Press release

GlobalData: Mergers & Acquisitions And Investments Surged In The Medical Equipment Industry In Q1 2010

GlobalData's Medical Equipment Quarterly Deals Analysis M&A and Investments Trends - Q1 2010 report is an essential source of data and trend analysis on the Mergers and Acquisitions (M&As) and financing in the medical equipment market. The report provides detailed information on M&As, equity/debt offerings, Private Equity (PE), venture financing and partnership transactions registered in the medical equipment industry in Q1 2010. The report gives detailed comparative data on the number of deals and their value in the last five quarters, subdivided by deal types, segments and geographies. Additionally, the report provides information on the top PE, Venture Capital (VC) and advisory firms in the medical equipment industry.Data presented in this report is derived from GlobalData’s proprietary in-house Medical eTrack deals database and primary and secondary research.

M&A Activities Increased In The Medical Equipment Industry In Q1 2010

M&A and asset transactions, which include changes in ownership and control of companies or assets (GlobalData considers this value as not a new investment into the market), witnessed a huge increase, from $4.8 billion in Q4 2009 to $39.8 billion in Q1 2010. However excluding Novartis’ agreement to acquire an additional 52% stake in Alcon for $28.1 billion and Merck's agreement to acquire Millipore for $ 7.2 billion in Q1 2010, the industry has seen almost steady investment in the last two quarters, with $4.7 billion in Q4 2009 and $4.8 billion Q1 2010. This signifies that most of the companies are still taking a skeptical approach to the business integration process in the medical equipment market. Further, the number of M&A deals decreased from 141 deals in Q4 2009 to 135 deals in Q1 2010.

In terms of the number of deals, the most active buyers were Inverness Medical Innovations, Inc. with three M&A deals, followed by Thermo Fisher Scientific Inc. with two M&A deals.

The average P/E (Price Earnings Ratio) of acquired medical equipment companies, which reflects the willingness of investors to pay for a company’s earnings, increased from 17 times (x) in Q4 2009 to 25x in Q1 2010. This indicates that investors are anticipating higher earnings in the growing medical equipment industry in the short term. Further, the first quarter has seen a considerable increase in the average deal value and median deal value in the medical equipment industry, reporting $1 billion and $93 million respectively in Q1 2010, compared to $98 million and $25 million in Q4 2009. This huge increase in the average deal value can primarily be attributed to Novartis’ agreement to acquire an additional 52% stake in Alcon from Nestle for $28.1 billion.

According to Akanksha Jain, Analyst at GlobalData, the increasing M&A trend will continue in the next quarter with the passage of health reform in March. Companies are likely to rethink their strategy and act quickly to counter the burden of 2.3% excise tax in 2013. An improved outlook on capital markets is going to further boost M&A activity over the next quarter.

New Investments In The Medical Equipment Industry Increased By 15% In Q1 2010

Investments in medical equipment companies, including new investment through equity/debt offerings and financings by PE/VC firms reported an increase of 15%, with $15.8 billion in Q1 2010 compared to $13.8 billion in Q4 2009. However, the number of deals decreased from 272 deals in Q4 2009 to 258 deals in Q1 2010. On a year-on-year basis, the market witnessed an increase in the number of deals and a decrease in deal value in Q1 2010, compared to 189 deals worth $25.3 billion in Q1 2009. Overall, the industry is well settled after a lull in the financial market and the trend is moving towards more concentrated efforts on core activities.

GlobalData expects that per capita healthcare expenditures will continue to rise and will benefit the medical equipment industry. In turn, it will enable companies to increase their sales throughout 2010.

Increased Financing Through Debt Offerings In Q1 2010

Debt offerings, including secondary offerings and private debt placements, became the most prominent among all financing activities in the medical equipment market with $12.9 billion raised in Q1 2010 as compared to $8.6 billion in Q4 2009. The change in the investment level can primarily be attributed to the contribution by two major companies in deal making activity in Q1 2010: Novartis’ raising of $5 billion through public offerings of senior notes in three separate transactions, and Medtronic’s raising of $2.5 billion through public offerings of senior notes in two separate transactions. A weak global equity market coupled with low prevailing interest rates have made debt offerings a lucrative source of funding for medical device companies over the past quarter. Further, the number of debt offering deals decreased from 27 deals in Q4 2009 to 22 deals in Q1 2010.

Additionally, global equity offerings, including Initial Public Offerings (IPOs), secondary offerings, and Private Investment in Public Equities (PIPE), decreased by 49% with $1.3 billion in Q1 2010 compared to $2.5 billion in Q4 2009. The number of deals also decreased from 91 deals in Q4 2009 to 64 deals in Q1 2010. On a year-on-year basis, the number of deals and deal value witnessed a marginal increase, reporting 64 deals worth $1.3 billion in Q1 2010 compared to 55 deals worth $821 million in Q1 2009.

According to Akanksha Jain, Analyst at GlobalData, continued low interest rates and turbulent equity markets have sustained the growth in debt offerings in Q1 2010. Since interest rates are likely to hover slightly below 1% for 2010, debt offerings are likely to remain the preferred mode of raising finance for rest of the year.

New Investment By Venture Capital Firms Increased Marginally In Q1 2010

Medical equipment companies received investments of $1.2 billion in venture financing during Q1 2010, compared to $1.1 billion in Q4 2009. The VC firms are showing much more confidence in start up companies, with over $617.9 million of financing provided in Q1 2010, followed by growth capital/expansion stage companies with $305.5 million. Drug delivery service companies gained the most funding, with $202.5 million raised in 12 deals. In second place, the in vitro diagnostics segment received $167.6 million of VC funding in 31 deals in Q1 2010. Kleiner Perkins Caufield & Byers topped the list of venture financing firms by participating in nine financing rounds for deal value worth $243 million during Q2 2009 - Q1 2010.

Furthermore, the PE market saw a decrease in investments from $1.5 billion in Q4 2009 to $407 million in Q1 2010. The number of deals also decreased marginally from 16 deals in Q4 2009 to 14 deals in Q1 2010.

Investments In Europe And North America Stepped-Up In Q1 2010

The medical equipment industry has seen a rapid increase in investments in the European region, reporting $35.6 billion in Q1 2010 compared to $2.3 billion in Q4 2009. The increase in investment in Europe can primarily be attributed to the landmark deal of Novartis' agreement to acquire an additional 52% stake in Alcon from Nestle for $28.1 billion, and Novartis' three debt offering deals for $5 billion in Q1 2010. In total, Novartis represented almost 93% of the total investment of $35.6 billion in Europe. However, the number of deals decreased marginally from 115 deals in Q4 2009 to 108 deals in Q1 2010.

Further, the North American region also registered an increase in the number of deals and deal value, reporting 418 deals worth $19.8 billion in Q1 2010 compared to 401 deals worth 14.5 billion in Q4 2009, an increase of 37% in terms of deal value.

GlobalData: Mergers & Acquisitions And Investments Surged In The Medical Equipment Industry In Q1 2010:

http://www.reports-research.com/studien/medical-equipment-quarterly-deals-analysis-investments-trends-2010-p-77142.html

GlobalData: More market data and market reports:

http://www.reports-research.com/studien/globaldata-m-304.html

markt-studie.de, founded in 2002 has emerged as a leading online portal for market surveys and market research in German speaking areas. Four years later the English language portal reports-research.com was introduced due to the extraordinary success of the portal. Again one year later estudio-mercado.es - the Spanish spoken portal - was founded. The objective of the three portals is to competently and efficiently support consultants and decision makers in management, sales and marketing in the search for worldwide market research. Prospective buyers can look into more than 60,000 market surveys from more than 200 international publishers, current market data for more than 6,000 branches worldwide, 10,000 company profiles as well as a free-of-charge research and recommendation service for individual market research.

reports-research.com

c/o dynamic technologies GmbH

Siegburger Str. 233

50679 Köln

Germany

Manuel Bravo Sanchez (CEO)

info@reports-research.com

or

Tel ++49 (0)221 677 897 32

Fax ++49 (0)221 677 897 34

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GlobalData: Mergers & Acquisitions And Investments Surged In The Medical Equipment Industry In Q1 2010 here

News-ID: 134268 • Views: …

More Releases from dynamic technologies Gmbh, Köln, Germany

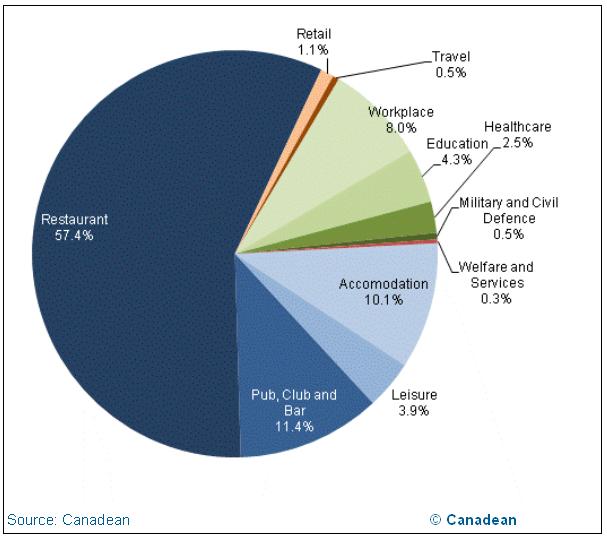

Canadean: New Zealand - The Future of Foodservice to 2016

The New Zealand foodservice market recorded a CAGR of 1.43% during the review period. Per capita sales increased at a review period CAGR of 0.38%. In 2011, the profit sector contributed 92.1% to the country’s total foodservice sales and posted a per capital sales CAGR of 0.33%. Growth in the profit sector is attributable to the growth in the restaurant channel which grew by a CAGR of 1.56%. In…

yStats.com: South Korea B2C E-Commerce Report 2011 published on reports-research …

The latest South Korea B2C E-Commerce Report 2011, compiled by Hamburg-based market research firm yStats.com features important B2C E-Commerce facts and figures on South Korea. In addition to revenue figures, market shares and customers, the report also covers general online use, the latest trends and major competitors.

In 2010, the number of internet users in South Korea rose to more than 35 million. Growth rates were very low in the last…

yStats.com: Turkey Top 100 E-Commerce Players 2011 published on reports-research …

The latest and highly informative Turkey Top 100 E-Commerce Players 2011 ranking, compiled by the Hamburg-based market research firm yStats com, presents the 100 most successful players on the Turkish E-Commerce market. Turkey’s top 100 E-Commerce players have been ranked based on local unique visitor numbers from September 2011.

The yStats com ranking highlights important details about competitors in the Turkish E-Commerce sector, shareholders, business models, product ranges, local and…

GlobalData: Wind Power - Global Market Size, Turbine Market Share, Installation …

Wind Power - Global Market Size, Turbine Market Share, Installation Prices, Regulations and Investment Analysis to 2020 is the latest report from GlobalData, the industry analysis specialists that offer comprehensive information and understanding of the Global Wind Power market.

The research provides an understanding of the technology, key drivers and challenges in the global wind power market. It also provides historical and forecast data to 2020 for installed capacity and power…

More Releases for Data

Data Catalog Market: Serving Data Consumers

Data Catalog Market size was valued at US$ 801.10 Mn. in 2022 and the total revenue is expected to grow at a CAGR of 23.2% from 2023 to 2029, reaching nearly US$ 3451.16 Mn.

Data Catalog Market Report Scope and Research Methodology

The Data Catalog Market is poised to reach a valuation of US$ 3451.16 million by 2029. A data catalog serves as an organized inventory of an organization's data assets, leveraging…

Big Data Security: Increasing Data Volume and Data Velocity

Big data security is a term used to describe the security of data that is too large or complex to be managed using traditional security methods. Big data security is a growing concern for organizations as the amount of data generated continues to increase. There are a number of challenges associated with securing big data, including the need to store and process data in a secure manner, the need to…

HOW TO TRANSFORM BIG DATA TO SMART DATA USING DATA ENGINEERING?

We are at the cross-roads of a universe that is composed of actors, entities and use-cases; along with the associated data relationships across zillions of business scenarios. Organizations must derive the most out of data, and modern AI platforms can help businesses in this direction. These help ideally turn Big Data into plug-and-play pieces of information that are being widely known as Smart Data.

Specialized components backed up by AI and…

Test Data Management (TDM) Market - test data profiling, test data planning, tes …

The report categorizes the global Test Data Management (TDM) market by top players/brands, region, type, end user, market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and challenges, sales channels and distributors.

This report studies the global market size of Test Data Management (TDM) in key regions like North America, Europe, Asia Pacific, Central & South America and Middle East & Africa, focuses on the consumption…

Data Prep Market Report 2018: Segmentation by Platform (Self-Service Data Prep, …

Global Data Prep market research report provides company profile for Alteryx, Inc. (U.S.), Informatica (U.S.), International Business Corporation (U.S.), TIBCO Software, Inc. (U.S.), Microsoft Corporation (U.S.), SAS Institute (U.S.), Datawatch Corporation (U.S.), Tableau Software, Inc. (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY…

Long Term Data Retention Solutions Market - The Increasing Demand For Big Data W …

Data retention is a technique to store the database of the organization for the future. An organization may retain data for several different reasons. One of the reasons is to act in accordance with state and federal regulations, i.e. information that may be considered old or irrelevant for internal use may need to be retained to comply with the laws of a particular jurisdiction or industry. Another reason is to…