Press release

Tax Software Market Estimated to Experience a Hike in Growth of 12010 million $ by 2022| Global Top Players: Avalara, Vertex, SOVOS, H&R Block, EGov Systems, Intuit

The Global Tax Software Market 2019 report gives has been prepared reliant on the mix, examination, and interpretation of information about the global Tax Software market assembled from specific sources. The industry report lists the leading competitors and provides the insights strategic industry analysis of the key factors influencing the market.Global Tax Software Market Overview:

The report spread crosswise over 125 pages is an outline of the Global Tax Software Market Report 2019. The Global Tax Software Market is anticipated to develop at a solid development rate from 2019 to 2022 as indicated by new research. The investigation centers around market patterns, driving players, inventory network patterns, technological advancements, key improvements, and future procedures.

Accessible Exclusive Sample Copy of This Report @ https://www.businessindustryreports.com/sample-request/118966.

With the slowdown in world economic growth, the Tax Software industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Tax Software market size to maintain the average annual growth rate of 4.27% from 8600 million $ in 2014 to 9750 million $ in 2017, Market analysts believe that in the next few years, Tax Software market size will be further expanded, we expect that by 2022, The market size of the Tax Software will reach 12010 million $.

The report also covers segment data, including: type segment, Component segment, channel, and region. On the basis of tax type, the market is categorized as sales tax, income tax, and others such as VAT, service tax, and estate tax.

Base on Sales tax refers to the amount of money, which is added to the cost of a product or service when purchased by a consumer at a retail location. Sales tax is calculated as a percentage of the cost of the good or service purchased. Sales tax software enables individuals and business organizations to file various kinds of transactional taxes electronically and helps in streamlining the tax filing process by calculating the individual’s tax obligations automatically.

Based on component, the market can be segmented into tax software and services. Furthermore, the tax software is sub-segmented as standalone and integrated whereas services are sub-segmented as managed and professional.

Based on regions, North America is anticipated to overwhelm the assessment programming market because of the nearness of solid players in the U.S. furthermore, spending by the U.S. government for the arrangement of expense the executives frameworks in different open and private associations. The market in Asia Pacific and Europe is probably going to display solid development openings amid the gauge period, due to an ascent in interests in the tax assessment industry and business extension of sellers over the region.

Purchase This Report Online with 125 Pages List of Tables and Figures and All around Table of Contents On @ https://www.businessindustryreports.com/buy-now/118966/single.

Significant Key Players :

1 Avalara

2 Vertex, Inc.

3 SOVOS

4 H&R Block

5 EGov Systems

6 Intuit Inc.

Tax Software Market, By Region:

1 North America Country

2 South America

3 Asia Country

3 Europe Country

4 Other Country

Global Tax Software market 2019-2022: segment analysis, risk assessment, trend outlook and business strategy is based on a comprehensive research study of the Tax Software market by analyzing the entire global market and all its sub-segments through extensively detailed classifications. Profound analysis and assessment are generated from premium information sources with inputs derived from industry professionals across the value chain.

Snatch your report @ https://www.businessindustryreports.com/check-discount/118966.

This investigation answers to the underneath key inquiries:

1 How has the global Tax Software market performed so far and how will it perform in the coming years?

2 What are the key regional markets in the global Tax Software industry?

3 What are the price trends of Tax Software in the region?

4 What are the various stages in the value chain of the global Tax Software industry?

In the end this report covers information and information on limit and generation outline creation piece of the pie investigation deals review supply deals and lack import fare and utilization and additionally cost value income and gross margin of Tax Software.

Significant points in table of contents:

1 Tax Software Product Definition

2 Global Tax Software Market Manufacturer Share and Market Overview

3 Manufacturers Tax Software Business Introduction

4 Global Tax Software Market Segmentation (Region Level)

5 Global Tax Software Market Segmentation (Product Type Level)

6 Global Tax Software Market Segmentation (Industry Level)

7 Global Tax Software Market Segmentation (Channel Level)

8 Tax Software Market Forecast 2018-2022

9 Tax Software Segmentation Product Type

10 Tax Software Segmentation Industry

11 Tax Software Cost of Production Analysis

12 Conclusion

About us

Businessindustryreports.com is digital database of comprehensive market reports for global industries. As a market research company we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed strategic and therefore successful decisions for themselves.

Media contact

Business industry reports

pune – india

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Software Market Estimated to Experience a Hike in Growth of 12010 million $ by 2022| Global Top Players: Avalara, Vertex, SOVOS, H&R Block, EGov Systems, Intuit here

News-ID: 1504666 • Views: …

More Releases from Business Industry Reports

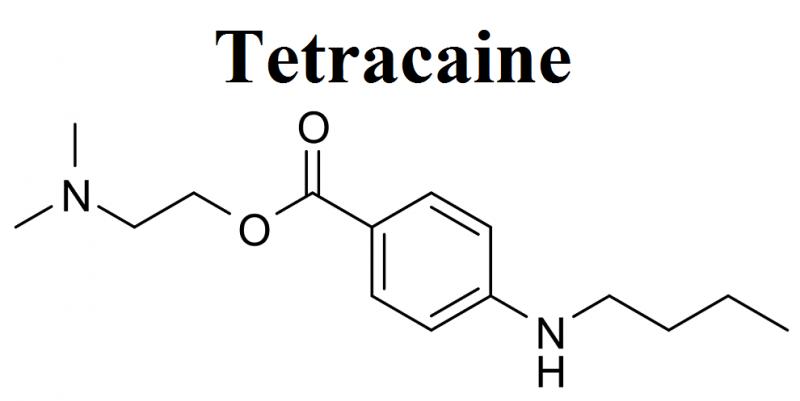

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

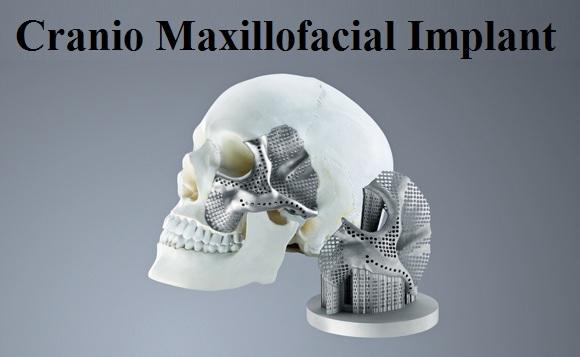

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…