Press release

Fintech blockchain Market Outlook 2023 – AWS, IBM, Microsoft, Ripple, Chain, Earthport, Bitfury, BTL, Oracle, Digital Asset, Circle, Factom, Alphapoint, Coinbase, Abra, Auxesis, Bitpay, Blockcypher, Applied Blockchain, Recordskeeper, Symboint

The FinTech blockchain market study aims at estimating the market size and future growth potential of the market across different segments, such as providers, applications, and regions. The application segment includes payments, clearing, and settlement, exchanges and remittances, smart contracts, identity management, compliance management/Know Your Customer (KYC), and others (cyber liability and content storage management). The payments, clearing, and settlement segment is expected to dominate the application segment in terms of contribution to the overall market, as financial companies are deploying blockchain-based smart contracts to bring reduction in costs of verification, execution, arbitration, and fraud prevention.Get Sample Copy of this Report at https://www.researchreportsinc.com/sample-request?id=235019

The research report not only offers readers a broad overview of the international industry but also provides a granular assessment of the regional market in several countries and regions. Furthermore, the report consists a part that acknowledges the competitive analysis of the global FinTech blockchain market. These strategies followed by prominent players to stay ahead in the competition, the hurdles they are facing, competition they are dealing with, and the opportunities that are keeping them motivated are included in this section. This will help both large scale and small scale companies to deliberately understand the outlook of competition, which will help them to expand their territory.

Over the next five years, Publisher projects that Fintech blockchain will register an xx% CAGR in terms of revenue, reach US$ xx million by 2023, from US$ xx million in 2017.

In this report, Publisher studies the present scenario (with the base year being 2017) and the growth prospects of global Fintech blockchain market for 2018-2023.

This report presents a comprehensive overview, market shares and growth opportunities of Fintech blockchain market by product type, application, key companies and key regions.

To calculate the market size, Publisher considers value generated from the sales of the following segments:

Segmentation by product type:

Payments, clearing, and settlement

Exchanges and remittance

Identity management

Compliance management/Know Your Customer (KYC)

Cyber liability

Content storage management

Segmentation by application:

Banking

Non-banking financial services

Insurance

We can also provide the customized separate regional or country-level reports, for the following regions:

Americas

United States

Canada

Mexico

Brazil

APAC

China

Japan

Korea

Southeast Asia

India

Australia

Europe

Germany

France

UK

Italy

Russia

Spain

Middle East & Africa

Egypt

South Africa

Israel

Turkey

GCC Countries

The report also presents the market competition landscape and a corresponding detailed analysis of the major players in the market. The key players covered in this report:

AWS

IBM

Microsoft

Ripple

Chain

Earthport

Bitfury

BTL

Oracle

Digital Asset

Circle

Factom

Alphapoint

Coinbase

Abra

Auxesis

Bitpay

Blockcypher

Applied Blockchain

Recordskeeper

Symboint

Guardtime

Cambridge Blockchain

Tradle

Purchase this Premium Report at (Flat 20% off Apply Coupon Code ‘DISC20’):- https://researchreportsinc.com/checkout/?add-to-cart=235019&&attribute_pa_choose-license=single-user&&quantity=1

Table of Contents

2018-2023 Global Fintech blockchain Market Report (Status and Outlook)

1 Scope of the Report

2 Executive Summary

3 Global Fintech blockchain by Players

4 Fintech blockchain by Regions

5 Americas

6 APAC

7 Europe

8 Middle East & Africa

9 Market Drivers, Challenges and Trends

10 Global Fintech blockchain Market Forecast

11 Key Players Analysis

11.1 AWS

11.1.1 Company Details

11.1.2 Fintech blockchain Product Offered

11.1.3 AWS Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.1.4 Main Business Overview

11.1.5 AWS News

11.2 IBM

11.2.1 Company Details

11.2.2 Fintech blockchain Product Offered

11.2.3 IBM Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.2.4 Main Business Overview

11.2.5 IBM News

11.3 Microsoft

11.3.1 Company Details

11.3.2 Fintech blockchain Product Offered

11.3.3 Microsoft Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.3.4 Main Business Overview

11.3.5 Microsoft News

11.4 Ripple

11.4.1 Company Details

11.4.2 Fintech blockchain Product Offered

11.4.3 Ripple Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.4.4 Main Business Overview

11.4.5 Ripple News

11.5 Chain

11.5.1 Company Details

11.5.2 Fintech blockchain Product Offered

11.5.3 Chain Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.5.4 Main Business Overview

11.5.5 Chain News

11.6 Earthport

11.6.1 Company Details

11.6.2 Fintech blockchain Product Offered

11.6.3 Earthport Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.6.4 Main Business Overview

11.6.5 Earthport News

11.7 Bitfury

11.7.1 Company Details

11.7.2 Fintech blockchain Product Offered

11.7.3 Bitfury Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.7.4 Main Business Overview

11.7.5 Bitfury News

11.8 BTL

11.8.1 Company Details

11.8.2 Fintech blockchain Product Offered

11.8.3 BTL Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.8.4 Main Business Overview

11.8.5 BTL News

11.9 Oracle

11.9.1 Company Details

11.9.2 Fintech blockchain Product Offered

11.9.3 Oracle Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.9.4 Main Business Overview

11.9.5 Oracle News

11.10 Digital Asset

11.10.1 Company Details

11.10.2 Fintech blockchain Product Offered

11.10.3 Digital Asset Fintech blockchain Revenue, Gross Margin and Market Share (2016-2018)

11.10.4 Main Business Overview

11.10.5 Digital Asset News

11.11 Circle

11.12 Factom

11.13 Alphapoint

11.14 Coinbase

11.15 Abra

11.16 Auxesis

11.17 Bitpay

11.18 Blockcypher

11.19 Applied Blockchain

11.20 Recordskeeper

11.21 Symboint

11.22 Guardtime

11.23 Cambridge Blockchain

11.24 Tradle

12 Research Findings and Conclusion

Have Any Query? Ask Our Experts @ https://researchreportsinc.com/enquiry?id=235019

In addition, this report discusses the key drivers influencing market growth, opportunities, the challenges and the risks faced by key players and the market as a whole. It also analyzes key emerging trends and their impact on present and future development.

Research objectives

To study and analyze the global Fintech blockchain market size by key regions/countries, product type and application, history data from 2013 to 2017, and forecast to 2023.

To understand the structure of Fintech blockchain market by identifying its various subsegments.

Focuses on the key global Fintech blockchain players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the Fintech blockchain with respect to individual growth trends, future prospects, and their contribution to the total market.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

To project the size of Fintech blockchain submarkets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies.

About us

Research Reports Inc. is one of the leading destinations for market research reports across all industries, companies, and technologies. Our repository features an exhaustive list of market research reports from thousands of publishers worldwide.

Contact us

David

Sales Manager,

US +1-855-419-2424,

UK +4403308087757

Email- sales@researchreportsinc.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech blockchain Market Outlook 2023 – AWS, IBM, Microsoft, Ripple, Chain, Earthport, Bitfury, BTL, Oracle, Digital Asset, Circle, Factom, Alphapoint, Coinbase, Abra, Auxesis, Bitpay, Blockcypher, Applied Blockchain, Recordskeeper, Symboint here

News-ID: 1396556 • Views: …

More Releases from Research Reports Inc.

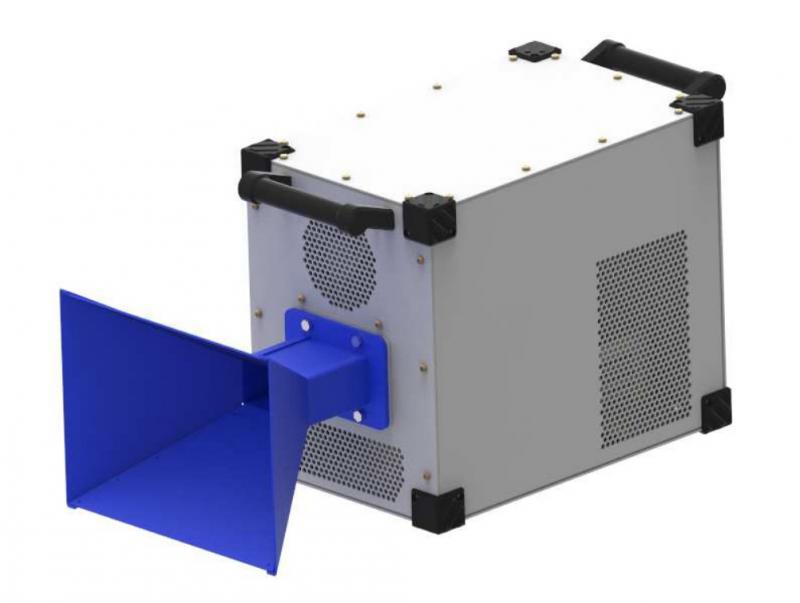

Microwave Generators Market Share And SWOT Analysis By 2021: DARE Instruments, C …

The Microwave Generators market report contains a study on the change within the dynamics of competition. It also delivers specific awareness that helps you select the proper business executions and steps. The Microwave Generators market report systematically presents information within the sort of organizational charts, facts, diagrams, statistical charts, and figures that represent the state of the relevant trading on the worldwide and regional platform. Additionally, the report comprises the…

Mini Data Center Market SWOT Analysis By 2021: Schneider Electric, Hewlett, IBM, …

The Mini Data Center market report contains a study on the change within the dynamics of competition. It also delivers specific awareness that helps you select the proper business executions and steps. The Mini Data Center market report systematically presents information within the sort of organizational charts, facts, diagrams, statistical charts, and figures that represent the state of the relevant trading on the worldwide and regional platform. Additionally, the report…

Contact Lenses Market Share, Trends and SWOT Analysis By 2021: Novartis, Menicon …

Contact Lenses market competitive insights provide details by a competitor. Details included are market overview, company financials, revenue generated, market potential, Porter’s analysis, investment in research and development, drivers and restraints, new market initiatives, company strengths, overview, and weaknesses, regional presence, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies’ focus related to the Contact Lenses market.

Research Reports inc is…

Robot Market Share and SWOT Analysis By 2021 Top Key Players: ABB, Ecovacs, Estu …

Robot market competitive insights provide details by a competitor. Details included are market overview, company financials, revenue generated, market potential, Porter’s analysis, investment in research and development, drivers and restraints, new market initiatives, company strengths, overview, and weaknesses, regional presence, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies’ focus related to the Robot market.

Get Free PDF Sample Copy of…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…