Press release

Global Mobile Payment Technologies Market

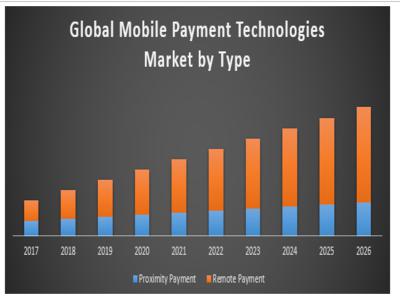

Global Mobile Payment Technologies Market – Industry Analysis and Forecast (2018-2026) – By Type, Technology, Purchase Type, End use, and GeographyGlobal mobile payment technologies market was valued at US$ 3.01 Bn in 2017 and is expected to reach US$ 34.69 Bn by 2026, at a CAGR of 35.74% during a forecast period.

The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data and projections with a suitable set of assumptions and methodology. The report also helps in understanding mobile payment technologies market dynamics, structure by identifying and analyzing the market segments and project the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence. The report also provides PEST analysis, PORTER’s analysis, SWOT analysis to address questions of shareholders to prioritizing the efforts and investment in the near future to the emerging segment in the mobile payment technologies market.

For More Information about Report Visit here

https://www.maximizemarketresearch.com/market-report/global-mobile-payment-technologies-market/24851/

Mobile payment is a concept wherein a portable electronic device such as a tablet, smartphone, or cell phone is operated as a payment medium. Mobile payment technology allows consumers to make instant payments for products and services.

The global mobile payment technologies market is primarily driven by the rising adoption of smart applications and growing mobile data usage across the world. Increasing adoption of advanced technologies such as wearable devices, near field communication, and mobile point-of-sale is estimated to boost the demand for mobile payment technologies in the forecast period. Rapid enlargement in the mobile payment solutions to provide better payment service to the end-users are projected to be the factor driving the growth of the mobile payment technologies market.

However, the risks related to processing mobile payments with financial details of the card owner in the transaction can stance a threat for the market growth. Government initiatives in supporting digital payments are projected to generate many opportunities in the mobile payment technology market.

The retail sector is looking for mobile payment technologies to simplicity payment transactions. Additionally, it projected to grow at a higher CAGR during the forecast period. This is primarily driven by major factors such as income growth, urbanization, favorable government regulations and policies, and changes in tastes & preferences of consumers across the world. The retail sector is also estimated to see exponential growth in the forecast period.

Remote payment segment to increase rapidly during the forecast period due to the rising adoption of mobile wallets by consumers for payment purposes at the retailers or for e-commerce. Moreover, improve relationships with businesses by installing a remote payment system terminal at a bank, convenience store, neighborhood supermarket or other off-site location in the service area.

In 2016 the SMS segment contributed to more than half of the entire market share and is anticipated to hold its position through the forecast period. Yet, the NFC segment would raise at the maximum CAGR of 36% from 2017 to 2023. However, the digital wallet/bank cards segment would index the highest CAGR of 35.2% from 2017 to 2023.

North America is anticipated to hold the highest share in the global mobile payment technology market owing to substantial adoption of mobile phones that are more than 70% in the U.S. The technology is gradually being used in BFSI and government sectors, for instance, it deals both security and transparency along with fast payment processing alternatives. Further, the Asia Pacific is expected to grow at a high rate during the forecast period owing to the rise in population and the active online media in India as well as growth in e-commerce. Moreover, quick acceptance of new technology and the advantages of secure and easy money transactions are pacing the growth of the North America market.

The scope of the Global Mobile Payment Technologies Market

Global Mobile Payment Technologies Market by Type

• Proximity Payment

• Remote Payment

Global Mobile Payment Technologies Market by Technology

• NFC

• QR Code

• WAP & Card-Based

• Digital Wallet

• Banking App-based

• SMS-based/DCB

• USSD/STK

• Others

Global Mobile Payment Technologies Market by Purchase Type

• Airtime Transfers & Top-ups

• Money Transfers & Payments

• Merchandise & Coupons

• Travel & Ticketing

Global Mobile Payment Technologies Market by End-use

• Hospitality & Tourism Sector

• BFSI

• Media & Entertainment

• Retail Sector

• Education

• IT & Telecom

Key Players operating in the Global Mobile Payment Technologies Market

• MasterCard International

• Visa

• American Express

• Boku

• Fortumo

• PayPal

• Bharti Airtel

• Vodafone

• Microsoft Corporation

• Apple

• Orange S.A

• Vodacom Group Limited,

• MTN Group Limited

• Safaricom Limited

• Millicom International Cellular SA

• Mahindra Comviva

• Econet Wireless Zimbabwe Limited

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

For More Information about Report Visit here

https://www.maximizemarketresearch.com/market-report/global-mobile-payment-technologies-market/24851/

Report Published by https://www.maximizemarketresearch.com MAXIMIZE MARKET RESEARCH PVT. LTD.

Omkar Heights,

Sinhagad Road,

Manik Baug, Vadgaon Bk,

Pune, Maharashtra 411051, India.

+91 96071 95908

sales@maximizemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Mobile Payment Technologies Market here

News-ID: 1583241 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…