Press release

Global ePayment System Market 2019 Top Vendors are Bluefin Payment Systems, Braintree, CyberSource, Elavon, Inc., Index (acquired by Stripe), Ingenico Group, Shift4 Corporation, SISA Information Security, TNS Tokenex pureLiFi, Velmenni, OLEDCOMM, Philips,

Global ePayment System Market 2018 Global Industry report provides the latest market statistics, industry growth, size, share, trends, as well as driving factors. The Retail Analytics report further covers the extensive analysis of the upcoming progress of the Retail Analytics Market. The detailed overview of the market segments, product description, Retail Analytics applications is presented in this report.Global ePayment System Market Statistical Overview Report 2018 gives an outstanding tool for market Survey, openings, and Vital key and strategic basic leadership. This report perceives that in this quickly advancing and competitive scenario, up-coming data on the basis of ePayment System Market research execution and settles on basic choices for development and benefit. It gives data on ePayment System Market trends and advancements and sheds light on various sectors, limitations and advancements, and on the evolving structure of the market.

The Global ePayment System Market is expected to reach USD 25.9 billion by 2025 from USD 12.7 billion in 2017 and is projected to grow at a CAGR of 17.7% in the forecast period of 2018 to 2025. The upcoming market report contains data for historic years 2016, the base year of calculation is 2017 and the forecast period is 2018 to 2025.

Download Free PDF Sample Copy of Report@ https://databridgemarketresearch.com/request-a-sample/?dbmr=global-epayment-

system-market

Key Players:

• Bluefin Payment Systems,

• Braintree,

• Cybersource,

• Elavon,

• Index,

• Ingenico Epayments Intelligent Payments Geobridge Corporation,

• Shift4 Corporation,

• Sisa Information Security Signifyd,

• TNS Tokenex pureLiFi,

• Velmenni,

• Oledcomm,

• Philips,

• VLNComm,

• Wipro,

• General Electric,

• LVX System,

• Nakagawa Labs and LightPointe Communications.

• many more.

ePayment system is defined as a mode of making transaction or payment of goods and services with an electronic medium without using cash or cheque. It is also known as online or electronic payment system.Due to increasing use of Internet-based banking and shopping, the ePayment system market has been developing over the last few years. There are various number of ePayment systems which are developed offer improvement in secure ePayment transaction while decreasing cheque and cash transactions. ePayment systems is categorized into two areas which include cash payment systems and credit payment systems. The various advantages of ePayment system are it is a more effective and efficient transaction system, without wasting time, It has lowers the whole transaction cost. It is easy to add ePayment system online, start processing payments online. Payment providers and payment gateways offer high security and anti-fraud tools for reliable transactions.

In 2018 Prime Minister Narendra Modi launched BHIM, RuPay and SBI app a three Indian mobile payment apps in Singapore at a business event. It helped in internationalisation of the country’s digital payment platform.

To Avail 10% Discount On This Report Mail Us on :-

sopan.gedam@databridgemarketresearch.com

Market Drivers and Restraints:

• Increased speed of transactions

• No distance barriers

• Decreasing cost of technology

• Rising adoption and demand of customers for mobile and electronic commerce

• Growing trend of cashless payment

• Increasing contactless payment enabled instruments like e-wallets, cards and smartphones

• Increasing number of schemes on various cards pushing the adoption of several ePayment modes

• Growing dependency on smartphones

• Emergence of fast internet (4G/3G) technologies

• User friendliness and growing social media platform

• Declining efficiencies of aging assets and the need for operational safety

• E-commerce frau

• Lack of secrecy

Market Segmentation:

• The market is based on solution, service, organization size, vertical and geographical segments.

• Based on solution, the market is segmented into encryption, tokenization, fraud detection and prevention.

• Based on services are segmented into integration, support, and consulting.

• Based on organization size are segmented into large enterprises and small and medium enterprises

• Based on vertical, the market is segmented into retail, BFSI, IT& telecom, healthcare, hospitality, transportation,

education, government, media, entertainment and others.

• Based on geography, the market report covers data points for 28 countries across multiple geographies such as North

America, South America, Europe, Asia-Pacific and Middle East & Africa.

Competitive Analysis:

The global ePayment System market is fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market in order to sustain in long run. The report includes market shares of ePAYMENT system market for global, Europe, North America, Asia Pacific and South America.

To Inquire before Buy Report @ https://databridgemarketresearch.com/inquire-before-buying/?dbmr=global-epayment-system-market

Key Questions Answered in Global ePayment System Market Report:-

What will the market growth rate, Overview and Analysis by Type of Global ePayment System Marketin 2025?

What are the key factors driving, Analysis by Applications and Global Nutraceutical Ingredients Market?

What are Dynamics, This Overview Includes Analysis of Scope, and price analysis of top Vendors Profiles of Global

Nutraceutical Ingredients Market?

What are Opportunities, Risk and Driving Force of Global Nutraceutical Ingredients Market?

What are the opportunities and threats faced by the vendors in Global Nutraceutical Ingredients Market?

What are the Global ePayment System Marketopportunities, market risk and market overview of the Market?

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: sopan.gedam@databridgemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global ePayment System Market 2019 Top Vendors are Bluefin Payment Systems, Braintree, CyberSource, Elavon, Inc., Index (acquired by Stripe), Ingenico Group, Shift4 Corporation, SISA Information Security, TNS Tokenex pureLiFi, Velmenni, OLEDCOMM, Philips, here

News-ID: 1534367 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

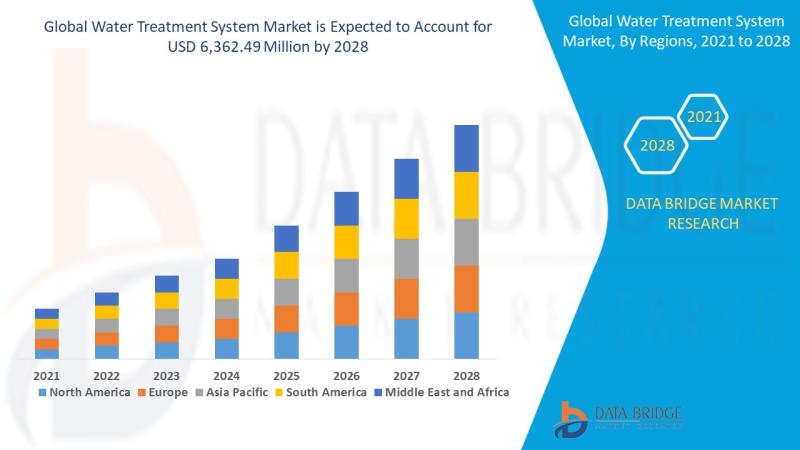

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…