Press release

Big boom by Tax Management System Market 2019 with an impressive double-digit growth rate by 2023 | Top International Players - Avalara, Wolters Kluwer, Longview, TaxSlayer, TaxJar

This report provides in depth study of “Tax Management System Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Tax Management System Market report also provides an in-depth survey of key players in the market organization.Global Tax Management System Market Synopsis:

The Global “Tax Management System Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 90 Pages, figures, graphs and table of contents to analyze the situations of global Tax Management System Market and Assessment to 2023.

Get Sample Study Papers of “Global Tax Management System Market” @ https://www.businessindustryreports.com/sample-request/159440 .

This report studies the Global Tax Management System Market over the forecast period of 2019 to 2023. The Global Tax Management System Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2019 to 2023.

While studying the worldwide markets for Tax Management System industry, The report also provides details analysis of the market drivers, trends and restraints to showcase the current and future market scenario. The markets are expected to show significant growth during the forecasted period due to an increasing demand for the Tax Management System.

According to the Report, Technological inventions in electronic equipment have increased at a fast pace. Tax management systems are one such innovation that play a vital role in banking, government, telecom, retail, etc.

Avalara, Inc. a leading provider of tax compliance automation software for businesses of all sizes announced a strategic partnership agreement between Avalara MyLodgeTax, the company’s tax compliance software division for the lodging industry, and the Vacation Rental Management Association (VRMA), a provider of best-in-class education, networking, and professional development opportunities for vacation property rental companies and vacation property rental owners.

Avalara helps businesses of all sizes get tax compliance right. In partnership with leading ERP, accounting, ecommerce, and other financial management system providers, Avalara delivers cloud-based compliance solutions for various transaction taxes, including sales and use, VAT, excise, communications, and other indirect tax types.

Tax Management System Market Covers the Table of Contents With Segments, Key Players And Region. Based on Product Type, Tax Management System Market is sub segmented into Cloud-based and On-premise. On the Basis of Application, Market is sub segmented into Personal Use and Commercial Use.

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/159440 .

Major Players profiled in the Tax Management System Market report incorporate: Avalara, Wolters Kluwer, Longview, TaxSlayer, TaxJar, Xero, Intuit, Thomson Reuters, H&R Block, Drake Software, SOVOS, Canopy, TaxACT, Outright, Shoeboxed, Rethink Solutions, ClearTAX, WEBTEL, Inspur, Seapower

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Tax Management System in these regions, from 2014 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Significant points in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

Report contents include

1 Analysis of the Tax Management System Market including revenues, future growth, market outlook

2 Historical data and forecast

3 Regional analysis including growth estimates

4 Analyzes the end user markets including growth estimates.

5 Profiles on Tax Management System including products, sales/revenues, and market position

6 Market structure, market drivers and restraints.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Big boom by Tax Management System Market 2019 with an impressive double-digit growth rate by 2023 | Top International Players - Avalara, Wolters Kluwer, Longview, TaxSlayer, TaxJar here

News-ID: 1754387 • Views: …

More Releases from Business Industry Reports

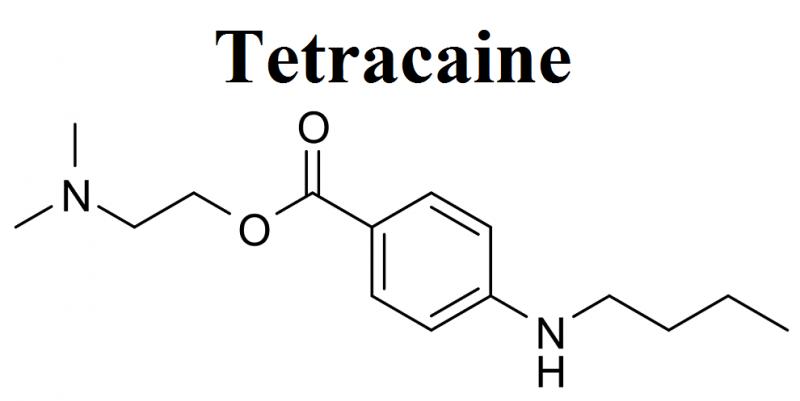

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

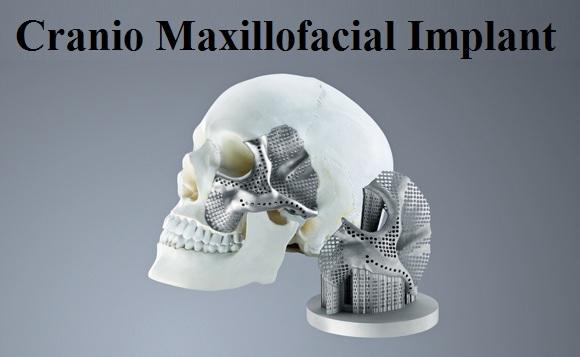

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…