Press release

End-User Preference for Customizable Non-PHO Emulsifiers Growing: Fact.MR Survey

FDA’s mandate on the removal of artificial trans-fats of partially hydrogenated (PHO) products as emulsifiers in the food industry has bemused food manufacturers. Non-PHO emulsifiers are designed to make this transition from PHO ingredients to alternatives such as non-PHO emulsifiers easy for manufacturers. Complete transition is expected to be cost intensive as PHO ingredients provided the most economical and highly functional alternatives in the food supply. Identifying these challenges, manufactures in the non-PHO emulsifier market are actively engaged in introducing non-PHO emulsifiers at competitive pricing without compromising quality and shelf stability.Corbion, a chemicals company started the non-PHO emulsifier production even before FDA regulations were mandated. The company launched its Ensemble emulsifier line of non-PHO emulsifier fats and oils with similar functionality as PHOs. Kerry Ingredients has also launched non-PHO emulsifiers with oxidative stability similar to PHO oils. Cargill, another food giant has also introduced soy lecithins as non-PHO emulsifiers and an alternative to PHO-based monoglycerides and DATEM. As discriminating consumers demand transparency in their food product purchase, non-PHO emulsifier are set to gain momentum during the forecast period. As the F&B sector continues to witness a rapidly transforming labelling claims, the non-PHO emulsifier market is likely to grow at a steady pace in the future.

Claim Sample Report For FREE: https://www.factmr.com/connectus/sample?flag=S&rep_id=736

While the global specialty food market grows at a CAGR of around 8%, demand for specialty food ingredients is likely to surge rapidly in the upcoming years. Emulsifiers play an important role in stabilizing processed foods, and the rapidly growing specialty food market in complementing the growth of the global emulsifiers market. Nevertheless, high stringency of food safety rules and regulations has a huge impact on the development of the food emulsifiers market.

A Federal Ban on Partially Hydrogenated Oils in North America to Lubricate the Market Growth

Partially hydrogenated oils (PHOs) are one of the primary sources of Trans Fatty Acids (TFAs), consuming which can increase the risk of cardiovascular diseases (CVDs) as well as coronary heart diseases (CHD). As stated by the World Health Organization, CVDs were the main reason for over 45% deaths caused due to noncommunicable diseases (NCDs), in 2016. Removing PHOs from human food products can bring down the number of heart attacks and deaths each year, demand for non-PHO emulsifiers in likely to swell in the food industry. In Denmark, banning the sales of food products containing PHOs or TFAs reduced the number of deaths caused due to CHDs by around 50% in past 20 years. This is primarily boosting the growth of the global non-PHO emulsifiers market.

Request Full Report With TOC: https://www.factmr.com/connectus/sample?flag=T&rep_id=736

Considering the alarming number of deaths caused due to CHDs, the U.S. Food and Drug Association imposed a ban on the use of PHOs in processed food products. FDA stated that PHOs are no longer ‘Generally Recognized as Safe (GRAS)’ to be used in human foods, and the ban will be implemented from June 2018. In addition, ‘Health Canada’ – the public health department of the government of Canada – prohibited the use of PHOs in human foods by releasing a “Notice of proposal” that mirrors the decision of FDA. As PHOs are banned in both Canada and the U.S., the non-PHO emulsifiers market in North America is expected to grow rapidly in the near future.

Apart from North America, many European countries such as Denmark, Austria, Norway, Iceland, and Switzerland have curbed the amount of TFAs in food products up to the maximum limit of 2g per 100g of total fats. Various guidelines, dietary recommendations, and voluntary measures are being taken in the European food industry to reduce the use of PHOs in manufacturing process food products. This is likely to drive the growth of the global non-PHO emulsifiers market in the upcoming years.

Non-PHO Emulsifier Manufacturers to Bank on an Increasing Number of Label-conscious Consumers

While consumers are becoming more health-conscious, they are relating their food choices to health. Rising awareness about the health hazards of consuming specific food ingredients such as PHOs is triggering the use of non-PHO emulsifiers while manufacturing processed food products. Food manufacturing companies, especially bakery manufacturers, are viewing clean label as about improving the nutritious value of food products. As consumers critically check food labels and nutritional information, which mainly affects their purchasing decisions, food manufacturers are using high-quality food ingredients and maintaining the integrity of their products.

In order to fulfill the demands of label-conscious consumers, bakery manufacturers are making use of non-PHO emulsifiers to produce PHO-free and healthier baked foods. Corbion N.V. – a Dutch food company – conducted its own proprietary research, which focused on the consumer behavior while purchasing bakery products such as bread, as well as processed meat. Corbion came to a conclusion that consumers checked food labels and ranked bread with no artificial preservatives and no PHO the highest. Based on results of the research, the company introduced enhanced baking ingredients such as cake mixes, icing stabilizers, and non-PHO emulsifiers to improve their clean-label product portfolio.

Market Players to Boost Investments in R&D to Find Ideal PHO Alternatives

As the 2018 deadline to comply with FDA’s ban on PHOs nears, food manufacturers, especially bakers, are intensifying their efforts to find PHO alternatives. Leading manufacturers in the global non-PHO emulsifiers market are focusing on R&D activities to find the most appropriate replacement for PHOs in emulsifiers. The National Sunflower Association stated that the sales of sunflower oil in the U.S. increased from 433 million pounds to more than 510 million pounds in a year by the end of 2017. Based on these statistics, the National Sunflower Association proposed that sunflower oil is the most appropriate replacer for PHOs in emulsifiers.

Apart from sunflower oil, many market players are making use of other innovative ingredients such as palm oil, canola, and soy to produce non-PHO emulsifiers. For an instance, Palsgaard – a leading manufacturing company in the global non-PHO emulsifiers market – recently introduced vegetable-based, non-PHO emulsifiers that are gluten-free and suitable for vegans. It produced non-PHO emulsifiers in the powdered format, which can provide better stability, enhanced texture, and shelf life of food products, while reducing the overall cooking cost.

Grow Your Business From Expert Advice: https://www.factmr.com/report/736/non-pho-emulsifiers-market

About US

Fact.MR is a fast-growing market research firm that offers the most comprehensive suite of syndicated and customized market research reports. We believe transformative intelligence can educate and inspire businesses to make smarter decisions. We know the limitations of the one-size-fits-all approach; that’s why we publish multi-industry global, regional, and country-specific research reports.

Contact Us

Rohit Bhisey

Fact.MR

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Email: sales@factmr.com

Web: https://www.factmr.com/

Blog: https://factmrblog.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release End-User Preference for Customizable Non-PHO Emulsifiers Growing: Fact.MR Survey here

News-ID: 1513267 • Views: …

More Releases from Fact.MR

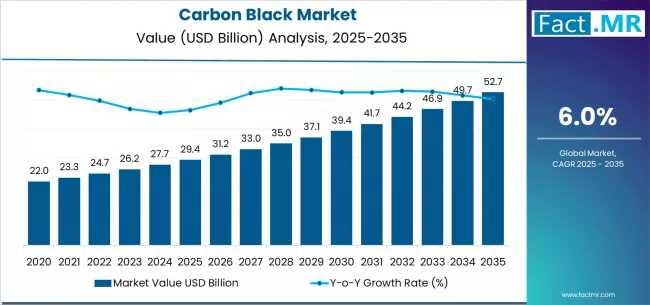

Carbon Black Market Forecast 2026-2036: Market to Reach USD 52.7 Billion by 2036 …

The global carbon black market is valued at USD 29.4 billion in 2025 and is projected to reach USD 52.7 billion by 2035. This robust expansion represents a total growth of 79.1%, progressing at a compound annual growth rate (CAGR) of 6.0% over the ten-year forecast period. As automotive manufacturing scales and tire production capacities rise, the market is expected to grow by approximately 1.8X, driven by the essential role…

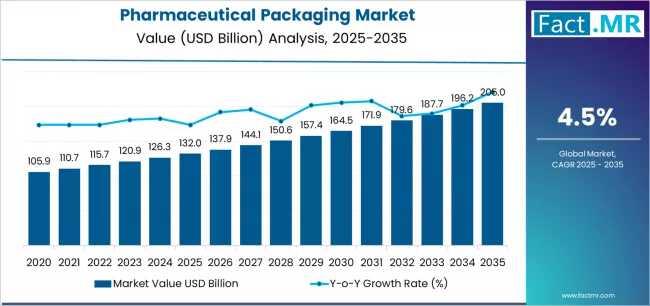

Pharmaceutical Packaging Market Forecast 2026-2036: Market to Reach USD 206.0 Bi …

The global pharmaceutical packaging market is valued at USD 132.0 billion in 2026 and is projected to reach USD 206.0 billion by 2036, expanding at a steady CAGR of 4.5%. This growth reflects a fundamental shift toward advanced sterile packaging, driven by the rapid rise of biologics and the necessity for global regulatory harmonization.

Get Access of Report Sample: https://www.factmr.com/connectus/sample?flag=S&rep_id=4573

pharmaceutical packaging market Quickstat

Market Size 2026: USD 132.0 billion

Market Size…

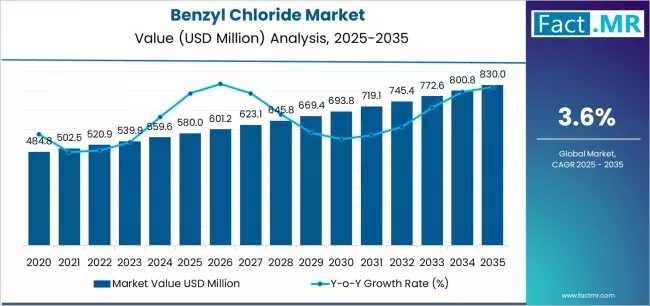

benzyl chloride Market Forecast 2026-2036: Market to Reach USD 830.0 Million by …

The global benzyl chloride market is projected to expand from a valuation of USD 580.0 million in 2025 to approximately USD 830.0 million by 2035. This growth represents an absolute increase of USD 250.0 million, with the market forecast to grow at a compound annual growth rate (CAGR) of 3.6% over the ten-year period. As a critical chemical intermediate, benzyl chloride is seeing heightened utilization in pharmaceutical manufacturing and the…

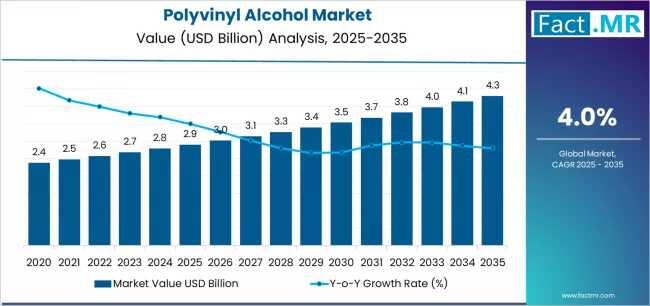

Polyvinyl Alcohol Market Forecast 2026-2036: Market to Reach USD 4,300.0 Million …

The global Polyvinyl Alcohol Market is valued at USD 2,900.0 million in 2025 and is projected to reach USD 4,300.0 million by 2035. This steady expansion represents a CAGR of 4.0% over the ten-year assessment period, marking an absolute increase of USD 1,400.0 million. The market's growth is primarily underpinned by an escalating global demand for water-soluble packaging solutions and advanced film-forming technologies across industrial, textile, and food sectors.

Get Access…

More Releases for PHO

PHO and Non-PHO Oils Market reaches US$248.3Bn in 2025 boosted by rising health …

The global PHO and non-PHO based oils and fats market is experiencing sustained expansion driven by evolving consumer preferences, regulatory transitions, and heightened demand from food processing industries. Valued at US$ 248.3 billion in 2025, the market is projected to reach US$ 335.6 billion by 2032, advancing at a CAGR of 5.1% throughout the forecast period from 2025 to 2032. This trajectory reflects a combination of key growth accelerators, including…

PHO and Non-PHO Oils Market Trends - Growing Adoption of Health-Friendly Oil Alt …

PHO and Non-PHO based Oils Market report, published by DataM Intelligence has released its latest in-depth analysis on the global PHO and Non-PHO based Oils Market, delivering a detailed overview of regional growth patterns, market segmentation, CAGR, and financial performance among leading industry players. The report offers readers a clear snapshot of the current market value and volume, alongside an exploration of emerging opportunities and ongoing developments. By shining a…

PHO and Non-PHO based Oils Market Growing Rapidly by - ADM, Bunge Limited, Wilma …

DataM Intelligence has published a new research report on "PHO and Non-PHO based Oils Market Size 2024". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Free Sample…

PHO and Non-PHO based Oils Market 2024 Projections, Trends and Forecast 2024 - D …

A new Report by DataM Intelligence, titled "PHO and Non-PHO based Oils Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2031,"" offers a comprehensive analysis of the industry, which comprises insights on the PHO and Non-PHO based Oils market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts, as well as insightful…

PHO and Non-PHO based Oils Market Size, Share, Growth, Analysis, and Forecast Re …

PHO and Non-PHO based Oils Market Overview

The global market, which includes partially hydrogenated and non-hydrogenated oils, is crucial to the food sector. The global market for PHO and non-PHO-based oils is made up of a wide range of culinary and industrial-grade oils that are frequently used in food processing, cooking, and various non-food industrial uses. The oils indicated above are essential parts of a wide range of savory food, including…

PHO and Non-PHO based Oils and Fats Market Global Demand And Precise Outlook

The market for non-PHO based oils and fats is concentrated in the countries of South East Asia such as Thailand, Malaysia, and Indonesia. Key players in the global non-PHO based oils and fats market are importing non-PHO oils and fats from these countries at very low price points and supplying these oils as private label products to other regional markets. Manufacturers are also investing in R&D to produce non-PHO oils…