Press release

Market Segmentation, Size And Industry Analysis In Lending And Payments Market

The lending and payments market consists of sales of lending and payments services by entities (organizations, sole traders and partnerships) that engage in lending and payments related activities such as lending, payments and money transfer services. The lending and payments industry is categorized on the basis of the business model of the firms present in the industry. Some firms offering lending services may offer other services, financial or otherwise. Revenues from lending and payments services include interest on loans, margins or commissions charged on transactions, and not the loan or repayment values themselves.View Complete Report:

https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report

The lending and payments market size is expected to reach $9 trillion by 2022, significantly growing at a CAGR of around 7% during the forecast period. The growth in the lending and payments market is due to recent legislations in Europe and China which limit the fees charged on card-based payments and increasing demand for loans in developing countries such as Brazil, Russia, India and China (BRIC).

However, the market for lending and payments is expected to face certain restraints from several factors such as interest rate increases, workforce issues.

Lending And Payments Market Trends - Growing adoption of europay, MasterCard, and visa (EMV) technology, strong growth potential for near-field communication (NFC) based mobile payments are the major trends witnessed in the global lending and payments market.

Lending And Payments Market Potential Opportunities - With increase in positive economic outlook, government policies, the scope and potential for the global market is expected to significantly rise in the forecast period.

Request a Sample of This Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=1886&type=smp

Table Of Content

1. Executive Summary

2. Report Structure

3. Lending And Payments Market Characteristics

4. Lending And Payments Market Product Analysis

5. Lending And Payments Market Supply Chain

6. Lending And Payments Market Customer Information

7. Lending And Payments Market Trends And Strategies

8. Lending And Payments Market Size And Growth

9. Lending And Payments Market Regional Analysis

10. Lending And Payments Market Segmentation

12. Lending And Payments Market Metrics

13. Asia-Pacific Lending And Payments Market

14. Western Europe Lending And Payments Market

15. Eastern Europe Lending And Payments Market

16. North America Lending And Payments Market

17. South America Lending And Payments Market

18. Middle East Lending And Payments Market

19. Africa Lending And Payments Market

20. Lending And Payments Market Competitive Landscape

21. Key Mergers And Acquisitions In The Lending And Payments Market

22. Market Background: Financial Services Market

23. Recommendations

24. Appendix

25. Copyright And Disclaimer

Avail the Discount provided on this report@ https://www.thebusinessresearchcompany.com/sample.aspx?id=1886&type=discount

About The Business Research Company:

The Business Research Company is a Business Intelligence Company which excels in company, market and consumer research. It has offices in the UK, the US and India and a network of trained researchers in 15 countries globally.

Contact Information

The Business Research Company

https://www.thebusinessresearchcompany.com

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on LinkedIn: https://in.linkedin.com/company/the-business-research-company

Follow us on Twitter: https://twitter.com/tbrc_Info

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Market Segmentation, Size And Industry Analysis In Lending And Payments Market here

News-ID: 1701333 • Views: …

More Releases from The Business Research Company

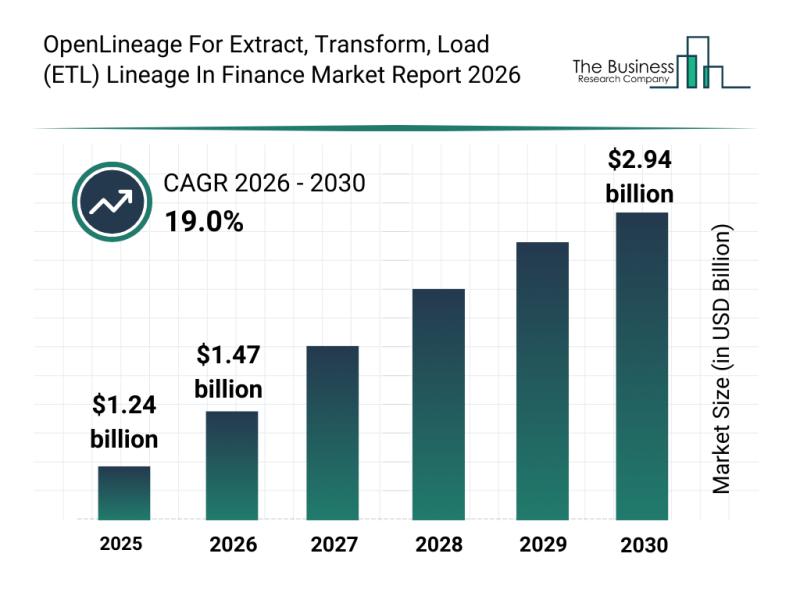

Future Perspectives: Key Trends Shaping the OpenLineage for Extract, Transform, …

The finance sector is increasingly relying on advanced data management technologies to improve transparency and compliance. One such technology, OpenLineage for Extract, Transform, Load (ETL) lineage, is gaining significant traction as it helps financial institutions track and manage the flow of data through complex pipelines. This report explores the expected growth, key players, trends, and market segments shaping the future of the OpenLineage ETL lineage market in finance.

Projected Expansion of…

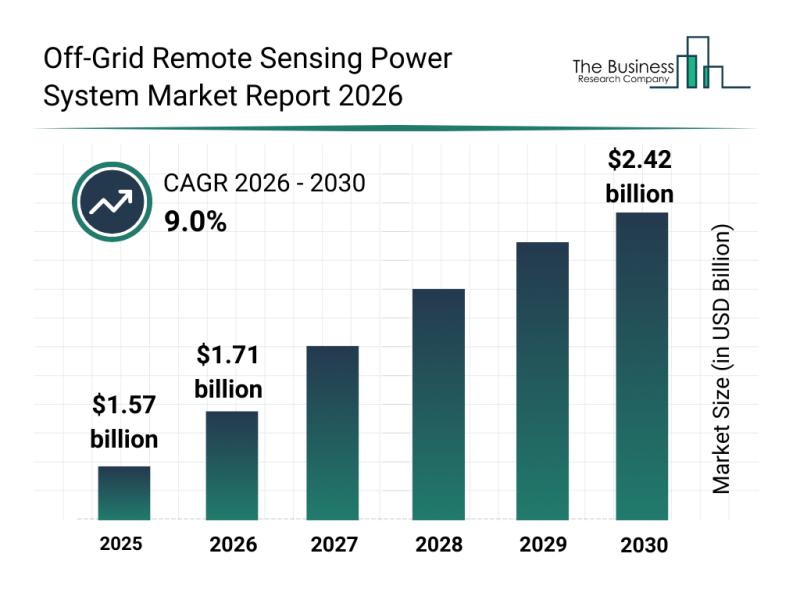

Analysis of Key Market Segments Influencing the Off-Grid Remote Sensing Power Sy …

The off-grid remote sensing power system industry is poised for significant growth as technological advancements and expanding applications drive demand. With increasing needs for reliable, autonomous power in remote locations, this market is attracting innovations and investments that promise to transform how off-grid sensing operates worldwide.

Projected Market Size and Growth Trajectory of the Off-Grid Remote Sensing Power System Market

The market for off-grid remote sensing power systems is forecasted…

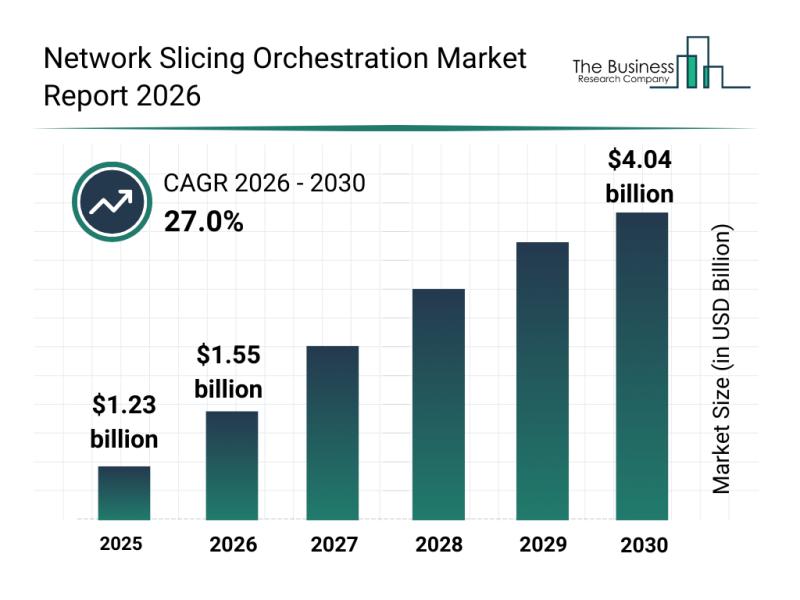

Global Trends Overview: The Rapid Development of the Network Slicing Orchestrati …

The network slicing orchestration market is positioned for remarkable expansion over the coming years, driven by rapid advancements in telecommunications and evolving enterprise demands. As technologies like 5G and edge computing become more widespread, the market is set to transform how networks are managed and optimized, enabling more flexible and efficient connectivity solutions.

Projected Market Size and Growth Trajectory for Network Slicing Orchestration

The network slicing orchestration market is anticipated…

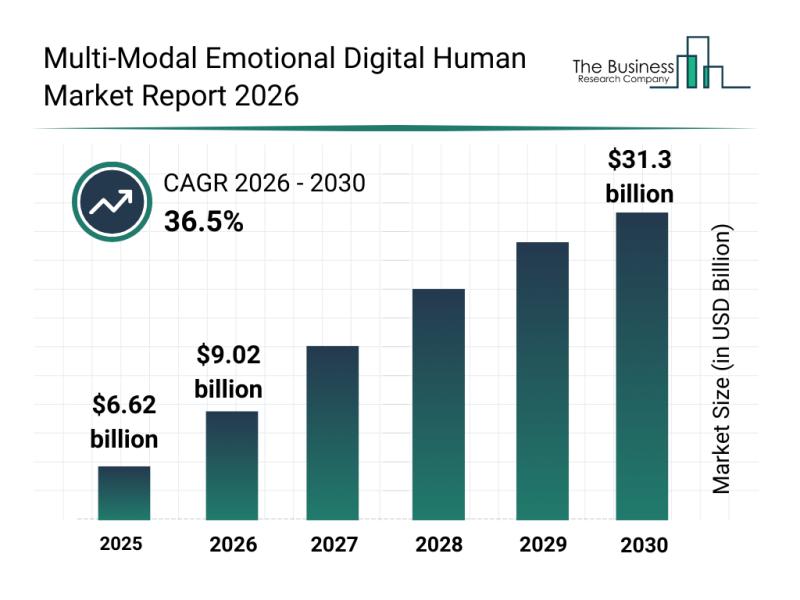

Segmentation, Major Trends, and Competitive Overview of the Multi-Modal Emotiona …

The multi-modal emotional digital human market is poised for remarkable expansion, transforming how digital entities interact with human emotions across various sectors. This emerging field combines advanced AI technologies and emotional intelligence to create digital humans capable of nuanced, empathetic interactions. Let's explore the market's growth outlook, key players, technological trends, and segment classifications shaping this evolving industry.

Projected Growth and Market Value of the Multi-Modal Emotional Digital Human Market …

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…