Press release

GlobalData: Oil and Gas Quarterly Deals Analysis- M&A and Investments Trends on reports-research.com

GlobalData's Oil and Gas Quarterly Deals Analysis M&A and Investments Trends - Q1 2010 report is an essential source of data and trend analysis on the Mergers and Acquisitions (M&A) and financings in the oil and gas industry. The report provides detailed information on M&A, equity/debt offerings, Private Equity (PE), venture financing and partnership transactions registered in the oil and gas industry in Q1 2010. The report gives detailed comparative data on the number of deals and their value in the last five quarters subdivided by deal types, segments, and geographies. Additionally, the report provides information on the top PE, Venture Capital (VC), and advisory firms in the oil and gas industry.Data presented in this report is derived from GlobalData’s proprietary in-house Energy eTrack deals database and primary and secondary research.

M&A Activity Decelerated In The Oil And Gas Industry In Q1 2010

M&As, which include changes in ownership and control of companies (GlobalData considers this value as not a new investment into the market), witnessed a decline of 55% in deal value, reporting $27 billion in Q1 2010 compared to $59.6 billion in Q4 2009. However, excluding Exxon Mobil’s proposed acquisition of XTO Energy for $41 billion in Q4 2009, the industry has seen some promising moves in deal making activity, with an increase of $8.4 billion in deal value in Q1 2010. Further, the number of M&A deals registered a marginal decline, with 120 deals in Q1 2010 compared to 129 deals in Q4 2009. The average P/E of the acquired oil and gas companies, which reflects the willingness of the investors to pay for a company’s earnings, increased sharply from 9.1x (times) in Q4 2009 to 25.7x in Q1 2010. The oil and gas industry has witnessed a volatile trend in the average P/E ratio over the last five quarters, with 29.5x in Q1 2009; 15.9x in Q2 2009; 32x in Q3 2009; 9.1x in Q4 2009; and 25.7x in Q1 2010, due to the uncertain economic conditions.

Further, the average deal value decreased rapidly from $641 million in Q4 2009 to $216 million in Q1 2010. The median value of the deals also decreased, from $28 million in Q4 2009 to $26 million in Q1 2010. The huge decrease in the average deal value can primarily be attributed to Exxon Mobil’s agreement to acquire XTO Energy for $41 billion in Q4 2009. The majority of companies are not anticipating short term sustainable growth opportunities, and as a result are concerned with maintaining their current capital expenditure rather than going forward with new investments.

According to Swati Singh, Lead Analyst at GlobalData, “Major oil and gas companies are selling their non-core assets to fund their core business operations. This is resulting in more assets coming to the M&A market. ConocoPhillips is divesting 10% of its portfolio; Devon is selling its international and Gulf of Mexico assets; EOG plans to sell certain North American natural gas assets; Royal Dutch Shell plans to sell its operationsin Finland; and Nexen is planning to sell heavy oil assets in Western Canada. Also, many gas-focused companies are also looking to acquire oil assets to leverage on the rising oil prices. In 2010, we expect that many well funded and capitalized companies will acquire companies and assets that strategically fit into their oil and gas portfolios.”

Asset Transactions Picked Up Momentum In Oil And Gas Industry In Q1 2010

The industry witnessed an increase in oil and gas asset purchases, reporting $21.9 billion of investments in Q1 2010 compared to $17.8 billion in Q4 2009. On a year-on-year basis, the industry witnessed over a four fold increase, with $21.9 billion in Q1 2010 compared to $5.2 billion in Q1 2009. The volatile oil prices and relatively tight financial market conditions are driving small and medium companies to sell their assets for funding towards operational continuity. GlobalData expects that, “Going forward companies will dilute their risk portfolio through expansion with a diversified portfolio of prospects and assets. We expect some of the large independent oil companies to make more positive moves in deal making activity in 2010”.

Further, the oil and gas valuations witnessed a marginal decline, with an average deal implied value of $74,339.9 per barrels of oil equivalent (Boe) of daily production in Q1 2010, compared to $77,043.2 per Boe of daily production in Q4 2009. Further, on a year-on-year basis, oil and gas asset valuations increased by 47% in Q1 2010 from $50,537.4 per Boe of daily production in Q1 2009. Additionally, the value of proved or 1P reserves increased by 9% to reach $15.9 per Boe in Q1 2010.

New Investments In The Oil and Gas Industry Decreased By 10% In Q1 2010

Investments in oil and gas companies, including financings through equity offerings, debt offerings, PE and venture financing, reported a decrease of 10% in the first quarter of 2010, with $35.9 billion of investments in Q1 2010 compared to $39.7 billion in Q4 2009. The industry also witnessed a decrease in the number of deals, with 106 deals in Q1 2010 compared to 89 deals in Q4 2009. The uncertainty in the current oil and gas prices coupled with less demand is making it difficult for oil and gas companies to finalize their future investment plans in the industry.

Decreased Financing Through Debt Offerings In Q1 2010

Global capital raising through debt offerings has declined gradually since Q3 2009. The market registered 77 deals worth $35.2 billion in Q1 2010 compared to 84 deals worth $38.3 billion in Q4 2009. On a year-on-year basis, the deal value witnessed a decrease of 55%, reporting $35.2 billion in Q1 2010 compared to $78.7 billion in Q1 2009. Further, debt offerings through public offerings and private debt placements saw a shift in trend, as public offerings witnessed a decrease, with 38 deals worth $17.7 billion in Q1 2010 compared to 55 deals worth $29 billion in Q4 2009, and private debt placements registered an increase, from 29 deals worth $9.3 billion in Q4 2009 to 39 deals worth $17.6 billion in Q1 2010.

Further, equity offerings through initial public offerings (IPOs), secondary offerings, and private investment in public equities (PIPEs) registered an increase in investments, reporting $15.2 billion in Q1 2010, compared to $13 billion in Q4 2009. This was driven by retail and institutional investors’ strong confidence in the long term future outlook of the oil and gas industry. Further, the number of equity offering deals decreased from 256 deals in Q4 2009 to 198 deals in Q1 2010. GlobalData expects that the equity market in the oil and gas industry will remain positive, with many IPO's expected to hit the market in 2010.

New Investments From The Private Equity Market Slumped In Q1 2010

Investments by PE firms in the oil and gas industry registered a sharp decline in investments from $1.4 billion in Q4 2009 to $650.4 million in Q1 2010. PE investors were wary in their movements, reducing their risk with a close eye on current market developments. In the upstream sector, CCMP Capital advisors’ acquisition of a 37% interest in Chaparral Energy for $345 million was the key deal that contributed the most to the total deal value in Q1 2010. The lack of PE investments in the oil and gas industry can primarily be attributed to the fact that North American activity has been down over the past few months and investments in the upstream sector are also holding course only with the largest independent oil companies.

North America And Eurpoe Registered A Significant Drop Out In Investments, While Asia Pacific Registered An Increase In Investments In Q1 2010

North America registered a decline in deal making activity, with 443 deals worth $70.5 billion in Q1 2010 compared to 515 deals worth $87.1 billion in Q4 2009. Further, the European region witnessed a decline in the number of deals and deal value, reporting 93 deals worth $11.9 billion in Q1 2010 compared to 121 deals worth $19.3 billion in Q4 2009.

Additionally, the Asia-Pacific witnessed an increase in deal value, reporting $15.6 billion in Q1 2010 compared to $12.9 billion in Q4 2009. However, the number of deals decreased from 105 deals in Q4 2009 to 95 deals in Q1 2010. The rest of the world, including South and Central America and the Middle East and Africa, reported an increase in investments, with $16.4 billion in Q1 2010 compared to $10.8 billion in Q4 2009. The increase in investments in the rest of the world can primarily be attributed to BP’s agreement to acquire oil assets from Devon Energy for $7 billion in Q1 2010.

According to Swati Singh, “M&A deals have been increasing in the Asia-Pacific region, driven by China, India and South Korea's national oil companies (NOCs), which are keen to increase their access to oil reserves. These companies are emerging as a strong competition to leading independent and integrated companies for assets globally. Reserve replacement, declining domestic production and expansion into new territories and unconventional plays remain the key drivers for international M&A.”

GlobalData: Oil and Gas Quarterly Deals Analysis - M&A and Investments Trends - Q1 2010:

http://www.reports-research.com/market-surveys/quarterly-deals-analysis-investments-trends-2010-p-77120.html

GlobalData: More market data and market reports:

http://www.reports-research.com/studien/globaldata-m-304.html

markt-studie.de, founded in 2002 has emerged as a leading online portal for market surveys and market research in German speaking areas. Four years later the English language portal reports-research.com was introduced due to the extraordinary success of the portal. Again one year later estudio-mercado.es - the Spanish spoken portal - was founded. The objective of the three portals is to competently and efficiently support consultants and decision makers in management, sales and marketing in the search for worldwide market research. Prospective buyers can look into more than 60,000 market surveys from more than 200 international publishers, current market data for more than 6,000 branches worldwide, 10,000 company profiles as well as a free-of-charge research and recommendation service for individual market research.

reports-research.com

c/o dynamic technologies GmbH

Siegburger Str. 233

50679 Köln

Germany

Manuel Bravo Sanchez (CEO)

info@reports-research.com

or

Tel ++49 (0)221 677 897 32

Fax ++49 (0)221 677 897 34

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GlobalData: Oil and Gas Quarterly Deals Analysis- M&A and Investments Trends on reports-research.com here

News-ID: 135134 • Views: …

More Releases from dynamic technologies Gmbh, Köln, Germany

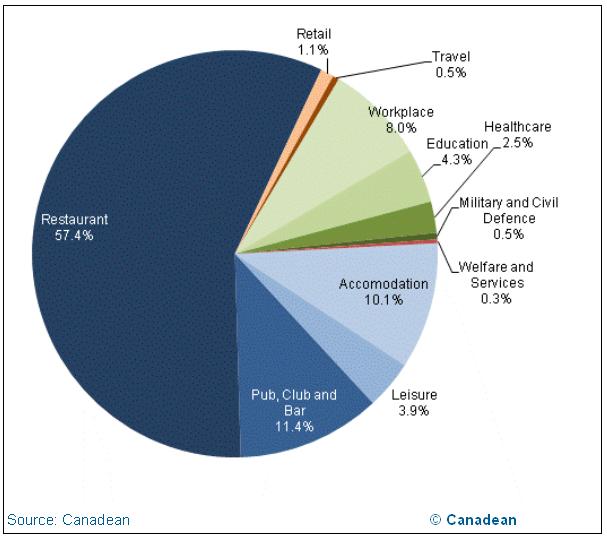

Canadean: New Zealand - The Future of Foodservice to 2016

The New Zealand foodservice market recorded a CAGR of 1.43% during the review period. Per capita sales increased at a review period CAGR of 0.38%. In 2011, the profit sector contributed 92.1% to the country’s total foodservice sales and posted a per capital sales CAGR of 0.33%. Growth in the profit sector is attributable to the growth in the restaurant channel which grew by a CAGR of 1.56%. In…

yStats.com: South Korea B2C E-Commerce Report 2011 published on reports-research …

The latest South Korea B2C E-Commerce Report 2011, compiled by Hamburg-based market research firm yStats.com features important B2C E-Commerce facts and figures on South Korea. In addition to revenue figures, market shares and customers, the report also covers general online use, the latest trends and major competitors.

In 2010, the number of internet users in South Korea rose to more than 35 million. Growth rates were very low in the last…

yStats.com: Turkey Top 100 E-Commerce Players 2011 published on reports-research …

The latest and highly informative Turkey Top 100 E-Commerce Players 2011 ranking, compiled by the Hamburg-based market research firm yStats com, presents the 100 most successful players on the Turkish E-Commerce market. Turkey’s top 100 E-Commerce players have been ranked based on local unique visitor numbers from September 2011.

The yStats com ranking highlights important details about competitors in the Turkish E-Commerce sector, shareholders, business models, product ranges, local and…

GlobalData: Wind Power - Global Market Size, Turbine Market Share, Installation …

Wind Power - Global Market Size, Turbine Market Share, Installation Prices, Regulations and Investment Analysis to 2020 is the latest report from GlobalData, the industry analysis specialists that offer comprehensive information and understanding of the Global Wind Power market.

The research provides an understanding of the technology, key drivers and challenges in the global wind power market. It also provides historical and forecast data to 2020 for installed capacity and power…

More Releases for Data

Data Catalog Market: Serving Data Consumers

Data Catalog Market size was valued at US$ 801.10 Mn. in 2022 and the total revenue is expected to grow at a CAGR of 23.2% from 2023 to 2029, reaching nearly US$ 3451.16 Mn.

Data Catalog Market Report Scope and Research Methodology

The Data Catalog Market is poised to reach a valuation of US$ 3451.16 million by 2029. A data catalog serves as an organized inventory of an organization's data assets, leveraging…

Big Data Security: Increasing Data Volume and Data Velocity

Big data security is a term used to describe the security of data that is too large or complex to be managed using traditional security methods. Big data security is a growing concern for organizations as the amount of data generated continues to increase. There are a number of challenges associated with securing big data, including the need to store and process data in a secure manner, the need to…

HOW TO TRANSFORM BIG DATA TO SMART DATA USING DATA ENGINEERING?

We are at the cross-roads of a universe that is composed of actors, entities and use-cases; along with the associated data relationships across zillions of business scenarios. Organizations must derive the most out of data, and modern AI platforms can help businesses in this direction. These help ideally turn Big Data into plug-and-play pieces of information that are being widely known as Smart Data.

Specialized components backed up by AI and…

Test Data Management (TDM) Market - test data profiling, test data planning, tes …

The report categorizes the global Test Data Management (TDM) market by top players/brands, region, type, end user, market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and challenges, sales channels and distributors.

This report studies the global market size of Test Data Management (TDM) in key regions like North America, Europe, Asia Pacific, Central & South America and Middle East & Africa, focuses on the consumption…

Data Prep Market Report 2018: Segmentation by Platform (Self-Service Data Prep, …

Global Data Prep market research report provides company profile for Alteryx, Inc. (U.S.), Informatica (U.S.), International Business Corporation (U.S.), TIBCO Software, Inc. (U.S.), Microsoft Corporation (U.S.), SAS Institute (U.S.), Datawatch Corporation (U.S.), Tableau Software, Inc. (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY…

Long Term Data Retention Solutions Market - The Increasing Demand For Big Data W …

Data retention is a technique to store the database of the organization for the future. An organization may retain data for several different reasons. One of the reasons is to act in accordance with state and federal regulations, i.e. information that may be considered old or irrelevant for internal use may need to be retained to comply with the laws of a particular jurisdiction or industry. Another reason is to…