Press release

Tax Management Software Market Size, Insights, Trends, Outlook 2018 | Top Key Players: Avalara, Outright, Shoeboxed, SAXTAX, H&R Block, CrowdReason, Paychex, Inc.

Tax Management Software is a software which helping people to report and pay their tax. It could be in different type which include Installed-Mobilesite, mobile App etc. The goal of Tax Management Software is to save people’s time and give them a more convenience method to pay their tax.Tax Management Software Market 2018 which encloses important data about the production, consumption, revenue and market share, merged with information related to the market scope and product overview. The report anticipates that the market for Tax Management Software would rise at a positive CAGR during the period 2018-2023.

Request for the Sample Copy: https://www.reporthive.com/enquiry.php?id=1601323&req_type=smpl

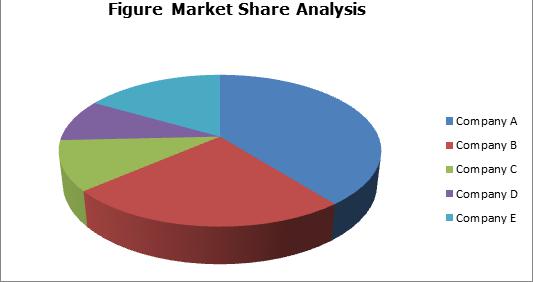

The market of Tax Management Software is highly competitive. Top 10 players occupy 12.67% of global market share in 2016.The top players cover DuPont, Staron(SAMSUNG), LG Hausys, Kuraray and Aristech Acrylics etc., which are playing important roles in global Tax Management Software market.

The key manufacturers covered in this report:

• Avalara

• Outright

• Shoeboxed

• SAXTAX

• H&R Block

• CrowdReason

• Paychex, Inc.

• Drake Software

• Taxify

• Accurate Tax

• Canopy

• Beanstalk

• CCH

• Others

Segmentation by product type:

• Cloud, SaaS, Installed-Mobile

• Installed-PC

Segmentation by application:

• Personal Use

• Commercial Use

This report also splits the market by region:

• Americas

• United States

• Canada

• Mexico

• Brazil

• APAC

• China

Research objectives

To study and analyze the global Tax Management Software consumption (value & volume) by key regions/countries, product type and application, history data from 2013 to 2017, and forecast to 2023.

To understand the structure of Tax Management Software market by identifying its various subsegments.

Focuses on the key global Tax Management Software manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the Tax Management Software with respect to individual growth trends, future prospects, and their contribution to the total market.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

Click to buy complete Report: https://www.reporthive.com/enquiry.php?id=1601323&req_type=purch

Table of Contents

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Economic Indicators

1.6 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Tax Management Software Market Size 2013-2023

2.1.2 Tax Management Software Market Size CAGR by Region

2.2 Tax Management Software Segment by Type

2.2.1 Cloud, SaaS, Installed-Mobile

2.2.2 Installed-PC

2.2.3 Installed-Mobile

2.3 Tax Management Software Market Size by Type

2.3.1 Global Tax Management Software Market Size Market Share by Type (2013-2018)

2.3.2 Global Tax Management Software Market Size Growth Rate by Type (2013-2018)

2.4 Tax Management Software Segment by Application

2.4.1 Personal Use

2.4.2 Commercial Use

2.5 Tax Management Software Market Size by Application

2.5.1 Global Tax Management Software Market Size Market Share by Application (2013-2018)

2.5.2 Global Tax Management Software Market Size Growth Rate by Application (2013-2018)

3 Global Tax Management Software by Players

3.1 Global Tax Management Software Market Size Market Share by Players

3.1.1 Global Tax Management Software Market Size by Players (2016-2018)

3.1.2 Global Tax Management Software Market Size Market Share by Players (2016-2018)

3.2 Global Tax Management Software Key Players Head office and Products Offered

3.3 Market Concentration Rate Analysis

3.3.1 Competition Landscape Analysis

3.3.2 Concentration Ratio (CR3, CR5 and CR10) (2016-2018)

3.4 New Products and Potential Entrants

3.5 Mergers & Acquisitions, Expansion

Toc Continued…!

List of Tables and Figures

Table Product Specifications of Tax Management Software

Figure Tax Management Software Report Years Considered

Figure Market Research Methodology

Figure Global Tax Management Software Market Size Growth Rate 2013-2023 ($ Millions)

Table Tax Management Software Market Size CAGR by Region 2013-2023 ($ Millions)

Table Major Players of Cloud, SaaS, Installed-Mobile…and more

About Report Hive Research

Report Hive Research delivers strategic market research reports, statistical survey, industry analysis & forecast data on products & services, markets and companies. Our clientele ranges mix of global Business Leaders, Government Organizations, SME’s, Individual & Start-ups, Management Consulting Firms, and Universities etc. Our library of 600,000+ market reports covers industries like Chemical, Healthcare, IT, Telecom, Semiconductor, etc. in the USA, Europe Middle East, Africa, Asia Pacific. We help in business decision-making on aspects such as market entry strategies, market sizing, market share analysis, sales & revenue, technology trends, competitive analysis, product portfolio & application analysis etc.

500, North Michigan Avenue,

Suite 6014

Chicago, IL - 60611

United States

Contact Us

Mike Ross

Marketing Manager

sales@reporthive.com

https://www.reporthive.com

Phone Number: +1-312 604 7084

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Software Market Size, Insights, Trends, Outlook 2018 | Top Key Players: Avalara, Outright, Shoeboxed, SAXTAX, H&R Block, CrowdReason, Paychex, Inc. here

News-ID: 1329915 • Views: …

More Releases from Report Hive Research

Oryzenin Market 2022 scope and Research methodology | Axiom Foods, Inc., AIDP

The global Oryzenin market is expected to reach an estimated USD 561.1 Million by 2030 with a CAGR of 14.2% from 2022 to 2030.

The Global Oryzenin market 2022 research provides a overview of the industry including definitions, classifications, applications and industry chain structure. The Global Oryzenin market report is provided for the US, EU, APAC, as well as development trends, competitive landscape analysis, and key regions development status. Development policies…

Polymer Emulsions Market SWOT Analysis, Competitive Landscape and Massive Growth …

The global Polymer Emulsions market was estimated at USD 27.3 billion in 2021 and is projected to expand at a CAGR of 7.5% from 2022 to 2030.

The Report Hive Research has added a new statistical market report to its repository titled as, Polymer Emulsions Market. It provides the industry overview with market growth analysis with a historical & futuristic perspective for the following parameters; cost, revenue, demands, and supply data…

Glufosinate Market Future Set to Significant Growth with High CAGR value 2022 | …

The global Glufosinate market is expected to reach an estimated USD 4.12 billion by 2030 with a CAGR of 8.68% from 2022 to 2030.

The Glufosinate market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product…

Glass Filled Nylon Market 2022 scope and Research methodology | DowDuPont, BASF, …

The global Glass Filled Nylon market is projected to register an average CAGR of 5.6% during the forecast period 2022-2030.

The Global Glass Filled Nylon market 2022 research provides a overview of the industry including definitions, classifications, applications and industry chain structure. The Global Glass Filled Nylon market report is provided for the US, EU, APAC, as well as development trends, competitive landscape analysis, and key regions development status. Development policies…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…