Press release

Online Payment Software Market Size 2018 by Top Key Players and Application with Trend and Growth by - Bill.com, PaySimple Pro, PDCflow, EBizCharge, Tipalti

Global “Online Payment Software Market” Report Covers a detailed Outlook and future prospects of the Industry. The Online Payment Software Market report includes various topics like market size & share, Product types, applications, key market drivers & restraints, challenges, growth opportunities, key players, competitive landscape.This report focuses on the global Online Payment Software status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Online Payment Software development in United States, Europe and China.

Request for Sample Copy of this Report @ http://supplydemandmarketresearch.com/home/contact/69646?ref=Sample-and-Brochure&toccode=SDMRSE69646

Top Key Players includes:

• Bill.com

• PaySimple Pro

• PDCflow

• EBizCharge

• Tipalti and More…

Market segment by Type, the product can be split into

• On-premises

• Cloud-Based

Market segment by Application, split into

• Small and Medium Enterprises (SMEs)

• Large Enterprises

Key Questions Answered in this Report

• What will the market size be in 2025 and what will the growth rate be?

• What are the key market trends?

• What is driving this market?

• What are the challenges to market growth?

• Who are the key vendors in this market space?

• What are the market opportunities and threats faced by the key vendors?

• What are the strengths and weaknesses of the key vendors?

Click Here For More Details @ http://supplydemandmarketresearch.com/home/toc_publisher/69646?code=SDMRSE69646#1

Objectives of this Report are:

• To analyze global Online Payment Software status, future forecast, growth opportunity, key market and key players.

• To present the Online Payment Software development in United States, Europe and China.

• To strategically profile the key players and comprehensively analyze their development plan and strategies.

• To define, describe and forecast the market by product type, market and key regions.

Table of Content:

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Online Payment Software Market Size Growth Rate by Type (2013-2025)

1.4.2 On-premises

1.4.3 Cloud-Based

1.5 Market by Application

2 Global Growth Trends

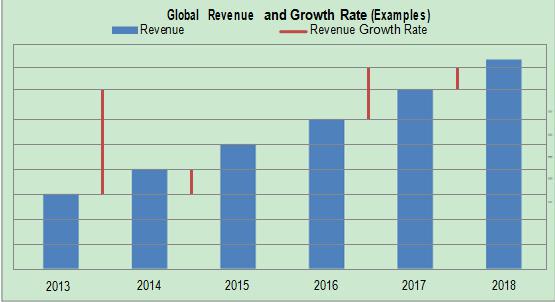

2.1 Online Payment Software Market Size

2.2 Online Payment Software Growth Trends by Regions

2.2.1 Online Payment Software Market Size by Regions (2013-2025)

2.2.2 Online Payment Software Market Share by Regions (2013-2018)

3 Market Share by Key Players

3.1 Online Payment Software Market Size by Manufacturers

3.1.1 Global Online Payment Software Revenue by Manufacturers (2013-2018)

3.1.2 Global Online Payment Software Revenue Market Share by Manufacturers (2013-2018)

3.1.3 Global Online Payment Software Market Concentration Ratio (CR5 and HHI)

4 Breakdown Data by Type and Application

4.1 Global Online Payment Software Market Size by Type (2013-2018)

4.2 Global Online Payment Software Market Size by Application (2013-2018)

TOC Continued……!

Tables and Figures:

• Table Online Payment Software Key Market Segments

• Table Key Players Online Payment Software Covered

• Table Global Online Payment Software Market Size Growth Rate by Type 2013-2025 (Million US$)

• Figure Global Online Payment Software Market Size Market Share by Type 2013-2025

• Figure On-premises Figures and More…

About Us:

We have a strong network of high powered and experienced global consultants who have about 10+ years of experience in the specific industry to deliver quality research and analysis. Having such an experienced network, our services not only cater to the client who wants the basic reference of market numbers and related high growth areas in the demand side, but also we provide detailed and granular information using which the client can definitely plan the strategies with respect to both supply and demand side.

302-20 Misssisauga Valley, Missisauga, L5A 3S1, Toronto

Contact Us:

Email- info@supplydemandmarketresearch.com

Global- 918208285935

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Software Market Size 2018 by Top Key Players and Application with Trend and Growth by - Bill.com, PaySimple Pro, PDCflow, EBizCharge, Tipalti here

News-ID: 1406015 • Views: …

More Releases from Supply Demand Market Research

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…