Press release

Polish Private Label Market Grows In Crisis

The value of the Polish private label market jumped by 29% in 2009, according to estimates presented in “Private label in Poland 2010”, a new report from PMR. The high rate of market growth was a consequence of buoyant sales at hypermarkets and discount stores, which surged by 34% and 31%, respectively.The robust growth in the value of the Polish private label market in 2009 was no doubt helped by the economic downturn, which forced cash-strapped Polish consumers to look for bargains. “With price remaining the key determining factor, private label products – typically more attractive pricewise compared with their branded counterparts – fit in well with this need for more rational spending”, Patrycja Nalepa, Senior Retail Analyst at PMR, says.

In response, retailers are expanding their private-label offerings by introducing new labels, new products and new categories. They are also optimising product ranges by withdrawing slow-moving items and replacing them with new ones. Furthermore, new retailers are joining the private label bandwagon, most recently Piotr i Pawel or Zabka.

“More and more retailers are now able to offer their customers private label products at two or more price and quality points. Private labels in Poland are no longer synonymous with the cheapest items in simple packaging. More and more products are positioned in the middle price segment, providing a price-competitive alternative to branded products while offering comparable quality. In most cases such “value-for-money” items are 20-40% cheaper than their branded counterparts”, Patrycja Nalepa explains.

Retail chains which have expanded their private-label ranges during the past year include Tesco, Real, Auchan and Intermarche. According to PMR estimates, Tesco was the main engine of private label sales in Poland’s hypermarket sector in 2009. The UK retailer launched 50 new labels covering 1,000 products sold at discount prices last year. The new offering, introduced in response to greater demand for low-priced items during the economic downturn, is designed to enable Tesco to compete more effectively with discounters, particularly Biedronka.

Two other major contributors to the segment growth in 2009 were Real and Auchan, which last year focused mainly on developing their corporate private label brands launched in 2008, i.e. Real Quality and Auchan. Kaufland, which derives a bigger share of its revenues from private labels than any other hypermarket chain in Poland, enjoyed a strong increase in sales in 2009, also helping drive the overall market result.

The strong growth in private label sales in Poland is also being fuelled by a fast-expanding network of discount stores, where private label products account for over 60% of aggregate sales, more than in any other store format. In 2009 a total of 230 new discount stores were opened in the country, up from 178 in 2008. At the forefront of this expansion is Biedronka, which is adding 100-150 new stores a year. But quite apart from new store-openings, sales growth in this segment is also a result of rising popularity of the format itself, which translates into higher customer traffic at existing stores. Also, discount retailers, with their reputation for low prices, have benefited from the economic downturn, which forced more consumers to seek ways to save money.

“We forecast that the Polish private label market will continue to expand dynamically in 2010 and beyond. Fuelling this expansion will be continued by development of private label ranges across all modern retail formats, as well as by wholesalers supplying traditional retail outlets. Other important growth-supporting factors will be further expansion of discount stores and rising share of modern store formats in total retail sales. Furthermore, as more private label products are positioned above the economic price segment, and as their quality improves and packaging becomes more attractive, their image in the eyes of consumers is being steadily enhanced, inspiring greater confidence. Moreover, a certain number of consumers, who were forced to turn to private label products by the pressures of the economic downturn and became convinced of their good price-to-quality ratio, will continue to buy them even after their financial situation improves, perceiving such products as a viable alternative to their branded counterparts”, Patrycja Nalepa explains.

More information about the Polish private label market can be found in “Private label in Poland 2010. Market analysis and development forecasts for 2010-2012”, published by PMR in October 2010.

PMR (www.pmrcorporate.com) is a British-American company providing market information, advice and services to international businesses interested in Central and Eastern European countries as well as other emerging markets. PMR's key areas of operation include business publications (through PMR Publications), consultancy (through PMR Consulting) and market research (through PMR Research). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications, providing one of most frequently visited and top-ranked websites, PMR is one of the largest companies of its type in the region.

PMR Publications

ul. Dekerta 24, 30-703 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

www.pmrpublications.com

Contact person: Anna Rojek marketing@pmrcorporate.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polish Private Label Market Grows In Crisis here

News-ID: 149560 • Views: …

More Releases from PMR Publications

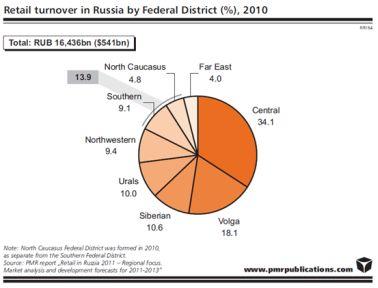

Russian retail market recovered after the economic slowdown

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Poland

Poland Agriculture Market, Poland Agriculture Industry, Agriculture Livestock Ma …

Poland is a significant European and global producer of numerous agricultural products. The agricultural land market in country is divided in two parts: privately owned farms and land owned farms by the State Treasury. Privately owned farm is an enterprise to cultivate various agricultural products under the control of one or more investor. Poland is among the world's primary producers of potatoes, rye, and apples, as well as pork and…

MAUSER Poland Celebrates 5th Anniversary

Bruehl/Germany, June 27, 2017

MAUSER Group, a worldwide leading company in industrial packaging, celebrates the 5th anniversary of its factory in Gliwice, Poland. Ideally located in the industrial heartland of Upper Silesia, and operated by a strong local management team, the plant offers high-quality industrial packaging solutions and services.

MAUSER Poland serves customers with a comprehensive product range of Composite Intermediate Bulk Containers (CIBCs) and plastic tight-head drums. In line with…

Agrochemicals Market in Poland

ReportsWorldwide has announced the addition of a new report title Poland: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Poland: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

A+ ratings on Poland

Jelenia Gora/Poland, 20.09.2011 - In August 2011 two rating agencies i.e. Standard & Poor's and Moody's Investors Service affirmed their A+ rating on Poland with a stable outlook. Both agencies noted that the Polish economy is competitive and increasingly diversified. Moody's evaluated Poland as relatively well placed to withstand global turmoil with its relatively resilient economy. Both agencies stressed that the Polish economy continued to expand in 2009, in contrast…

IT market in Poland

IT providers in Poland are starting the post-crisis period in actually quite good moods and are already beginning to predict what solutions will be most sought after by their customers during prosperity.

However last year hardware distributors recorded significant reduction in the number of orders placed, especially by business customers, software and IT services providers performed far better. A majority of them had similar sales as in previous periods, while some…

VoIP in Poland

At the end of 2008 the Polish VoIP telephony market was worth PLN 440m, with CaTV operators having generated the largest share of revenue in the segment. In recent years also fixed-line operators have included VoIP services into their offer.

According to research and consulting company PMR Polish VoIP market continues to represent a small share of the fixed-line telecommunications market. In 2008 it accounted for approximately five percent of the…