Press release

Fintech Technologies Market Technology Advancement by Top Key Players Stripe, YapStone, Braintree, Adyen, Lending Club, Addepar, Commonbond, Kabbage, Robinhood, Wealthfront, SoFi, BillGuard, Avant, PitchBook, Tala, Circle, TransferWise, Morningstar

The Research report published by Orian Research Consultant Global Fintech Technologies Market 2019 provides global coverage of Fintech Technologies market data from 2019 to 2025. The Fintech Technologies report start with the overview of Fintech Technologies industry, Chain structure, and describes the Fintech Technologies industry current situation, analyzes global Fintech Technologies market. The approvals and insights on the top companies prevalent in the market will enable the reader to get accustomed with the market opportunities that they can tackle with informed and favorable business strategiesGet Sample Copy of this Report @ https://www.orianresearch.com/request-sample/839336

The Global Fintech Technologies Market 2019 research provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The market Report also calculate the market size, the report considers the revenue generated from the sales of This Report and technologies by various application segments. The data and the information regarding the Fintech Technologies industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts.

Global Fintech Technologies Industry 2019 Market Research Report is spread across 120 pages and provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins. The report focuses on global major leading Fintech Technologies Industry players providing information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information.

Geographically, the report takes stock of the potential of Fintech Technologies market in the regions of North America including the U.S. and Canada, Latin America including Mexico, Brazil, and Argentina, Europe including the U.K., Germany, France, Italy, Spain, and Nordic, Asia Pacific except Japan (APEJ) including India, China, Thailand, Malaysia, Singapore, and Australia, and the Middle East and Africa including Gulf Cooperation Council (GCC), South Africa, Israel, and Nigeria.

Inquire More or Share Questions If Any before the Purchase on This Report @

https://www.orianresearch.com/enquiry-before-buying/839336

The following manufacturers are covered in this report, with sales, revenue, and market share for each company:

• Stripe

• YapStone

• Braintree

• Adyen

• Lending Club

• Addepar

• Commonbond

• Kabbage

• Robinhood

• Wealthfront

• SoFi

• BillGuard

• Avant

• PitchBook

• Tala

• Circle

• TransferWise

• Morningstar

• Enfusion

• …

The research study is a brilliant account of macroeconomic and microeconomic factors influencing the growth of the global Fintech Technologies market. This will help market players to make appropriate changes in their approach toward attaining growth and sustaining their position in the industry. This market is segmented as per type of product, application, and geography. Each segment is evaluated in great detail so that players can focus on high-growth areas of the global Fintech Technologies market and increase their sales growth. Even the competitive landscape is shed light upon for players to build powerful strategies and give a tough competition to other participants in the global Fintech Technologies market.

Market segment by Type, the product can be split into

• Mobile Based

• Web Based

Market segment by Application, split into

• Security Solutions

• Payment Solutions

• Wealth Management

• Insurance

• Others

Order a Copy of Global Fintech Technologies Market Report 2019 @ https://www.orianresearch.com/checkout/839336

Table of Contents

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Fintech Technologies Market Size Growth Rate by Type (2014-2025)

1.4.2 Mobile Based

1.4.3 Web Based

1.5 Market by Application

1.5.1 Global Fintech Technologies Market Share by Application (2014-2025)

1.5.2 Security Solutions

1.5.3 Payment Solutions

1.5.4 Wealth Management

1.5.5 Insurance

1.5.6 Others

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Fintech Technologies Market Size

2.2 Fintech Technologies Growth Trends by Regions

2.2.1 Fintech Technologies Market Size by Regions (2014-2025)

2.2.2 Fintech Technologies Market Share by Regions (2014-2019)

2.3 Industry Trends

2.3.1 Market Top Trends

2.3.2 Market Drivers

2.3.3 Market Opportunities

3 Market Share by Key Players

3.1 Fintech Technologies Market Size by Manufacturers

3.1.1 Global Fintech Technologies Revenue by Manufacturers (2014-2019)

3.1.2 Global Fintech Technologies Revenue Market Share by Manufacturers (2014-2019)

3.1.3 Global Fintech Technologies Market Concentration Ratio (CR5 and HHI)

3.2 Fintech Technologies Key Players Head office and Area Served

3.3 Key Players Fintech Technologies Product/Solution/Service

3.4 Date of Enter into Fintech Technologies Market

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type and Application

4.1 Global Fintech Technologies Market Size by Type (2014-2019)

4.2 Global Fintech Technologies Market Size by Application (2014-2019)

5 United States

5.1 United States Fintech Technologies Market Size (2014-2019)

5.2 Fintech Technologies Key Players in United States

5.3 United States Fintech Technologies Market Size by Type

5.4 United States Fintech Technologies Market Size by Application

6 Europe

6.1 Europe Fintech Technologies Market Size (2014-2019)

6.2 Fintech Technologies Key Players in Europe

6.3 Europe Fintech Technologies Market Size by Type

6.4 Europe Fintech Technologies Market Size by Application

7 China

7.1 China Fintech Technologies Market Size (2014-2019)

7.2 Fintech Technologies Key Players in China

7.3 China Fintech Technologies Market Size by Type

7.4 China Fintech Technologies Market Size by Application

8 Japan

8.1 Japan Fintech Technologies Market Size (2014-2019)

8.2 Fintech Technologies Key Players in Japan

8.3 Japan Fintech Technologies Market Size by Type

8.4 Japan Fintech Technologies Market Size by Application

9 Southeast Asia

9.1 Southeast Asia Fintech Technologies Market Size (2014-2019)

9.2 Fintech Technologies Key Players in Southeast Asia

9.3 Southeast Asia Fintech Technologies Market Size by Type

9.4 Southeast Asia Fintech Technologies Market Size by Application

10 India

10.1 India Fintech Technologies Market Size (2014-2019)

10.2 Fintech Technologies Key Players in India

10.3 India Fintech Technologies Market Size by Type

10.4 India Fintech Technologies Market Size by Application

11 Central & South America

11.1 Central & South America Fintech Technologies Market Size (2014-2019)

11.2 Fintech Technologies Key Players in Central & South America

11.3 Central & South America Fintech Technologies Market Size by Type

11.4 Central & South America Fintech Technologies Market Size by Application

12 International Players Profiles

12.1 Stripe

12.1.1 Stripe Company Details

12.1.2 Company Description and Business Overview

12.1.3 Fintech Technologies Introduction

12.1.4 Stripe Revenue in Fintech Technologies Business (2014-2019)

12.1.5 Stripe Recent Development

12.2 YapStone

12.2.1 YapStone Company Details

12.2.2 Company Description and Business Overview

12.2.3 Fintech Technologies Introduction

12.2.4 YapStone Revenue in Fintech Technologies Business (2014-2019)

12.2.5 YapStone Recent Development

12.3 Braintree

12.3.1 Braintree Company Details

12.3.2 Company Description and Business Overview

12.3.3 Fintech Technologies Introduction

12.3.4 Braintree Revenue in Fintech Technologies Business (2014-2019)

12.3.5 Braintree Recent Development

12.4 Adyen

12.4.1 Adyen Company Details

12.4.2 Company Description and Business Overview

12.4.3 Fintech Technologies Introduction

12.4.4 Adyen Revenue in Fintech Technologies Business (2014-2019)

12.4.5 Adyen Recent Development

12.5 Lending Club

12.5.1 Lending Club Company Details

12.5.2 Company Description and Business Overview

12.5.3 Fintech Technologies Introduction

12.5.4 Lending Club Revenue in Fintech Technologies Business (2014-2019)

12.5.5 Lending Club Recent Development

12.6 Addepar

Continued...

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Technologies Market Technology Advancement by Top Key Players Stripe, YapStone, Braintree, Adyen, Lending Club, Addepar, Commonbond, Kabbage, Robinhood, Wealthfront, SoFi, BillGuard, Avant, PitchBook, Tala, Circle, TransferWise, Morningstar here

News-ID: 1638209 • Views: …

More Releases from Orian Research

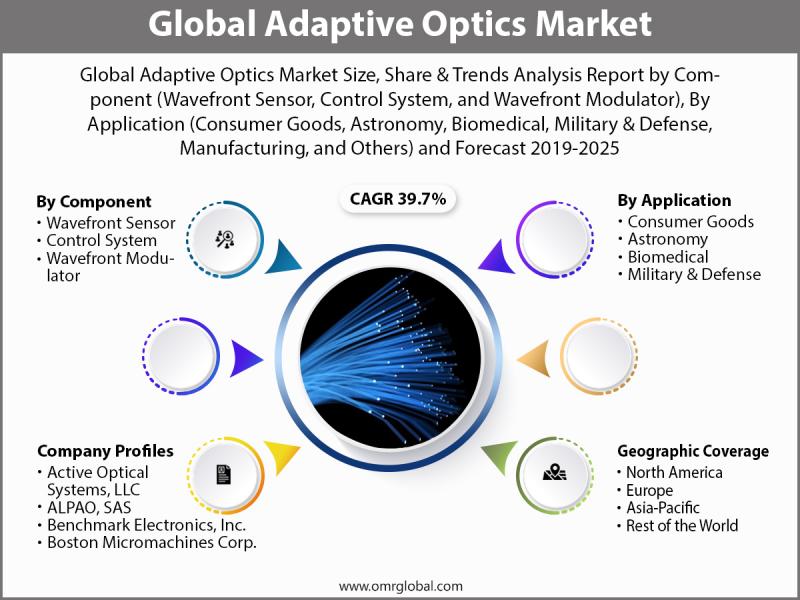

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

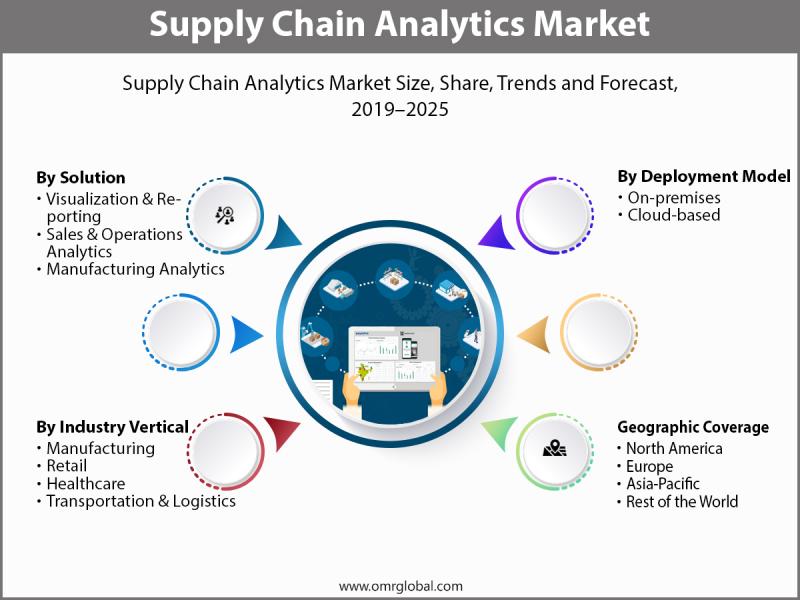

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

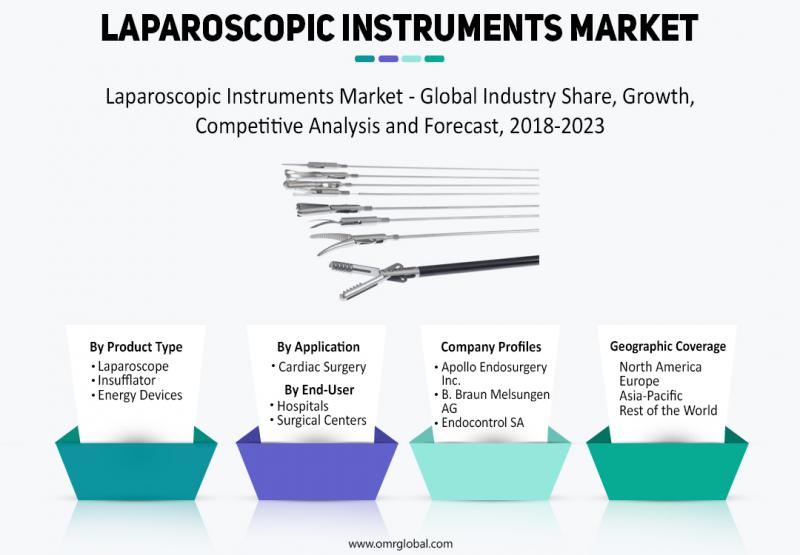

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…