Press release

Increase in the Polish construction industry economic climate

Driven by a steadily rising number of investment projects underway and planned, construction companies express slightly more favourable assessments of the economic situation of the market when compared to the findings of a study conducted six months ago. Construction activity is still hampered by numerous market barriers, but more and more companies are capable of identifying factors which have a positive bearing on the market.The results of a survey of high-level professionals from the management and operating divisions of 200 largest Polish construction companies, which was conducted by research and consulting company PMR for the purposes of report entitled “Construction sector in Poland H2 2010 – Comparative regional analysis and development forecasts for 2010-2013”, are evidence that sentiment in the Polish construction industry has taken a slight turn for the better. In September 2010, PMR Polish Construction Climate Indicator had a value of 7.8 pts, demonstrating that construction companies were more optimistic in their assessment of the market situation than they had been a year ago, despite adverse market circumstances prevailing in the early months of 2010.

Still, the companies which tend to see more negatives than positives in the current situation are more numerous in the market, but it should be noted that number of the former decreased in the past six months. The most frequent obstacles, cited by 41% of responding companies, were problems related to legal regulations and difficulties in dealings with officials. But, notably, in September the respondents were less concerned about the lack of relevant regulations to protect the Polish market against competition from foreign providers of construction services than they were six months ago, while more responses indicated excessive bureaucracy, overly complicated regulations and the lack of understanding of the nature of respondents’ business by legislators and officials.

Strong market competition was the second most frequently cited barrier to doing business, which was mentioned primarily by smaller companies. Further obstacles identified by respondents included underpricing, driven by strong market competition and low prices which contractors were forced by investors to accept. But it should be noted that the significance of this barrier slightly decreased in the recent months. The companies surveyed also mentioned other obstacles to doing business in the construction market. One-tenth of respondents cited considerable labour costs, while 9% of the surveyed companies still found it difficult to access loans. Staff shortages and payment backlogs were mentioned much less frequently as barriers to doing business in the construction market.

PMR Research interviewers also asked construction companies to identify factors considered by them to be the greatest facilitators to doing business in the construction market. Since most respondents did not see any significant factors facilitating market operations, only 51 valuable responses were received to this question.

Factors conducive to doing business in the Polish construction market most frequently cited by respondents were EU subsidies, which, to a significant extent, helped the public sector outweigh the fall in private sector investments (27% of respondents). Next in the order were good business contacts, including in particular lasting and strong relations with principals and subcontractors. Respondents also mentioned a stable legal environment, qualified staff employed by their companies and greater availability of loans.

This press release is based on information contained in the latest PMR report entitled “Construction Sector in Poland H2 2010 – Development Forecasts for 2010-2013”.

PMR (www.pmrcorporate.com) is a British-American company providing market information, advice and services to international businesses interested in Central and Eastern European countries as well as other emerging markets. PMR's key areas of operation include business publications (through PMR Publications), consultancy (through PMR Consulting) and market research (through PMR Research). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications, providing one of most frequently visited and top-ranked websites, PMR is one of the largest companies of its type in the region.

PMR Publications ul. Dekerta 24, 30-703 Krakow, Poland tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08 www.pmrpublications.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Increase in the Polish construction industry economic climate here

News-ID: 149215 • Views: …

More Releases from PMR Publications

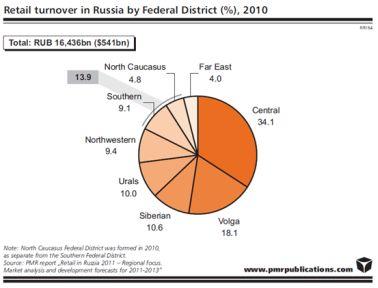

Russian retail market recovered after the economic slowdown

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Polish

Polish Foodies: A Culinary Journey Through the Delights of Polish Cuisine

Discovering the Delights of Polish Cuisine with Karolina Klesta: A Journey into the Eccentricities of Poland's Culinary World

Karolina Klesta, a renowned expert in Polish cuisine, is unveiling the mysteries and delights of Poland's culinary landscape in her latest endeavor. With a passion for exploring the weird and wonderful aspects of Polish food, Karolina is set to captivate taste buds and ignite curiosity around the globe.

From the depths of history to…

UV & LED Soak-Off Gel Polish: Benefits Compared to Regular Gel Polish

UV and LED soak-off gel polish has revolutionized the nail industry, offering numerous benefits compared to traditional gel polish. Let's delve into the advantages of UV/LED soak-off gel polish and why it's become a popular choice among nail enthusiasts.

Quick Dry Time

One of the standout benefits of UV/LED soak-off gel polish is its rapid drying time. When exposed to a UV or LED lamp, the gel polish dries within minutes, eliminating…

Polmedia Polish Pottery Shines Amidst Texas' Oldest Polish Roots

Texans are delving into the state's oldest Polish roots, courtesy of a December 2023 article in Texas Monthly. The article sheds light on Panna Maria, recognized as the oldest Polish settlement in the U.S., where a traditional Silesian Polish dialect and cultural influence have endured. However, South Texas boasts more than just Panna Maria as a torchbearer of Polish tradition. A mere 40-minute drive north of the Panna Maria Visitor…

Polmedia Polish Pottery Shines Amidst Texas' Oldest Polish Roots

Texans are delving into the state's oldest Polish roots, courtesy of a December 2023 article in Texas Monthly. The article sheds light on Panna Maria, recognized as the oldest Polish settlement in the U.S., where a traditional Silesian Polish dialect and cultural influence have endured. However, South Texas boasts more than just Panna Maria as a torchbearer of Polish tradition. A mere 40-minute drive north of the Panna Maria Visitor…

Don't be Fooled by Fakes: Polmedia Polish Pottery Shares Tips on Identifying Gen …

Seguin, Texas - 03/15/2023: Polmedia Polish Pottery wants to educate its customers and the general public about the growing problem of fake Polish pottery and how to avoid it. With the increasing popularity of this unique and beautiful pottery, it's important for consumers to know how to distinguish genuine Polish pottery from imitations.

Fake Polish pottery is often mass-produced in China and sold at lower prices. However, these pieces lack the…

Polish VoIP market 2010

Over the past two years, falling fixed telephony prices and the prominence of fixed mobile substitution have not managed to hinder the development of internet telephony.

This was particularly notable in small and medium enterprises segment, where VoIP technology is used most because it is easy to integrate VoIP telephony with IT systems alongside the dropping prices. On the other hand, growth in the individual clients segment was most visible…