Section 11: 200 USD Cost Structure & Section 12: 500 USD Conclusion] (Historical & Forecast)

• P2P Payment Market Revenue & Growth Rate by Application (Historical & Forecast)

• P2P Payment Market Revenue & Growth Rate by Each Region Specified (Historical & Forecast)

• P2P Payment Market Volume & Growth Rate by Each Region Specified, Application & Type (Historical & Forecast)

• P2P Payment Market Revenue, Volume & Y-O-Y Growth Rate by Players (Base Year)

Qualitative Data:

It would include chapter’s specific to market dynamics and the influencing factors affecting or driving the growth of the market. To list few names of sections involved are

• Industry Overview

• Global P2P PaymentMarket Growth Drivers

• Global P2P PaymentMarket Trend

• Restraints

• Opportunities in P2P Payment Market

• Market Entropy** [Special Designed to highlight Market Aggressiveness]

• PESTEL Analysis

• Porters Five Forces Model

• Patent & Trademark Analysis** [Licenses & Approvals by Players & Duration of Market Life Cycle]

• Competitive Landscape (SWOT Analysis by Players/Manufacturers)

• P2P Payment Market Development and Insights etc. [Covers Product/Service Launch, Innovation etc]

• Investment & Project Feasibility Study**

• Regulatory Framework

** May vary depending upon availability and feasibility of data with respect to Industry targeted

Detailed competitive landscape is Covered to highlight important parameters that players are gaining along with the product/service evolution

• % Market Share, Revenue for each profiled company [PayPal Pte. Ltd., Tencent., Square, Inc., Circle Internet Financial Limited, SnapCash, Dwolla, Inc., TransferWise Ltd., CurrencyFair LTD & One97 Communications Ltd.]

• Consumption, Capacity & Production by Players

• Business overview and Product/Service classification

• Swot Analysis

• Product/Service Landscape [Product/Service Mix with a comparative analysis]

• Recent Developments (Technology, Expansion, Manufacturing, R&D, Product Launch etc)

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1916192-global-p2p-payment-market-2

Important Features that are under offering & key highlights of the P2P Payment market report:

1) What Market data breakdown/segmentation does basic version of this report covers in addition to players?

Global P2P Payment Product Types In-Depth: , NFC/Smartcard, SMS, Mobile Apps, Industry Segmentation, Retail Payments, Travels & Hospitality Payments, Transportation & Logistics Payments, Energy & Utilities Payments, Channel (Direct Sales, Distributor) Segmentation, Section 8: 400 USD Trend (2018-2023), Section 9: 300 USD Product Type Detail, Section 10: 700 USD Downstream Consumer, Section 11: 200 USD Cost Structure & Section 12: 500 USD Conclusion

Global P2P Payment Major Applications/End users:

Geographical Analysis: North America Country (United States, Canada), South America, Asia Country (China, Japan, India, Korea), Europe Country (Germany, UK, France, Italy), Other Country (Middle East, Africa, GCC) & Section (5 6 7): 500 USD

2) What all companies are currently profiled in the report?

Following are list of players that are currently profiled in the the report "PayPal Pte. Ltd., Tencent., Square, Inc., Circle Internet Financial Limited, SnapCash, Dwolla, Inc., TransferWise Ltd., CurrencyFair LTD & One97 Communications Ltd."

** List of companies mentioned may vary in the final report subject to Name Change / Merger etc.

3) Can we add or profiled new company as per our need?

Yes, we can add or profile new company as per client need in the report. Final confirmation to be provided by research team depending upon the difficulty of survey.

** Data availability will be confirmed by research in case of privately held company. Upto 3 players can be added at no added cost.

Buy Full Copy Global P2P Payment Report 2018 @ https://www.htfmarketreport.com/buy-now?format=1&report=1916192

4) What all regional segmentation covered? Can specific country of interest be added?

Currently, research report gives special attention and focus on following regions:

North America Country (United States, Canada), South America, Asia Country (China, Japan, India, Korea), Europe Country (Germany, UK, France, Italy), Other Country (Middle East, Africa, GCC) & Section (5 6 7): 500 USD

** One country of specific interest can be included at no added cost. For inclusion of more regional segment quote may vary.

5) Can inclusion of additional Segmentation / Market breakdown is possible?

Yes, inclusion of additional segmentation / Market breakdown is possible subject to data availability and difficulty of survey. However a detailed requirement needs to be shared with our research before giving final confirmation to client.

** Depending upon the requirement the deliverable time and quote will vary.

To comprehend Global P2P Payment market dynamics in the world mainly, the worldwide P2P Payment market is analyzed across major global regions. HTF MI also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, and Brazil.

• Middle East & Africa: Saudi Arabia, UAE, Turkey, Egypt and South Africa.

• Europe: UK, France, Italy, Germany, Spain, and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Singapore, and Australia.

Browse for Full Report at @: https://www.htfmarketreport.com/reports/1916192-global-p2p-payment-market-2

Actual Numbers & In-Depth Analysis, Business opportunities, Market Size Estimation Available in Full Report.

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at

https://www.linkedin.com/company/13388569/

https://www.facebook.com/htfmarketintelligence/

https://twitter.com/htfmarketreport

https://plus.google.com/u/0/+NidhiBhawsar-SEO_Expert?rel=author

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release P2P Payment Market To Witness Astonishing Growth With Key Players|PayPal, Tencent, Square here

News-ID: 1773625 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Heating Coil for Heat Treatment Market to See Revolutionary Growth: Watlow, Chro …

HTF MI just released the Global Heating Coil for Heat Treatment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Watlow, Chromalox, NIBE Induction,…

CAD-CAM Dental Systems Market to Witness Phenomenal Growth |Medit, 3Shape, Planm …

HTF MI just released the Global CAD-CAM Dental Systems Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Dentsply Sirona, Straumann, 3Shape, Ivoclar Vivadent,…

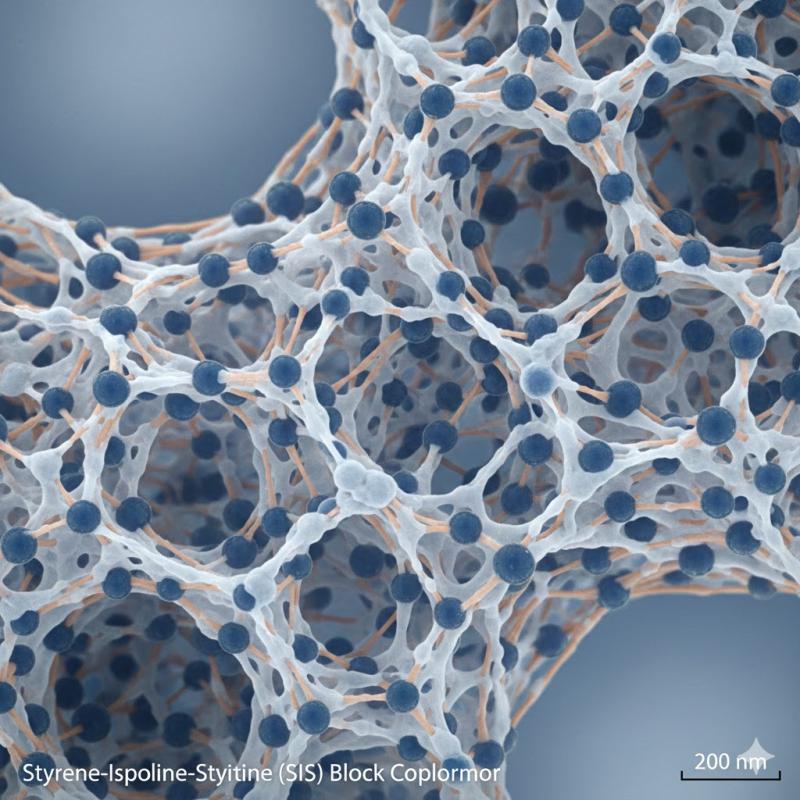

Styrene-Isoprene-Styrene (SIS) Market is Booming Worldwide | Major Giants Arlanx …

HTF MI just released the Global Styrene-Isoprene-Styrene (SIS) Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Kraton Polymers, Sinopec, LCY Chemical, TSRC, Zeon…

Smokeless Gunpowder Market Is Going to Boom | Major Giants Hodgdon, Alliant Powd …

HTF MI just released the Global Smokeless Gunpowder Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Smokeless Gunpowder Market are:

Hodgdon, Alliant Powder, IMR…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…