Press release

Online Payment Gateway Market Forecast By 2027 | PayPal Holdings, Inc., Amazon.com Inc., Avenues India Pvt. Ltd., Stripe, and CCBill

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating on the current scenario, the share for mobile usage has been growing significantly. The traditional ways of accepting payments has been declined as compared to advanced payment methods.To know key findings Request Sample Report @: https://www.futuremarketinsights.com/reports/sample/rep-gb-4331

Different mode of transactions are used for payment gateways such as real-time bank transfers, direct debits, and others. Transactions that include payment gateways are prepaid cards, debit cards, credit cards, and charge cards. The most widely used forms are credit cards and debit cards. Credit cardholders draw on a credit limit permitted by the card issuer such as a bank, store, or service provider. Credit card balances are usually rolling, whereby, part of the balance needs to be paid on a 30-day basis, until the full balance is paid. Whereas, debit cards are bank cards used in cash transactions, which are not credit cards. In a debit card transaction, the amount of a purchase is withdrawn from the available balance in the cardholder’s account. If the available funds are insufficient, the transaction is not completed. This is also called asset card (in the US), or payment card.

Request for Report Methodology @: https://www.futuremarketinsights.com/askus/rep-gb-4331

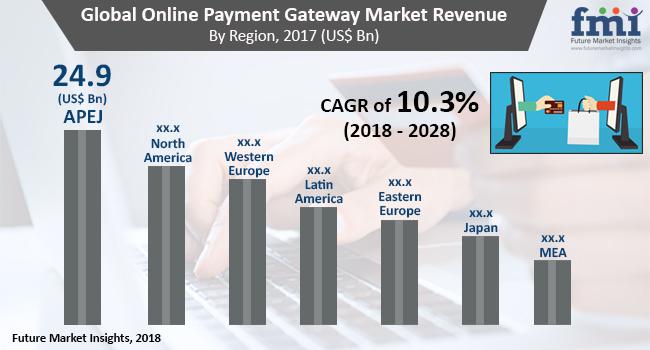

Companies operating in the market are also eyeing on the opportunities available in the global market. Some of the leading companies operating in this market are PayPal Holdings, Inc., Amazon.com Inc., Avenues India Pvt. Ltd., Stripe, and CCBill. According to the report, the global online payment gateway market is expected to witness a CAGR of 10.3% from 2018 to 2028. The market is expected to reach a valuation of US$ 191.7 Bn by the end of the forecast period rising from a valuation of US$ 65.5 Bn in 2017.

Growing Third Party Payments to Augur Well for Global Market Growth

Emerging markets are the home for 85% of the global population, and about 90% of people under 30 years of age reside within these emerging markets. These markets are presently discovering themselves at a 'sweet spot‘, where the population is favouring the growth of online transactions, which are in turn curtailing the black economy and stimulating economic growth. By opening up the banking market to non-bank players, regulators are side-stepping the requirement for banking institutions to being able to provide a full spectrum of financial services. This has brought about the ‘FinTech Revolution’. This has been a driver for the online payment gateway market, as regulators are allowing third parties to control payment processing.

Get access to full summary @: https://www.futuremarketinsights.com/reports/online-payment-gateway-market

NFC Payments to Obstruct Market Revenue Growth

Eyeing the current market scenario, payment gateways are booming all over the world, but there are new innovations to come. One such innovation that is predicted to come soon and is being worked upon is the payment through NFC technology, which could be the substituting point for the payment gateway market.

About Us

Future Market Insights is the premier provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in London, the global financial capital, and has delivery centres in the U.S. and India.

FMI’s research and consulting services help businesses around the globe navigate the challenges in a rapidly evolving marketplace with confidence and clarity. Our customised and syndicated market research reports deliver actionable insights that drive sustainable growth. We continuously track emerging trends and events in a broad range of end industries to ensure our clients prepare for the evolving needs of their consumers.

Contact Us

U.S. Office

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Web:https://www.futuremarketinsights.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Gateway Market Forecast By 2027 | PayPal Holdings, Inc., Amazon.com Inc., Avenues India Pvt. Ltd., Stripe, and CCBill here

News-ID: 1339692 • Views: …

More Releases from Future Market Insights

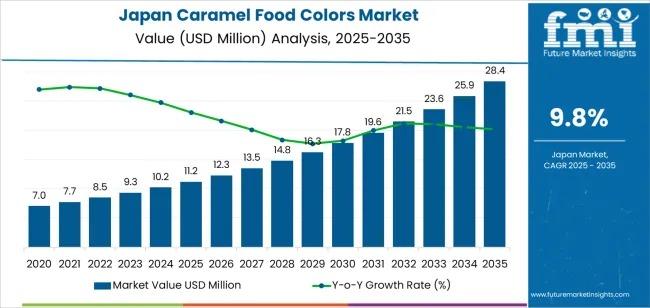

Japan Caramel Food Colors Industry Outlook to 2036: Strategic Insights for R&D, …

The Japanese caramel food colors market is on a steady growth trajectory, with demand projected to rise from USD 11.2 million in 2025 to USD 28.4 million by 2035, registering a CAGR of 9.8%. The initial phase of the forecast period (2025-2030) anticipates a steady increase in demand, reaching approximately USD 17.8 million by 2030, driven by the expanding use of caramel colors across confectionery, dairy, and baked goods.

The market's…

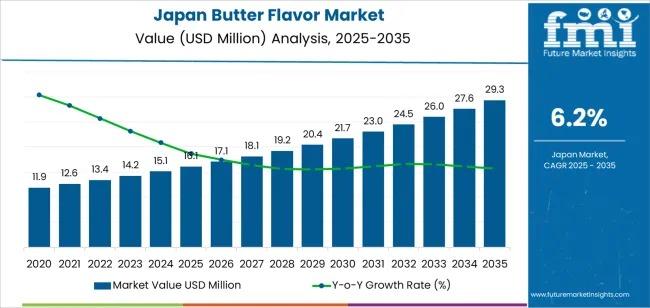

Comprehensive Analysis of the Japan Butter Flavor Market: Technology Evolution, …

The demand for butter flavor in Japan is projected to rise from USD 16.1 million in 2025 to USD 29.4 million by 2035, reflecting a steady compound annual growth rate (CAGR) of 6.2%. This growth is underpinned by increasing adoption across bakery products, confectionery items, and dairy-based preparations, as manufacturers seek to enhance taste experiences and deliver authentic dairy character in a wide range of food offerings.

The Japanese bakery and…

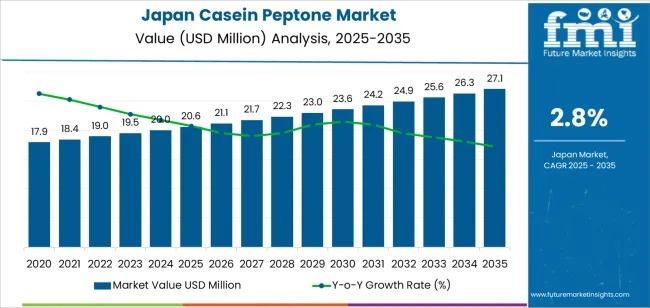

Japan Casein Peptone Market Deep-Dive 2026-2036: Strategic Forecasts, Market Ent …

The demand for casein peptone in Japan is projected to grow steadily, reaching USD 27.1 million by 2035, up from USD 20.6 million in 2025, reflecting a compound annual growth rate (CAGR) of 2.8%. During the early forecast period (2025-2030), demand is expected to rise from USD 20.6 million to approximately USD 23.6 million, supported by its widespread applications in biotechnology, pharmaceuticals, and food industries. Casein peptone continues to play…

Global Boride Powder Market Size, Share & Forecast: High-Growth Segments, Value …

The global boride powder market is valued at USD 19.7 billion in 2025 and is projected to reach USD 32.2 billion by 2035, advancing at a steady 5.0% CAGR over the forecast period. This upward trajectory reflects increasing adoption of boride-based compounds in aerospace technology, high-temperature processing environments, and advanced coating applications, where exceptional thermal stability, corrosion resistance, and mechanical strength are essential for operational performance and product reliability.

Key Market…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…